20 HABIT KECIL yg Bikin Aku Financial Freedom di Umur 25

Summary

TLDRIn this video, the creator shares 20 daily habits that helped them achieve financial freedom by the age of 25. The habits are divided into categories: mindset, financial management, business, and lifestyle. Key practices include adopting an abundance mindset, controlling what you can, setting financial goals, automating savings, and building multiple income streams. The creator emphasizes the importance of personal growth, investing in knowledge, and maintaining a positive environment. With a balance of practicality and mindset shifts, these habits aim to guide viewers towards long-term financial success.

Takeaways

- 😀 Stop blaming your situation and focus on finding solutions rather than making excuses.

- 😀 Focus on what you can control and leave things outside of your control to God.

- 😀 Money should be seen as a tool, not a goal. It's important, but it's not everything.

- 😀 Stop comparing yourself to others. The real competition is with your past self.

- 😀 Cultivate an abundance mindset and believe that there are many opportunities to earn money.

- 😀 Track your expenses to avoid overspending, and be mindful of unnecessary temptations.

- 😀 Invest according to clear financial goals rather than relying on guesswork.

- 😀 Pay yourself first by setting aside savings and investments right when you get paid.

- 😀 Automate your savings to ensure consistency and avoid forgetting to save.

- 😀 Surround yourself with positive influences who inspire financial literacy and personal growth.

Q & A

What is the main factor behind achieving financial freedom according to the script?

-The main factor behind achieving financial freedom is the consistent practice of small habits over time, rather than relying on one big moment or event. These habits accumulate over years and have a significant impact on personal finances.

Why is it important to stop blaming circumstances when it comes to financial freedom?

-Blaming circumstances prevents growth. Instead, focusing on solutions and taking responsibility allows individuals to overcome challenges. People who progress are those who find ways to move forward, even if they weren't born into wealth.

What does the script suggest about controlling stress and money?

-The script emphasizes focusing on things we can control, rather than stressing over what is beyond our control. By accepting that some things are outside our influence, such as external factors or events, individuals can reduce stress and take effective action where they do have control.

How does the script define the role of money in life?

-Money is viewed as a tool, not a goal. While money is necessary to ease our lives, it should not be the ultimate pursuit. The focus should be on using money wisely to achieve life goals and improve well-being.

What is the significance of an abundance mindset in financial success?

-An abundance mindset helps individuals view money as something abundant and achievable. This mindset makes the process of earning money enjoyable and less stressful, as it promotes the belief that there are many opportunities to earn.

What does the script suggest about recording personal expenses?

-Recording personal expenses helps individuals monitor their spending habits, making it easier to identify areas where they might be overspending. This allows for better control over finances and prevents unnecessary purchases.

How should investments align with financial goals according to the video?

-Investments should be purposeful and aligned with specific financial goals. For example, if someone wants to save a set amount by a certain time, they should calculate how much they need to save monthly to reach that target, ensuring their investments are directly contributing to their objectives.

What is the strategy behind saving a portion of unexpected income?

-When receiving unexpected income (like a bonus or extra earnings), the script advises allocating 80% of that money toward savings or investments to accelerate progress toward financial goals. The remaining 20% can be used for personal enjoyment.

Why does the script stress increasing income in addition to saving?

-While saving is important, it has its limits due to necessary living expenses. Increasing income provides more financial freedom, allowing individuals to live more comfortably without overly restricting their lifestyle.

What is the value of diversifying sources of income?

-Having multiple income streams reduces financial risk. Relying on just one source can be dangerous if that income source is disrupted. By building additional income streams, individuals ensure financial stability even if one income stream falters.

Why is investing in knowledge considered an important habit for success?

-Investing in knowledge provides the highest return on investment. By continually learning and gaining new skills, individuals open doors to greater opportunities, which can lead to a more prosperous and successful life.

What role does social circle play in achieving financial freedom?

-The people around you influence your mindset and actions. A positive, financially literate circle encourages better habits and decisions. Energy is contagious, and being surrounded by people who prioritize financial growth can motivate others to do the same.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5 Habits That Made Me A Crorepati By 23

This one mindset change made me $20,000 in a month..

9 Investing Habits That Made Me $600,000 by 24

كيف تعلمت اللغة الاسبانية من الصفر؟ | مصادر وطرق للتعلم بفعالية

7 Habits That Made Me A Multi-Millionaire At 25

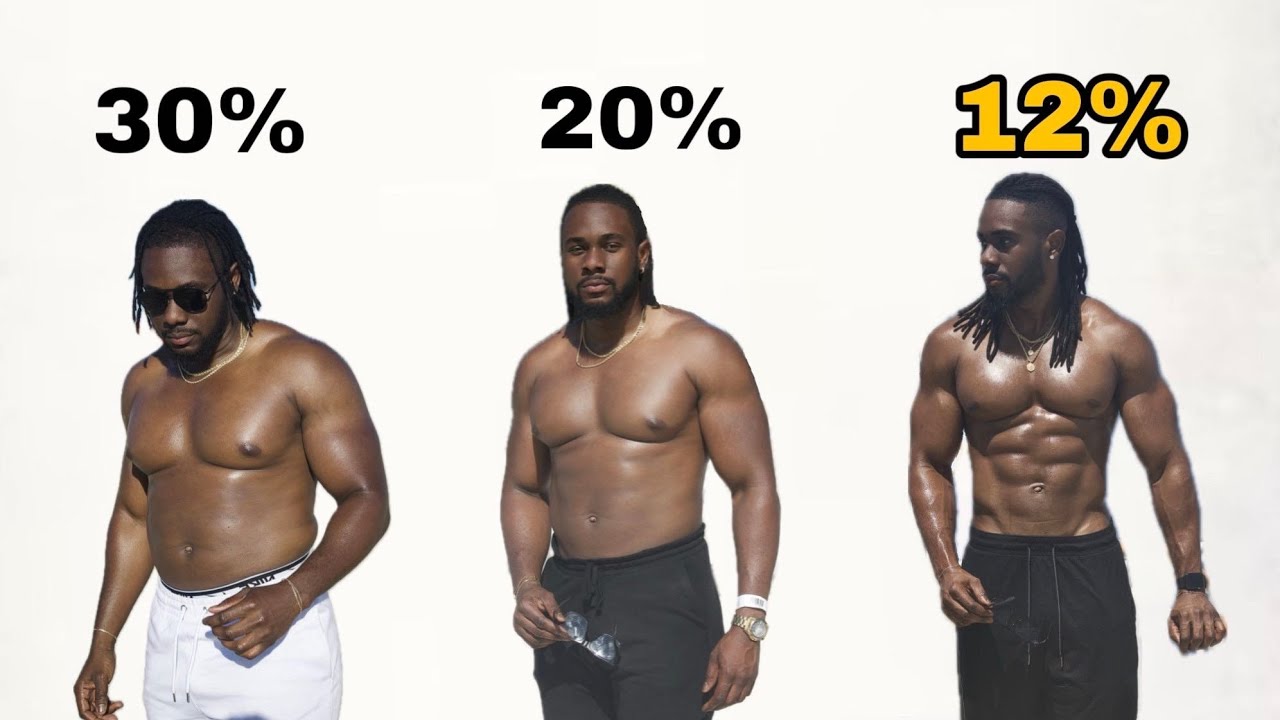

5 Easy daily habits that got me to 12% body fat quickly

5.0 / 5 (0 votes)