ملامح الاقتصاد العالمي في عام 2025 بعد عودة ترامب!

Summary

TLDRIn this discussion, Ahmed Naguib, Head of Research for the Arab region at Xs, provides insights into the current state of global markets. He highlights the resilience of Asian markets despite upcoming tariff concerns and the ongoing trade war. Naguib reflects on the potential challenges the US stock market faces amid past record performances and the impact of inflation and labor issues. He further discusses the outlook for small businesses, the effects of tax cuts, and the role of interest rates in shaping market dynamics, particularly for small and medium enterprises. He also touches on the potential influence of US presidential policies on the economy.

Takeaways

- 😀 The American markets will begin trading in approximately five hours, and this will provide more clarity on market expectations.

- 😀 Asian markets are performing well today, and there is potential for this to be sustained, but concerns remain about upcoming tariffs.

- 😀 The full effects of the trade war with President Trump and its impact on Chinese companies have not yet been fully priced into the markets.

- 😀 From 2017 to 2019, markets had a positive performance, but there is uncertainty about whether this will repeat given potential corrections and market pressures.

- 😀 The stock market has experienced strong growth in the past two years, but this exceptional performance may face pressure moving forward.

- 😀 The tax cuts expected by the markets may trigger repurchases of company shares, which could have a positive impact, though other challenges remain.

- 😀 Trump’s policies, including immigration control, may have significant impacts on inflation and could affect future Federal Reserve decisions.

- 😀 The strengthening of the U.S. dollar is likely to continue, with its direction influenced by the Federal Reserve's upcoming policy decisions and interest rate expectations.

- 😀 The Russell 2000 index, which includes small and medium-sized companies, may benefit from tax cuts but faces pressure from interest rate changes.

- 😀 Small companies will likely benefit from tax reductions, but challenges like high wages and the impact of tariffs remain key concerns for these businesses.

Q & A

What is the general sentiment towards the performance of Asian markets according to the speaker?

-The speaker highlights that Asian markets are currently performing well, and there is a sense of optimism surrounding their performance. However, the speaker acknowledges that pressures such as upcoming tariffs have caused some concerns.

How have the effects of the trade war under Trump been reflected in the markets?

-The speaker mentions that the trade war, particularly with China, has had a significant impact on many Chinese companies, which are still struggling. The trade war hasn't been fully priced in by the markets yet, especially in the bond market, which has not fully acknowledged the associated risks.

What is the speaker's view on the potential for a market correction following the strong performance in recent years?

-The speaker suggests that a market correction is likely due to the exceptional performance seen in the past two years, which may not be sustainable. While the markets have performed exceptionally well, especially due to low interest rates and other factors, a correction is expected to occur.

How does the potential tax reform relate to market expectations?

-The speaker explains that the potential tax cuts, particularly for small businesses, are expected to positively affect the markets. The expectation is that tax reforms could boost stock buybacks and company earnings, potentially driving market growth.

What are the main challenges the markets face according to the speaker?

-The speaker outlines several challenges, including the uncertainty surrounding tariff policies, potential changes in the labor market due to immigration policies, and the broader impacts of inflation on companies and the economy. These factors could create significant pressure on market growth.

What role does the Federal Reserve's policy play in the outlook for the markets?

-The speaker emphasizes that the Federal Reserve's actions, particularly regarding interest rate changes and monetary policy, will be crucial in shaping market behavior. Investors are closely watching whether the Fed will continue cutting rates or take a more cautious approach, as this will impact investor sentiment and market dynamics.

What impact has the coronavirus pandemic had on the economy and markets?

-The speaker notes that the pandemic had a major effect, especially as it coincided with the end of Trump's first term. The pandemic contributed to massive market shifts, including significant government stimulus measures that helped support the economy and led to a rally in stock prices.

How does the labor market, particularly issues around illegal immigration, affect economic policies?

-The speaker mentions that Trump's stance on illegal immigration, which could lead to deportations, may significantly affect inflation numbers, especially concerning wages. These changes could put pressure on the Federal Reserve and its ability to control inflation, thus influencing economic policies and market reactions.

What is the outlook for the US dollar based on recent developments?

