The Next Great Crash? Echoes of 1929-1939

Summary

TLDRIn this video, the speaker discusses strategies to prepare for a potential long-term recession, focusing on risk management and financial security. With over 35 years of experience in portfolio management and technical analysis, the speaker offers valuable insights on handling market volatility and making informed investment decisions. They also promote an online trading course designed to help retail investors avoid common mistakes and master money management. The speaker emphasizes their commitment to educating investors through a blog, newsletter, and practical guidance for long-term success.

Takeaways

- 😀 The speaker discusses the potential risks of a long-term recession and the importance of being prepared for it.

- 😀 A recession may not be immediate, but there are indicators suggesting it could happen in the next 12 to 18 months.

- 😀 Understanding economic cycles is crucial for planning ahead and positioning investments appropriately during a recession.

- 😀 Diversifying investments across asset classes, such as stocks, bonds, and precious metals, can help mitigate risks during economic downturns.

- 😀 Protecting portfolios with proper risk management tools, like stop-loss orders, is essential in times of market volatility.

- 😀 The speaker advocates for having a strategy to manage risk rather than focusing solely on short-term profits.

- 😀 The speaker is a seasoned portfolio manager with 35 years of experience and a pioneer in technical analysis in Canada.

- 😀 The speaker encourages viewers to consider enrolling in their online trading course, which offers a comprehensive money management system.

- 😀 The course is designed to help retail investors avoid common mistakes by providing step-by-step guidance based on the speaker's three decades of experience.

- 😀 The speaker promotes their blog and newsletter, which provide ongoing trading ideas and technical analysis without spamming or soliciting business.

- 😀 The content shared through the channel is aimed at educating retail investors on how to manage their investments properly for long-term success.

Q & A

What is the main focus of the speaker in this video?

-The main focus is on how to prepare for a potential long-term recession, including strategies and probabilities of such an event occurring.

How does the speaker suggest preparing for a long-term recession?

-The speaker discusses investing strategies, emphasizing the importance of being prepared for economic downturns through proper money management, risk assessment, and strategic asset allocation.

What are the speaker’s qualifications in the field of investing?

-The speaker has 35 years of experience as a portfolio manager and is considered one of the early pioneers of technical analysis in Canada.

What is the Value Trend online trading course about?

-The Value Trend online trading course is a comprehensive money management system. It is a step-by-step course designed to teach retail investors how to manage their investments effectively based on the speaker's 30+ years of experience.

How does the speaker price the trading course?

-The course is priced extremely low to make it accessible to retail investors, with the aim of providing value and helping people avoid common investing mistakes.

What kind of content is included in the Value Trend newsletter?

-The newsletter includes ongoing investment ideas, charts, and trading strategies, with a focus on educating retail investors and providing actionable insights.

How does the speaker differentiate the Value Trend newsletter from other newsletters?

-The speaker emphasizes that their newsletter is purely informational, without solicitation or spam. It is designed to educate retail investors without pushing unnecessary business or marketing.

What does the speaker mean by 'walk the walk'?

-When the speaker says 'walk the walk,' they mean that they not only talk about investment strategies but actively implement them, demonstrating their experience and credibility as a portfolio manager.

Why does the speaker recommend the course to retail investors?

-The speaker recommends the course because it condenses over 30 years of experience into a step-by-step format that helps investors avoid making costly mistakes, which they themselves faced in the early stages of investing.

What is the goal of the speaker's mission with Value Trend?

-The goal is to educate retail investors on how to invest properly, providing them with the tools and knowledge to manage their portfolios and avoid common errors in investing.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

4 PASIF INCOME TERBAIK DITENGAH PERANG DAGANG AMERIKA

SGO - 04 B I S N I S | Studium Generale Online @BerbagiMakna7 #binis #ugjcirebon #studiumgenerale

Manajemen Pembelanjaan

Achieving Investment Success: Providend's Philosophy of Sufficiency

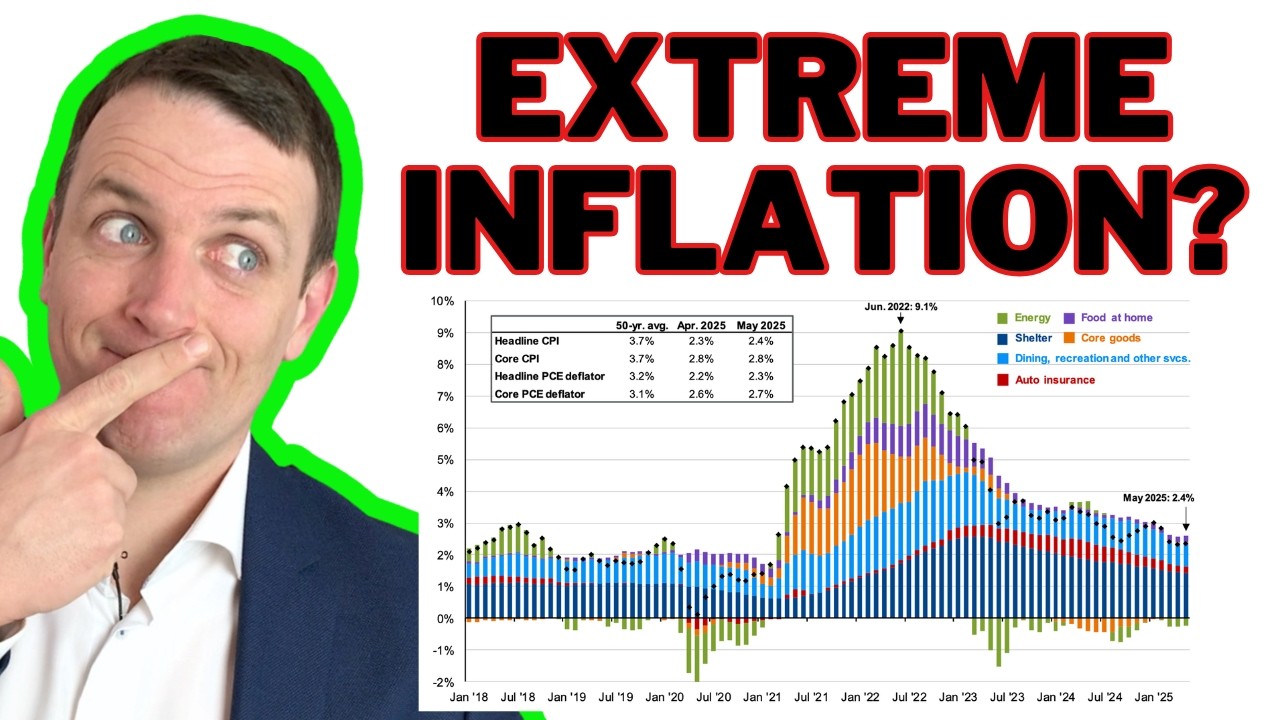

Ready for a possible extreme financial environment?

I risk $107 to make $7,500 in Trading… This is how

5.0 / 5 (0 votes)