You Need to Know This Before Buying or Selling AST SpaceMobile Stock | ASTS Stock Analysis

Summary

TLDRAS Space Mobile is an innovative company launching satellites to improve communication technology, with plans to launch 90 satellites in total. Despite rising costs due to tariffs, the company aims to break even with 25 satellites and generate significant cash flow at full scale. They anticipate revenue growth in 2025, primarily in Q3 and Q4. The company raised $400 million via a convertible note, which may lead to stock dilution. This is a high-risk, high-reward investment, ideal for investors with a higher risk tolerance, offering the potential for substantial returns.

Takeaways

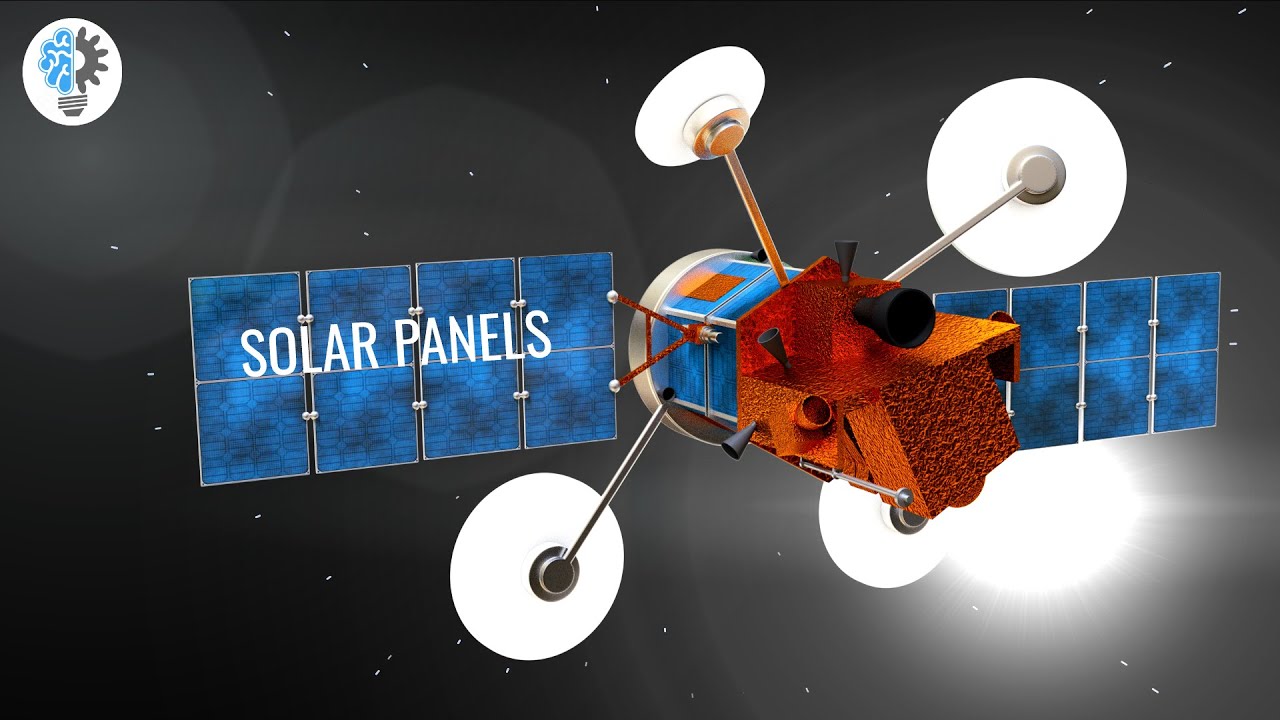

- 😀 AS Space Mobile is an innovative company launching satellites to improve communication technology, with a focus on space-based operations.

- 📊 The company plans to launch about 90 Block 2 Bluebird satellites, each costing between $21 to $23 million, which is a 10% increase compared to previous estimates.

- 🚀 Tariffs have increased costs for AS Space Mobile, specifically for components used to build their satellites, leading to a higher overall satellite cost.

- 💰 Despite higher costs, AS Space Mobile expects to break even or become cash flow positive with just 25 satellite launches, which is a crucial milestone for the company's financial independence.

- 📈 The company anticipates a ramp-up in revenue, projecting between $50 to $75 million in 2025, with the bulk of revenue coming in Q3 and Q4.

- 💸 AS Space Mobile ended Q1 2025 with $875 million in cash, which was boosted by a $400 million convertible note offering.

- 💳 Convertible notes are a form of financing where investors can either receive interest payments or convert the debt into shares of the company, potentially diluting existing shares in the future.

- 🔍 A convertible note allows AS Space Mobile to borrow money at a lower interest rate by offering investors the option to convert their loan into stock if the company succeeds.

- 📉 The increased number of shares resulting from convertible note conversions may affect earnings per share, as more shares will be outstanding in the future.

- ⚠️ Investing in AS Space Mobile involves high risk, as satellite launches may not go as planned, but the potential for significant returns exists if the company succeeds.

Q & A

What is AS Space Mobile's primary business focus?

-AS Space Mobile is focused on launching satellites to improve communication technology, with some of their operations extending outside the planet into space.

How do tariffs impact AS Space Mobile's satellite production?

-The tariffs have increased the cost of materials required for building satellites, pushing the price per satellite from $20 million to about $22 million, a 10% increase.

At what point does AS Space Mobile expect to become cash flow positive?

-AS Space Mobile expects to become cash flow positive with the operation of about 25 satellites, which they consider their break-even or inflection point.

What revenue range does AS Space Mobile expect for 2025?

-AS Space Mobile expects a revenue opportunity in 2025 between $50 million and $75 million, with most of this revenue anticipated to come in the second half of the year, specifically in Q3 and Q4.

What is a convertible note and why is it important for AS Space Mobile?

-A convertible note is a financial instrument where investors can loan money to the company, with an option to convert that loan into stock. AS Space Mobile used this to raise capital, allowing them to borrow at a lower interest rate while offering potential future equity to investors.

What did AS Space Mobile do to increase its cash reserves in Q1 2025?

-In Q1 2025, AS Space Mobile increased its cash reserves by $300 million, primarily through a $400 million convertible note offering that closed in late January.

How many satellites does AS Space Mobile plan to launch, and what is their timeline for achieving full scale?

-AS Space Mobile plans to launch a total of 90 Block 2 Bluebird satellites. They expect to become cash flow positive with 25 satellites and will continue to ramp up their operations toward 90 satellites for more significant cash flow generation.

What is the expected increase in capital expenditure for AS Space Mobile in Q2 2025?

-AS Space Mobile expects its capital expenditure in Q2 2025 to increase to around $250 million, driven primarily by the timing of payments on multiple launch contracts.

How does the company plan to reduce its reliance on investors for capital in the future?

-Once AS Space Mobile operates around 25 satellites and becomes cash flow positive, they will significantly reduce their reliance on investors for raising capital, relying more on the revenues from satellite operations.

What type of investors is AS Space Mobile's stock suited for?

-AS Space Mobile's stock is suited for high-risk, high-return investors who have a higher risk tolerance. The company is in an early, high-risk stage with potential for significant returns, but the risk of failure is also considerable.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)