Why Airbnb Fails to Disrupt the Hotel Industry

Summary

TLDRThe hotel industry operates on a complex business model balancing high fixed and variable costs with strategies to maximize revenue. Luxury hotels focus on additional amenities and peak-season pricing, while budget-friendly options cater to value-conscious travelers. Companies like Hilton and Marriott dominate the market, benefiting from franchise models that reduce risk and capital investment. Meanwhile, Airbnb's platform model disrupts traditional hotels by monetizing existing housing without ownership, but faces challenges in service consistency and regulation. Despite its growth, Airbnb competes on a different level, as established hotel chains leverage brand, reliability, and service to maintain their edge.

Takeaways

- 😀 Hotels operate on economies of scale and scope, adjusting pricing based on seasonality and guest volume to maximize revenue.

- 🏨 The hotel business is costly, with high fixed and variable expenses, particularly in luxury hotels that offer a wide range of amenities.

- 💡 Hotel giants like Hilton, Marriott, and Hyatt already follow an asset-light, fee-based platform model similar to Airbnb, making them more resilient to disruption.

- 📉 Hotels face challenges during the low season (November to March) when occupancy is low, but they recover in the high season (May to August) with higher room rates and additional services.

- 💸 Luxury hotels make a significant portion of their revenue from amenities (e.g., bars, spas, valet) and services rather than just room rates.

- 🏆 Major hotel chains like Hilton, Marriott, and IHG are not just owners but rely heavily on franchising and management fees, generating more revenue from fees than from owning properties.

- 🔍 Airbnb's platform model is not a novel concept—it mirrors the fee-based business structure that major hotel chains have been using for decades.

- 🌍 Airbnb’s scale surpasses traditional hotels, with 6 million active listings in 2021 compared to 2.5 million hotel rooms from major chains like Marriott and Hilton combined.

- 💼 Despite the rise of Airbnb, traditional hotel chains maintain competitive advantages in consistency, service, and reliability, especially for business and leisure travelers.

- 🏠 The real challenge for Airbnb lies in service quality, safety concerns, and regulation, which have affected its ability to maintain the same perceived value and uniqueness it once had.

Q & A

What is the main business model of hotels?

-Hotels generate revenue by renting out rooms to guests at a nightly rate. They charge additional fees for various amenities such as breakfast, room service, and laundry. The hotel also benefits from economies of scale and scope by offering a variety of services and amenities like gyms, pools, and bars to increase the average guest bill.

Why do hotels slash prices during the low season?

-Hotels lower room prices in the low season to maintain volume and occupancy rates. Since demand drops due to factors like cold weather, fewer business trips, and reduced vacations, lower prices help ensure that rooms are filled, even if they are not at peak demand.

How do hotel chains manage operating costs during the low season?

-Even during the low season, hotels incur significant fixed costs such as staffing, utilities, and room maintenance. To manage these costs, hotels leverage amenities and additional services like food and beverage sales, spa treatments, and valet services to generate additional revenue and offset the losses from lower room occupancy.

How do luxury hotels maintain profitability despite lower occupancy during the low season?

-Luxury hotels, like the JW Marriott, use high-end amenities and services to increase revenue per guest. They offer services such as fine dining, spa treatments, and concierge services, which help compensate for the lower occupancy rates during the low season by increasing the average guest spend.

How do Hilton and Marriott differ in terms of room offerings and revenue generation?

-Hilton focuses on a broad portfolio of hotel brands across upscale and midscale segments, with a strong emphasis on business travelers. Marriott, in contrast, has a more diversified portfolio that includes luxury brands like Ritz-Carlton and St. Regis, and also dominates in midscale markets with brands like Courtyard and Fairfield. Marriott generates nearly three times as much revenue as Hilton, thanks to its larger scale and broader brand offerings.

What impact has Airbnb had on the hotel industry?

-Airbnb's platform model has disrupted the hotel industry by offering alternative accommodations that don’t require significant capital investment in real estate. Airbnb allows individuals to list their properties, which drastically increases the available supply of accommodations. However, despite Airbnb’s scale, hotel chains like Marriott, Hilton, and Hyatt are not particularly threatened by it, as they also operate as asset-light, fee-based platforms.

How does the asset-light business model work in the hotel industry?

-In the asset-light business model, hotel chains like Marriott and Hilton focus on branding, marketing, and management rather than owning or operating the properties. They franchise or manage hotels owned by third parties, collecting franchise fees and management fees rather than bearing the capital risk and operational costs of owning the hotel.

