Is AI’s Circular Financing Inflating a Bubble?

Summary

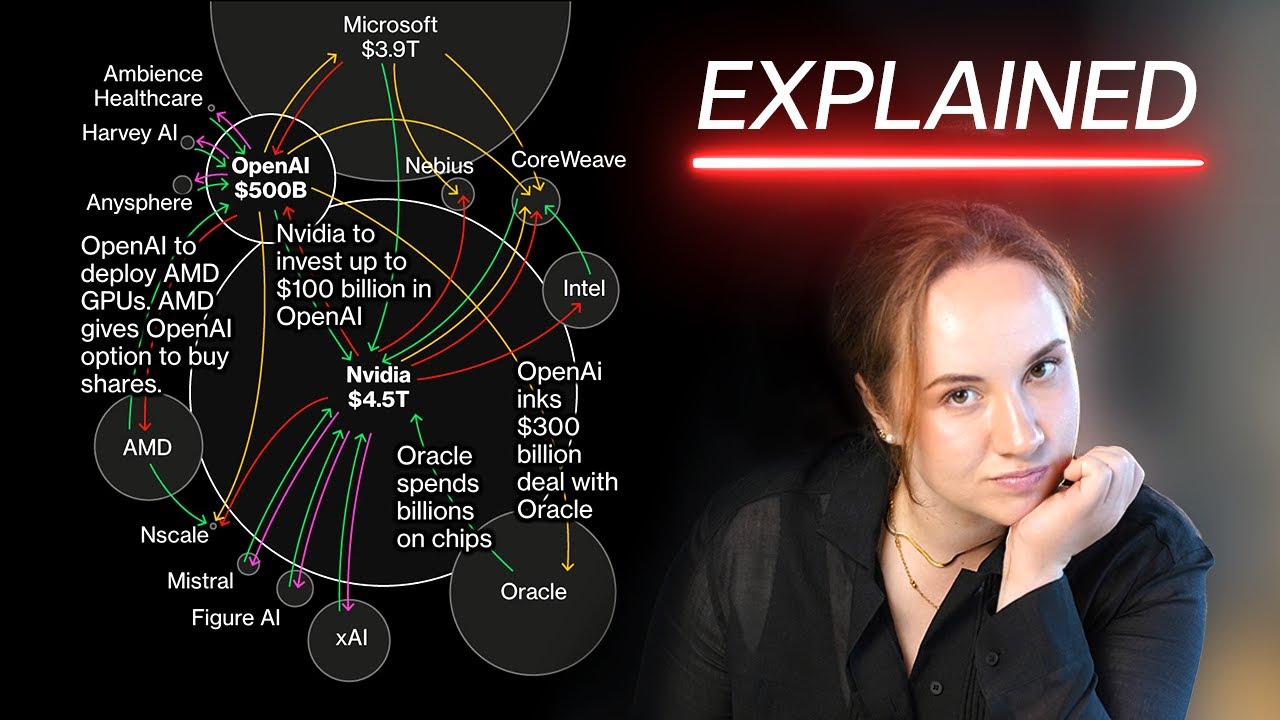

TLDRThe video explores the rapidly growing AI infrastructure, with major companies like OpenAI, Nvidia, and others deeply invested in each other, creating a circular financial ecosystem. These partnerships have raised concerns about sustainability and the true demand for AI infrastructure, especially given the massive costs involved. While the sector shows impressive investments, including multi-billion dollar agreements and AI-driven innovations, there's uncertainty about profitability and long-term success. The piece draws parallels to past tech bubbles, questioning whether AI's promised returns will materialize or if it could lead to a bubble, with risks for investors and the broader economy.

Takeaways

- 💸 AI companies like OpenAI, Nvidia, and Anthropic are deeply entangled through circular investments — each funding the others and buying each other’s products, creating a self-reinforcing financial loop.

- 🐍 These interconnected deals have been compared to an ouroboros — a snake eating its own tail — symbolizing circular financing that may not be sustainable without new outside capital.

- ⚡ The AI boom depends heavily on massive infrastructure spending, with projections of over $5.2 trillion in capital expenditures for chips, data centers, and energy by 2030.

- 🏭 OpenAI’s Stargate project alone aims to build data centers requiring around 23 gigawatts of power — equivalent to 23 nuclear plants — highlighting the immense energy demands of AI.

- 💰 Nvidia profits enormously from the boom but also fuels demand by investing in its own customers, blurring the line between genuine market growth and self-financed expansion.

- 🤝 Big tech firms like Amazon and Google use strategic investments to secure AI partnerships — such as Anthropic agreeing to use Amazon’s and Google’s cloud and chips in exchange for billions in funding.

