Benner Cycle: 2023 Bakal Bikin Banyak Orang Kaya Baru?

Summary

TLDRThe video explores the Benner Cycle, a financial prediction model created by Samuel Benner in 1875. The cycle forecasts market fluctuations, including crises and growth periods, based on historical patterns in commodities like iron ore. It highlights the periodic nature of financial crises and booms, suggesting that investors can predict the best times to buy and sell. By analyzing past financial crises and their alignment with the Benner Cycle, the video demonstrates its relevance to modern markets, especially for 2023, which is predicted to be a period of financial difficulty (period C).

Takeaways

- 🌍 Cycles exist in many systems, including seasons, astronomy, life, and brain waves, and can help predict patterns.

- 📈 The Benner Cycle is a historical financial cycle tool designed to predict market rises and falls from year to year.

- 👨🌾 Samuel Benner, a farmer-merchant, created the cycle in 1875 after experiencing bankruptcy and researching market crashes.

- 📚 Benner's original work focused on commodity prices like iron ore, corn, and cotton and aimed to guide profitable trading decisions.

- 🕰️ The Benner Cycle divides market conditions into three periods: A (panic/crisis), B (good market/sell), and C (difficult/buy low).

- 🔢 Each period has specific cycle lengths in years: Period A (20, 16, 18), Period B (6, 9, 10), Period C (9, 7, 11).

- 🟢🔴🟡 The cycle can be visualized like a traffic light: Green = Buy, Red = Sell, Yellow = Alert/Wait.

- 📜 Historical data shows the Benner Cycle accurately predicted most major financial crises from 1783 to 2023, missing only once.

- 💹 Mapping the Benner Cycle against modern indices like the Dow Jones demonstrates potential profits when timing buy and sell actions correctly.

- ⏳ One full Benner cycle lasts 54 years, giving an average adult three opportunities to buy assets at low prices and three potential crash risks.

- ⚠️ The Benner Cycle is not foolproof and should be used alongside other financial indicators, as it was originally based on limited commodity data over 100 years ago.

- 📊 Modern trading apps like Magic/Ajaib incorporate cycle insights with tools for stock analysis, margin trading, and market tracking to help investors make informed decisions.

Q & A

What is the Benner Cycle and how was it developed?

-The Benner Cycle is a predictive model for market trends, developed by Samuel Benner in 1875. A farmer who went bankrupt due to a financial crisis, Benner analyzed past market crashes and created a cycle system based on commodity prices like iron, corn, and cotton. The cycle divides market periods into three phases: panic/crisis (Period A), good market times (Period B), and difficult buying opportunities (Period C).

How accurate has the Benner Cycle been historically?

-Historically, the Benner Cycle has been remarkably accurate, predicting major crises with only one miss from 1783 to 2023. It has successfully matched events like the American Revolution, the Panic of 1819, the Great Depression of 1929, and even the COVID-19 pandemic in 2019.

What are the three key periods in the Benner Cycle?

-The three periods in the Benner Cycle are: Period A (panic or financial crisis), Period B (good market conditions, typically when prices are high and assets should be sold), and Period C (difficult times, usually following a crisis, where prices are low and assets can be bought at a discount).

How doesQ&A on Benner Cycle the Benner Cycle help predict market movements?

-The Benner Cycle helps predict market movements by analyzing historical trends in commodity prices and identifying repeating cycles. These cycles follow a pattern based on the timing between financial crises and good market times, allowing investors to know when to buy, sell, or stay cautious.

What are the specific cycles associated with each period in the Benner Cycle?

-In Period A (panic/crisis), the cycles are 20, 16, and 18 years, representing the time between crises. In Period B (good market times), cycles are 6, 9, and 10 years. In Period C (difficult times), cycles are 9, 7, and 11 years. These patterns repeat, creating a predictable rhythm for market movements.

What is the significance of the color coding in the Benner Cycle chart?

-The Benner Cycle chart uses color coding to signify different market conditions: yellow represents Period A (alert), red represents Period B (sell assets), and green represents Period C (buy assets). This is designed like a traffic light system to guide investment decisions.

What role does the Foundation for the Study of Cycles play in the Benner Cycle's history?

-The Foundation for the Study of Cycles, led by Edward R. Dewey, studied and verified the Benner Cycle in 1967. Their research confirmed that the cycle's predictions for when to buy and sell commodities like iron ore were accurate over long periods, further cementing the cycle’s credibility.

What is the relationship between the Benner Cycle and the Dow Jones Index?

