PPN 12 Persen Berlaku Mulai 2025, Analis: Kelas Menengah Paling Terpukul

Summary

TLDRThe Indonesian government plans to raise the Value Added Tax (VAT) from 11% to 12%, effective January 2025, under the provisions of the 2021 Tax Harmonization Law. This increase is expected to raise the cost of goods and services, particularly affecting the middle class, which has already faced declining purchasing power. Senior analysts predict that the VAT hike will reduce consumer demand, potentially leading to layoffs due to decreased production. Despite concerns, Finance Minister Sri Mulyani has affirmed that the tax increase is essential for maintaining the health of the national budget.

Takeaways

- 😀 The Indonesian government plans to raise the Value Added Tax (VAT or PPN) from 11% to 12% starting January 2025.

- 😀 The VAT increase follows the provisions of Law No. 7 of 2021 on tax harmonization.

- 😀 Senior analyst Roni P. Sasmita confirms that the VAT hike will lead to higher prices for goods and services.

- 😀 Businesses are likely to pass the VAT increase onto consumers, as they typically avoid absorbing additional tax costs.

- 😀 The middle class is expected to be the most affected by the VAT increase due to already declining purchasing power over the last two years.

- 😀 As prices rise, consumer demand is likely to decrease, which could affect overall economic activity.

- 😀 A reduction in demand could lead to a decrease in production across various industries.

- 😀 The decline in production could lead to potential layoffs and rising unemployment.

- 😀 Finance Minister Sri Mulyani Indrawati states the VAT increase is necessary to maintain the health of Indonesia's state budget (APBN).

- 😀 The increase in VAT aims to improve fiscal sustainability while addressing the country's budgetary needs.

Q & A

What is the main topic of the transcript?

-The main topic of the transcript is the planned increase in the Value Added Tax (VAT) in Indonesia from 11% to 12%, effective from January 2025, and its potential economic impacts.

Why is the government raising the VAT rate?

-The government is raising the VAT rate as part of the implementation of the harmonized tax regulation in accordance with the Law No. 7 of 2021, aiming to maintain the health of the national budget (APBN).

What will be the direct impact of the VAT increase on prices?

-The direct impact of the VAT increase will be a rise in the prices of goods and services, as businesses are likely to pass the tax increase onto consumers.

How will the VAT increase affect consumers, especially in the middle class?

-The VAT increase will put additional pressure on consumers, particularly the middle class, which has been experiencing a decline in purchasing power over the last two years.

Why is the middle class particularly affected by this VAT increase?

-The middle class is particularly affected because they are already struggling with reduced purchasing power, and the VAT increase will further burden their ability to purchase goods and services.

What economic consequence might result from decreased consumer spending due to the VAT increase?

-A decrease in consumer spending could lead to lower demand for goods and services, which may subsequently reduce production levels in businesses and could increase the risk of layoffs (PHK) in the workforce.

How does the VAT increase impact businesses in Indonesia?

-Businesses may face challenges as they will either need to pass the VAT increase onto consumers through higher prices or absorb the costs themselves, potentially reducing profitability and increasing financial pressures.

What does the expert, Roni P. Sasmita, say about the impact of the VAT increase?

-Roni P. Sasmita confirms that the VAT increase will lead to higher prices for goods and services, and businesses are likely to shift the increased tax burden onto consumers, which will negatively impact middle-class purchasing power.

What did Finance Minister Sri Mulyani Indrawati say about the VAT increase?

-Sri Mulyani Indrawati stated that the VAT increase is necessary to ensure the health of Indonesia's state budget (APBN) and will be implemented starting January 1, 2025.

What does the term 'harmonization of tax regulations' refer to in this context?

-The 'harmonization of tax regulations' refers to the reforms outlined in Law No. 7 of 2021, aimed at streamlining and improving the tax system in Indonesia, including the VAT increase.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Tepatkah Menerapkan Kenaikan PPN jadi 12 Persen di Awal 2025?

Bisa Banyak PHK? Ini Dampak Besar PPN Naik 12% Di Indonesia!

Why Indonesia Keeps Raising Taxes | Value Added Tax (VAT)

[BREAKING NEWS] Resmi 1 Januari PPN Naik 12%, Berikut Daftar Barangnya | tvOne

Pemerintah naikkan tarif PBB pedesaan dan perkotaan setelah kerek tarif PPN

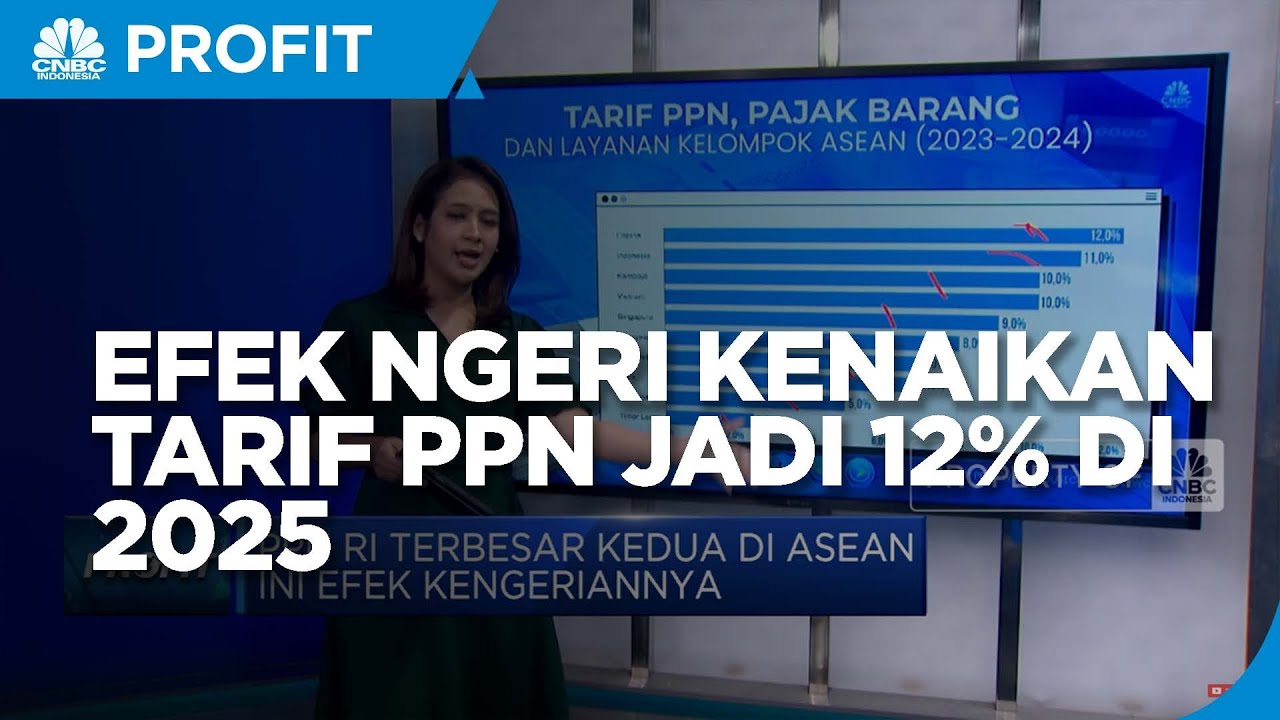

Tarif PPN RI Terbesar Kedua di ASEAN, Ini Efek Kengeriannya

5.0 / 5 (0 votes)