What is the role of franchising in the hotel industry?

-Franchising allows hotel chains to expand rapidly without bearing the full capital cost of building and operating hotels. Hotel owners pay a percentage of their gross booking revenue and additional fees for using the brand, marketing, and other services provided by the hotel chain. This model helps hotel companies scale efficiently while minimizing financial risk.

How do the major hotel chains make most of their money?

-The majority of revenue for large hotel chains like Hilton, Marriott, and Hyatt comes from franchise and management fees rather than directly from the operation of owned properties. These fees include a percentage of gross bookings and additional charges for food and beverage sales, loyalty programs, and marketing efforts.

What challenges does Airbnb face as it grows?

-Airbnb’s rapid growth faces challenges including service inconsistencies, safety concerns, privacy issues, and regulatory hurdles. Additionally, as Airbnb becomes more mainstream, the company's early advantage of offering cheaper and unique accommodations is being eroded, and it faces competition from hotels, which provide more predictable and reliable service.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

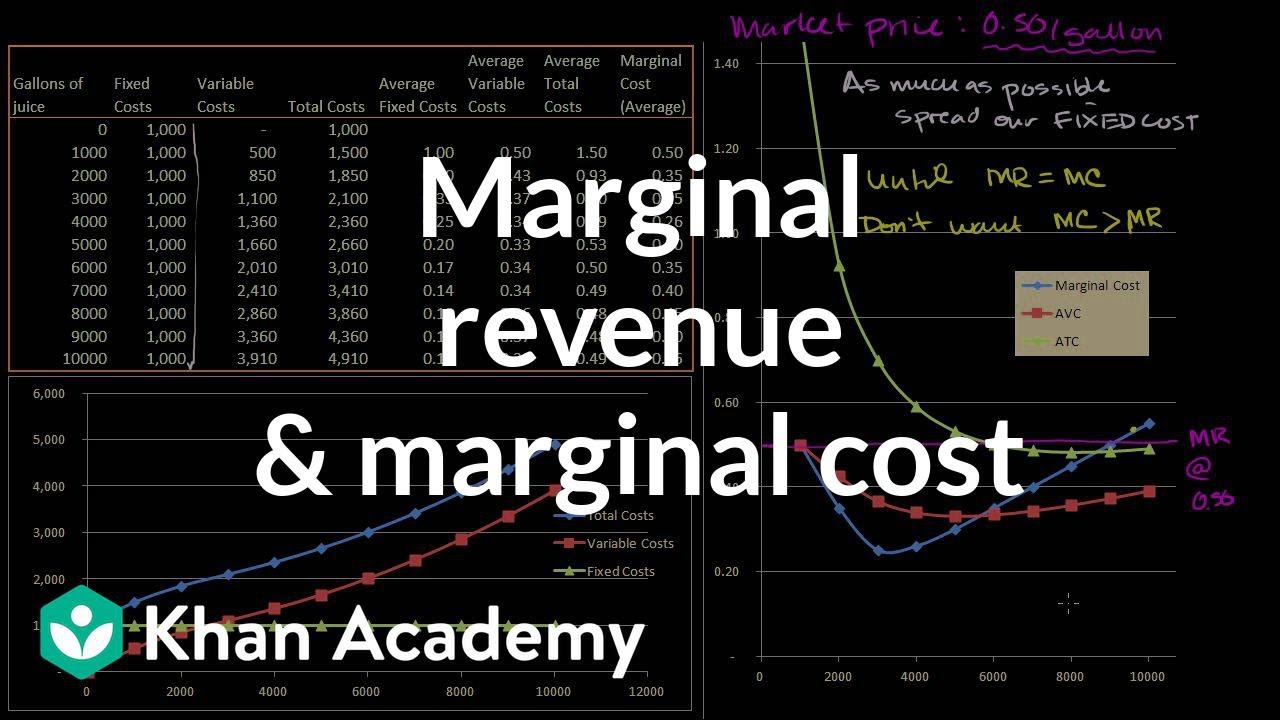

Marginal revenue and marginal cost | Microeconomics | Khan Academy

A level Business Revision - Profit

Precificação - Cálculo

ANALISIS PERILAKU BIAYA

Kapan Balikan? Ehh, Kapan Balik Modal? Perhitungan Sederhana BEP - Kuliah Online Matematika Bisnis

Cost Structure - GEE 003 Introduction to Entrepreneurship

5.0 / 5 (0 votes)