- 📉 The GPU rental market is already showing early signs of oversupply and price drops, suggesting that parts of the AI infrastructure may become unprofitable or underutilized.

- 🧩 Analysts warn that AI’s financial structure resembles historical systems like Japan’s keiretsu or Korea’s chaebol — dense corporate webs that once obscured risk and misallocated capital.

- ⚙️ Despite hype, AI monetization remains limited — OpenAI has 700 million weekly users but only 5% pay, and most AI projects deliver unclear or unproven business results.

- 📈 Unlike the 1990s dot-com bubble, today’s tech giants have strong balance sheets and real earnings, which may prevent a total collapse even if some AI investments fail.

- ⚖️ The long-term success of AI may depend less on the model builders and more on the businesses that effectively apply AI to real-world problems, as profitability for labs remains uncertain.

- 🔋 Electricity availability is emerging as a major bottleneck — even if chips and capital are ready, power generation and grid connections could delay AI growth significantly.

Q & A

What is the circular investment model in the AI industry?

-The circular investment model refers to the way AI companies like OpenAI, Nvidia, and others are heavily investing in one another. These companies act as both customers and investors, creating a cycle of capital flow. This interconnectedness may pose risks if AI demand fails to meet expectations, as companies rely on each other for financial support and infrastructure.

How does AI's energy demand impact its growth and sustainability?

-AI's energy demand is immense. OpenAI's Stargate project, for instance, is expected to require as much power as 10 nuclear reactors. This raises concerns about the adequacy of energy infrastructure to meet the growing needs of AI. Without sufficient energy supply, the expansion of AI models and data centers could be hindered, limiting AI's scalability and sustainability.

What challenges do AI companies face in terms of profitability?

-AI companies like OpenAI are currently burning more cash than they generate, with their profitability remaining uncertain. Although they have received significant funding from investors, they rely heavily on debt and equity to finance their operations. This financial instability poses a risk, especially if AI adoption doesn't accelerate as expected or fails to generate sufficient returns.

Why might the AI industry be considered to be in a bubble?

-The AI industry might be in a bubble due to overinflated valuations and overly optimistic expectations. While the demand for AI infrastructure is high, it may not materialize as expected. If AI's market does not live up to projections, companies could be left with unprofitable, costly investments, similar to the telecom investments that failed during the early 2000s.

What is meant by the 'winner-takes-all' market in the AI industry?

-In a 'winner-takes-all' market, one dominant company often rises to control the entire sector, leaving little room for competitors. In AI, however, there’s concern that the market may not follow this pattern. As AI models become replicable and easier to duplicate (as shown by Elon Musk’s rapid deployment of Grok), the market might be more competitive, and no single company may dominate.

How might AI become a more competitive market instead of a monopoly?

-AI could become a more competitive market if the models and technologies are replicated quickly and cheaply by multiple companies. This would reduce the pricing power of any single player, making the market highly competitive. Companies that once aimed to dominate AI might instead find themselves in an environment where differentiation and innovation are key to survival.

What is the risk for model builders in a competitive AI market?

-In a competitive AI market, model builders may struggle to monetize their technology if AI models become easily replicable. This could limit their ability to generate profits, as businesses using AI tools could benefit more than the companies that built the models themselves.

Who stands to profit from the rise of AI, according to the script?

-While AI may boost productivity across the economy, it is not clear that the companies building the AI models will be the ones to profit. Instead, the businesses that integrate and use these AI tools may capture most of the financial benefits. The script suggests that businesses utilizing AI might benefit more than the developers of the AI models.

What does the script suggest about the future of AI investment strategies?

-The investment strategies in AI are currently more cautious than in past tech bubbles. Large deals are being structured with room for backing out, which reflects an awareness of the high risks involved. Despite this caution, the uncertainty about who will ultimately profit from AI investments remains a significant challenge.

What does the script predict about the future of AI models and the market?

-The script predicts that the AI market may not produce a single dominant player but rather a competitive environment where many companies are vying for market share. AI models might become more standardized, leading to lower prices and limited pricing power for individual players. The future of AI remains uncertain, with businesses struggling to figure out how to monetize their innovations.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Why Everyone Wants You To Believe AI is a Bubble

U8-04 V2 Wichtige Akteure der Branche V3

Inside AI’s Circular Economy: Geopolitical Loopholes, Hidden Debt, and Financial Engineering

If the AI bubble pops, will the whole U.S. economy go with it? | About That

7 CRUCIAL AI Stocks CONTROLLING The AI Revolution!!

HUGE Microchip Breakthrough and The Secret Plan of NVIDIA

5.0 / 5 (0 votes)