-The outlook for the US dollar is somewhat positive in the short term, with expectations of a potential rise in its value due to the Federal Reserve's policy and market expectations. However, the speaker also anticipates a potential correction before the dollar could rise further, especially as the effects of the tariffs become clearer.

How are smaller businesses expected to fare compared to larger corporations in the current economic environment?

-The speaker believes that smaller businesses are more likely to benefit from tax cuts, especially since they often face higher relative costs than large corporations. However, challenges such as rising labor costs and the uncertainty surrounding tariffs could affect their performance. Large companies are more insulated due to their cash reserves and other advantages.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

هل تُنقذ البنوك المركزية الأسواق أم تُغرقها؟

رؤية في مستقبل أسعار الذهب لعام 2025

Sushil Kedia Latest | Sushil Kedia Today | Sushil Kedia CNBC Today | Sushil Kedia Zee Business

Do You Like Money?

المدوان | ما سبب قطع السعودية النفط عن أمريكا؟

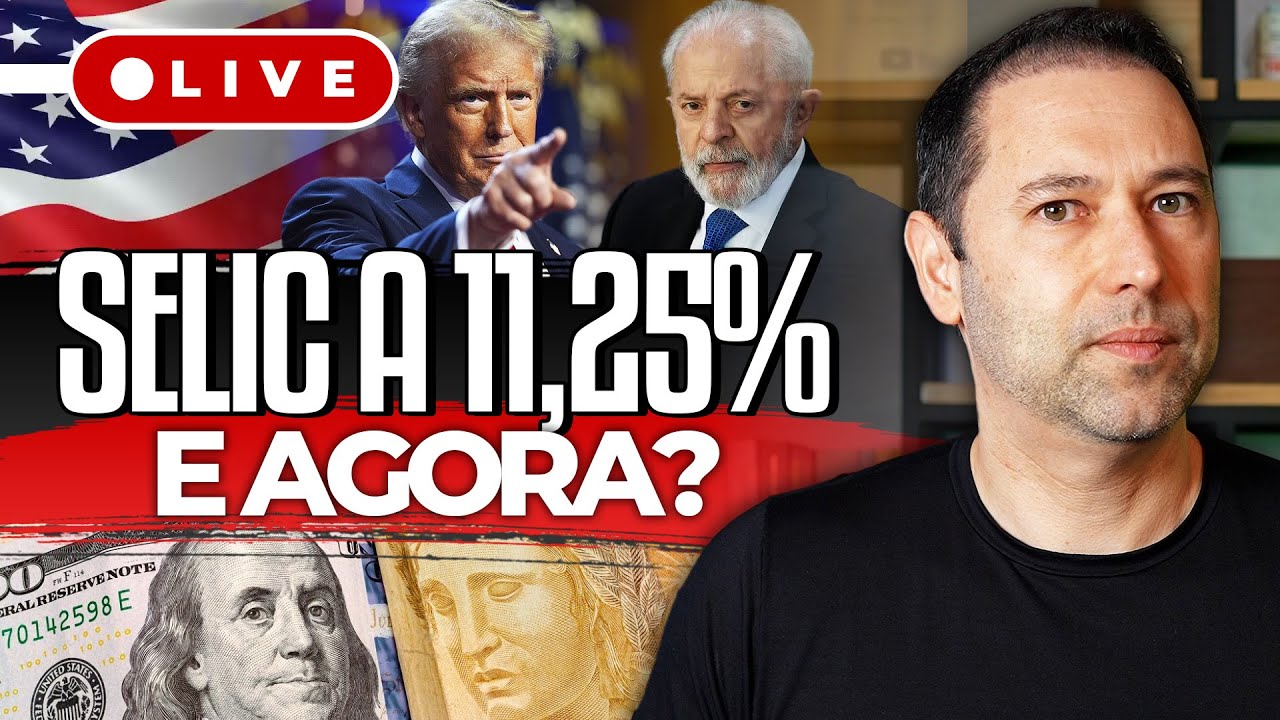

NOVA ALTA NA TAXA SELIC PARA 11,25% | COMO FICAM OS INVESTIMENTOS NO BRASIL + DONALD TRUMP ELEITO

5.0 / 5 (0 votes)