Anak Muda, Lindungi Uang Kalian

Summary

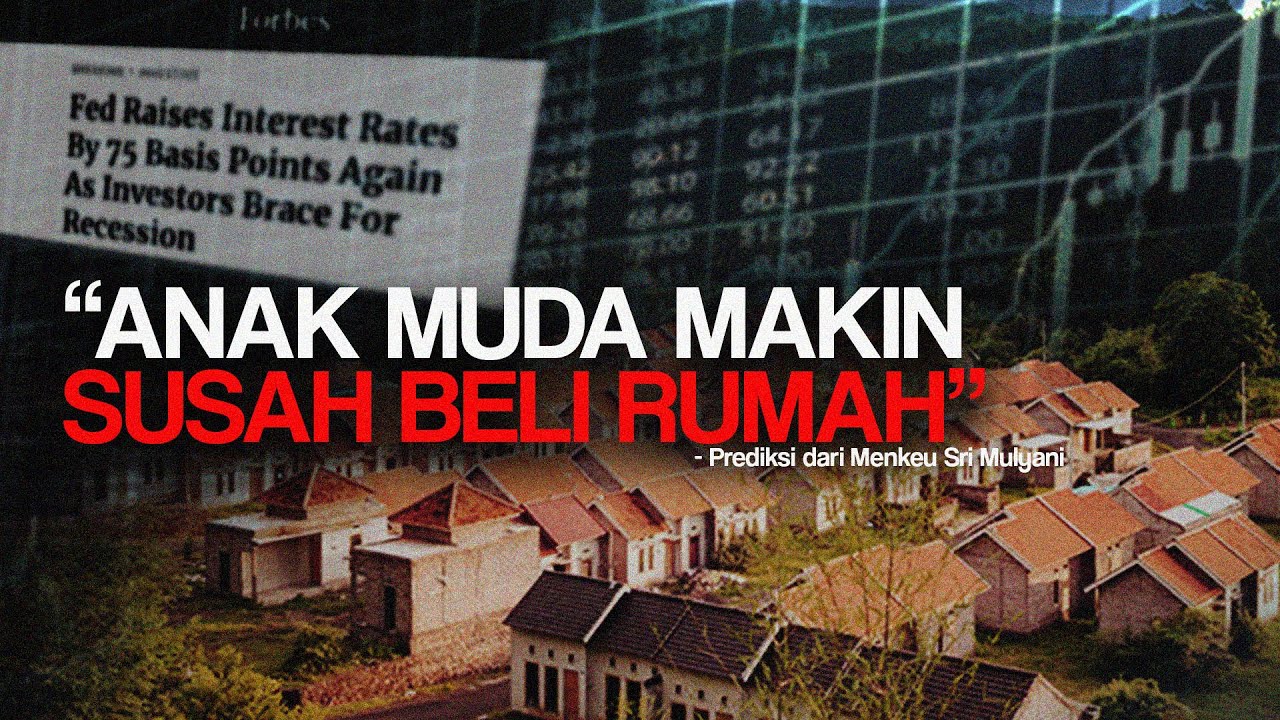

TLDRThe video discusses the financial challenges millennials and Gen Z may face in the future, highlighting issues such as rising costs, inflation, and spending habits. The speaker reflects on how the financial targets and perspectives of the younger generations are influenced by previous generations, but notes the current economic environment is vastly different. Key points include the impact of digitalization on spending, economic uncertainty, and the need for financial planning. The speaker emphasizes awareness and adaptability as crucial for achieving financial stability amidst these challenges.

Takeaways

- 😟 Millennials and Gen Z may face significant financial challenges in the future due to inflation and high living costs.

- 🏠 The dream of owning a home, getting married, and starting a family is becoming increasingly difficult for young people.

- 📈 Inflation and rising costs of essentials and property are key factors making financial stability hard to achieve.

- 💼 While young people are creative and can generate income, traditional career paths may not offer sufficient financial growth.

- 💸 Spending habits and perspectives on saving among younger generations are contributing to financial instability.

- 📉 Savings rates are decreasing, and trends like 'soft saving' emphasize enjoying life over saving money.

- 📊 Economic growth driven by domestic consumption can be risky if people aren't prepared for long-term financial stability.

- 📱 The influence of technology and social media increases impulsive spending, leading to financial challenges.

- 💳 The ease of spending through digital innovations and financing options like 'pay later' exacerbates financial risks.

- 🌐 Global economic uncertainties and events significantly impact local financial stability, affecting everyday life in Indonesia.

Q & A

What trend is the speaker concerned about regarding millennials and Gen Z?

-The speaker is concerned that millennials and Gen Z will face significant financial difficulties in the next 5, 10, or 20 years.

What does the speaker identify as one of the contributing factors to financial instability for young people?

-The speaker identifies themselves as a contributor to the problem, indicating that the current system and societal expectations influence financial instability.

What is FIRE and why is it considered a dilemma by the speaker?

-FIRE stands for Financial Independence, Retire Early. The speaker considers it a dilemma because, despite being an ambitious generation striving for financial independence, young people are influenced by unrealistic financial goals set by previous generations.

How does the speaker describe the financial goals influenced by previous generations?

-The speaker describes the financial goals of previous generations as centered around owning a house, getting married, and having a family, which are now much harder to achieve due to increased living costs.

What are the three factors the speaker believes will lead young people into financial difficulty?

-The three factors are rising prices (inflation), the ability to generate income, and spending habits.

How does the speaker describe the spending habits of the current generation compared to previous ones?

-The speaker believes the current generation has poor spending habits and perspectives on money, influenced by trends like 'soft saving' and a focus on living a happy, stress-free life rather than saving.

What is the significance of digitalization and social media according to the speaker?

-Digitalization and social media play a significant role in influencing young people's spending behavior, making it easier for them to spend money and be influenced by advertisements.

What does the speaker suggest about the ease of spending in today's world?

-The speaker suggests that spending money is now much easier due to technological advancements, making it almost effortless to make purchases, sometimes even without having the money immediately available (e.g., pay later options).

What is the 'FOMO Factor' mentioned by the speaker?

-The 'FOMO Factor' refers to the Fear of Missing Out, which drives young people to spend money influenced by social media and the constant exposure to new trends and products.

How does the speaker view economic uncertainty and its impact on young people?

-The speaker views economic uncertainty as a significant issue, exacerbated by global events and digital information flow, which can influence financial decisions and create anxiety among young people.

What is the speaker's main message to young people regarding financial planning?

-The main message is to be aware of the different economic and societal conditions compared to previous generations and to focus on both making and protecting money to achieve financial stability.

Why does the speaker mention the importance of balancing offensive and defensive strategies in financial planning?

-The speaker uses a game analogy to emphasize that while making money (offense) is important, protecting and managing money (defense) is crucial for long-term financial stability.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Kenapa MILENIAL Jadi Generasi PALING MISKIN Dalam Sejarah? Tidak Ada Harapan? | Learning By Googling

Why is Gen Z so Poor?

How Much Are Millennials REALLY Saving For Retirement?

Why are Gen Z Broke? | The Stream

Millennials & Gen Z: Young And In Debt. Why? | Talking Point | Full Episode

Apa Faktor Yang Membuat Millenial Susah Beli Rumah?

5.0 / 5 (0 votes)