Identifying The Structures of a Discussion Text about The Future Payment Method: Cashless

Summary

TLDRThe video discusses the pros and cons of transitioning to cashless payment methods. Proponents argue that cashless transactions offer convenience, lower crime rates, and easier international payments. On the other hand, opponents highlight issues such as overspending, lack of privacy, and increased risks of digital theft. While businesses benefit from cashless payments through lower handling costs and easier transaction tracking, some individuals still prefer cash for its universal acceptance. The video encourages viewers to consider both sides before making decisions about adopting cashless payments.

Takeaways

- 😀 Cashless payments are becoming increasingly common and are already in use in many financial transactions today.

- 😀 Proponents argue that cashless payments offer convenience, as they allow instantaneous access to cash using debit/credit cards or mobile payment services.

- 😀 Supporters believe that cashless transactions can help reduce crime rates since there's less physical cash to steal.

- 😀 A major benefit of cashless payments is the automatic paper trail, making it easier to track financial transactions.

- 😀 Businesses benefit from cashless payments through reduced costs for handling physical cash and processing fees from digital transactions.

- 😀 International payments are easier with cashless methods as currency conversion becomes seamless in digital transactions.

- 😀 Opponents of cashless payments argue that cash is universally accepted, and in some cases, a minimum purchase is required to pay with cash.

- 😀 Critics also believe that cashless payments may lead to overspending since people can’t physically see or feel the money leaving their accounts.

- 😀 Research suggests that people in debt may be at a higher risk of developing mental health issues such as depression and anxiety when using cashless payments.

- 😀 Concerns about privacy arise with cashless payments, as users' financial data is handled by organizations and could potentially be exposed to hackers or stolen by digital thieves.

- 😀 While cashless payments can benefit businesses and offer convenience, individuals are encouraged to carefully consider the pros and cons of using cash versus digital payment methods.

Q & A

What does the term 'cashless' refer to in the context of this video?

-In the video, 'cashless' refers to a financial system where paper money and coins are not used for transactions. Instead, payments are made using debit or credit cards, online payment systems like PayPal, or virtual accounts.

Why do proponents of cashless payments argue that it is a wise decision?

-Proponents believe cashless payments are wise because they offer increased convenience, lower crime rates, automatic paper trails, reduced transaction costs, and easier international payments.

How does the cashless payment system reduce crime rates?

-Cashless payments reduce crime rates by minimizing the use of physical cash, which is often targeted by criminals for theft. Digital transactions are more secure and traceable.

What is a key advantage of using digital payments, according to the video?

-A key advantage of using digital payments is the convenience of having instantaneous access to funds through cards or smartphones, making it easier to manage money and make transactions quickly.

What concerns do opponents of cashless payments raise?

-Opponents argue that cashless payments have several drawbacks, including limited acceptance in certain places, the potential for overspending due to the ease of credit card use, privacy issues, and security risks such as data theft and hacking.

Why do some people find it easier to overspend with digital payments?

-Some people find it easier to overspend with digital payments because they do not physically see the money being spent. This lack of tangible representation can make it harder to understand the value of money and control spending habits.

What are the privacy concerns associated with cashless payments?

-The privacy concerns with cashless payments include the exposure of personal transaction data to organizations that handle digital payments. This makes users vulnerable to privacy breaches and increases the risk of their data being misused or hacked.

How do cashless transactions affect business costs?

-Cashless transactions help businesses reduce costs associated with handling cash, such as processing fees, the need for physical storage, and security measures. They also streamline tracking of transactions, making financial operations more efficient.

What is the connection between digital payments and mental health issues?

-Research suggests that individuals who rely heavily on digital payments and incur debt through credit cards may be more likely to experience depression and anxiety due to financial stress and a lack of tangible control over their finances.

What is the final recommendation provided in the video regarding cashless payments?

-The video advises that individuals should be cautious when choosing between cash and cashless payments, carefully considering both the benefits and drawbacks of each method before making a decision.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Cashless Payment (Pros n Cons)

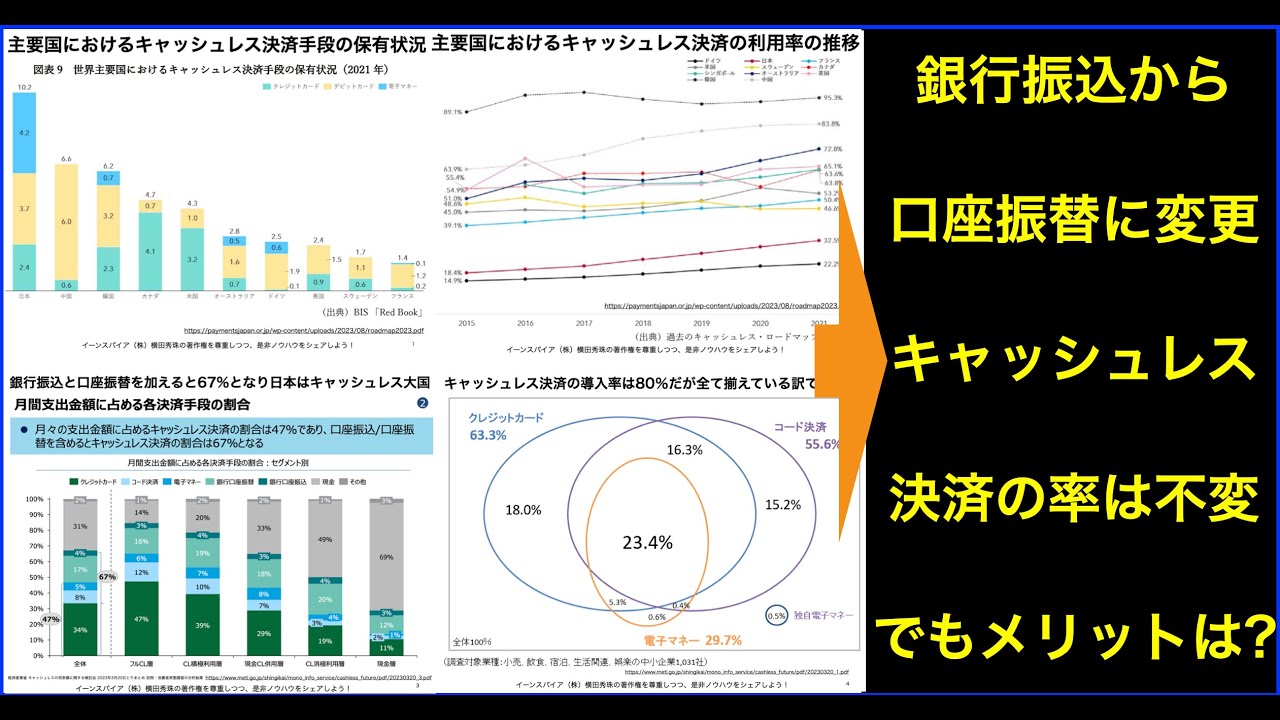

キャッシュレス決済のメリットとデメリットを最新データ分析②全6回

CARA PEMBAYARAN EKSPOR IMPOR - APA ITU LETTER OF CREDIT? - BELAJAR EXPORT UNTUK PEMULA DARI NOL

LPE 2403 Group Discussion Task 1 (GROUP 1) THEME 2

The Dark Side of Insurance: The Shocking Truths They Don’t Want You to Know

Understanding Payment Methods

5.0 / 5 (0 votes)