-When comparing the Benner Cycle to the Dow Jones Index, the cycle's phases align with market movements. Period C (green) signals buying opportunities when prices are low, Period B (red) signals selling times when prices are high, and Period A (yellow) signals caution during market downturns.

How does the Benner Cycle inform investors about the timing of financial crises?

-The Benner Cycle predicts financial crises by identifying repeating patterns in market downturns. Investors can use the cycle to anticipate when crises are likely to occur and plan accordingly, ensuring they buy assets at low prices during Period C and sell during the peak of Period B.

What is the main takeaway for investors from the Benner Cycle?

-The main takeaway from the Benner Cycle is that markets operate in predictable cycles, and by understanding these cycles, investors can make informed decisions about when to buy, sell, or hold assets. Additionally, the cycle highlights that in one human lifetime, an individual may experience three major financial crises and three major opportunities to buy low.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

N-110 Nursing Informatics Lecture 3: Informatics Theory and Practice Applications

Bitcoin: Liegen wir ALLE FALSCH & es kommt GANZ ANDERS?😳

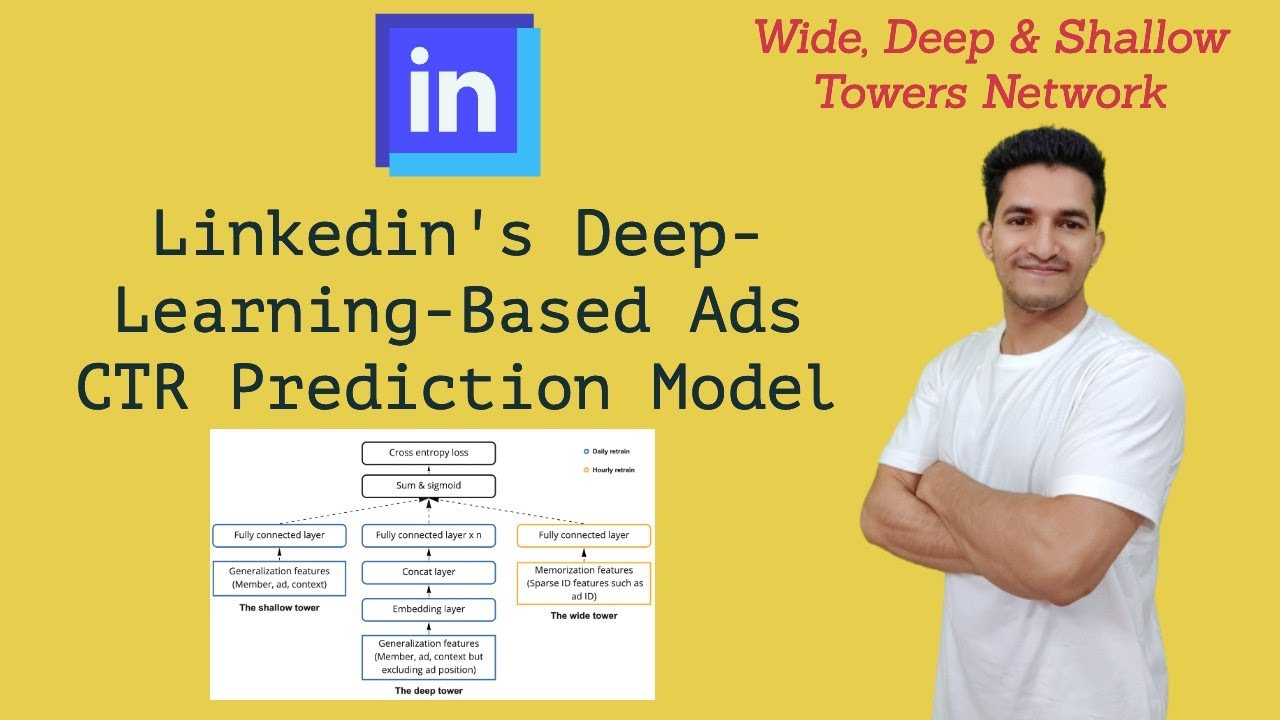

Innovative Linkedin's Deep-leaning based CTR Modeling: The Deep, Wide, and Shallow Towers Explained

Long Table Pancakes are The BEST Pancakes Kevin Has Ever Had! | Shark Tank US | Shark Tank Global

Наша бизнес модель финансового консалтинга

The real origin of mankind that you are not supposed to know: From the banned Bible

5.0 / 5 (0 votes)