12. What is Financial Risk

Summary

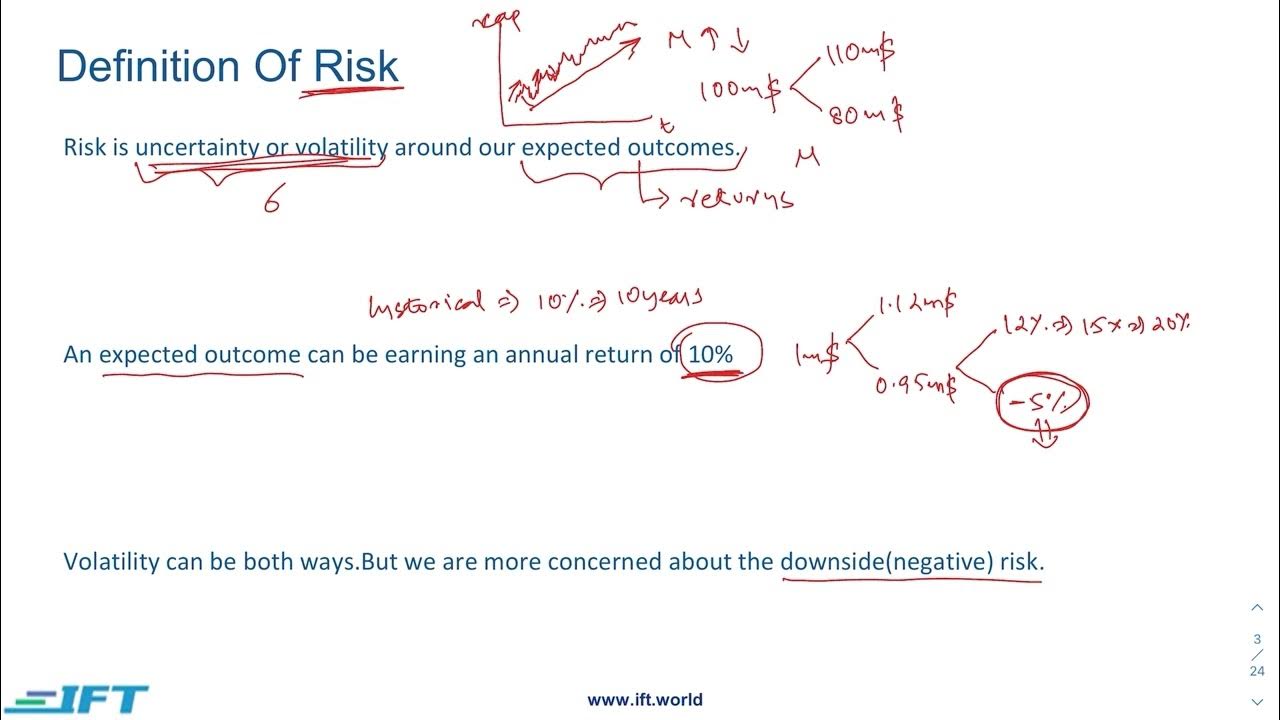

TLDRThis lesson on financial risk explores the balance between risk and reward in investments, using the 10-year Federal note as a benchmark. It covers three primary causes of financial risk: excessive debt, overpaying for investments, and lack of knowledge. Through relatable examples, such as the impact of debt on company performance and the consequences of overpaying for assets, it highlights how these factors increase investment risks. The lesson emphasizes the importance of understanding what you're investing in and knowing the true value of your assets, while referencing Warren Buffett’s wisdom on the dangers of excessive debt and ignorance in investing.

Takeaways

- 😀 Risk vs. Reward: Higher risk investments often bring higher rewards but also increased pressure and stress. It's important to assess your tolerance for risk before investing.

- 😀 Baseline Value: The 10-year Federal note serves as the benchmark for evaluating the risk and reward of other investments, as it is backed by the U.S. government.

- 😀 Debt Risk: Excessive debt in a company or investment increases financial risk. Companies use debt to speed up growth but too much debt can reduce their productivity and stability.

- 😀 Overpaying Risk: Paying more than an asset’s actual value (like overpaying for a house or stock) leads to poor returns, regardless of the asset’s quality.

- 😀 Knowledge is Key: Lack of understanding about the value of an investment is one of the biggest risks. Always assess what you're investing in before buying.

- 😀 Warren Buffett's Quote: 'Only when the tide goes out do you discover who’s been swimming naked'—companies with high debt are most at risk when the market collapses.

- 😀 Risk of Ponzi Schemes: Ponzi schemes are an example of high-risk, high-reward investments that offer short-term gains but ultimately collapse.

- 😀 Debt and Speed: Debt can speed up business growth, but excessive debt increases the likelihood of failure, as shown by the rat shooting game analogy.

- 😀 Risk Tolerance: Different investments, like stocks, bonds, or cash, carry varying levels of risk. Assessing your risk tolerance helps you make informed investment choices.

- 😀 The Importance of Value: Investors must differentiate between price (what you pay) and value (what you get). Pay attention to both when making investment decisions.

Q & A

What is the main concept behind risk versus reward in investments?

-Risk versus reward refers to the balance between the potential risk and the potential return of an investment. A higher risk generally offers higher potential rewards, but also greater chances of losing money, while lower risk investments typically provide more stable but smaller returns.

Why is the 10-year Federal note used as a baseline for assessing investment risk?

-The 10-year Federal note is used as a baseline because it is considered a low-risk investment, backed by the U.S. government. It offers a guaranteed 2.2% yield (as of May 2024), making it a reliable benchmark to compare other investments against, as the government can print more money to meet its obligations.

How does excessive debt affect a company’s productivity and investment risk?

-Excessive debt can negatively impact a company's productivity by putting pressure on its financial resources. The more debt a company takes on, the harder it becomes to generate sufficient returns, making it riskier for investors. A company with high debt may struggle to survive if market conditions worsen.

What is the risk associated with overpaying for an investment, and how can this be avoided?

-Overpaying for an investment is a major risk because it can result in poor returns even if the asset itself is of good quality. This can be avoided by carefully evaluating the intrinsic value of an asset before purchasing it, ensuring that the price paid is reasonable compared to its true worth.

Can you explain Warren Buffett's quote, 'Only when the tide goes out do you discover who’s been swimming naked'?

-This quote means that high levels of debt or risk often remain hidden during favorable economic conditions. However, when the market or economic situation worsens ('the tide goes out'), companies or individuals with excessive debt or weak financial positions are exposed and often fail.

How does a company's debt affect its ability to manage risks and perform over time?

-As a company accumulates more debt, it becomes increasingly difficult to manage risks effectively and sustain long-term performance. Excessive debt can lead to inefficiency and reduced productivity, which, in turn, increases the likelihood of business failure, especially during downturns.

Why is the concept of intrinsic value important when making investments?

-Intrinsic value is the true worth of an investment, independent of its market price. Understanding intrinsic value is crucial for making informed investment decisions because paying more than an asset's intrinsic value, such as buying a stock or property for more than it's worth, can lead to poor financial outcomes.

What analogy is used in the lesson to explain the effect of excessive debt on a company?

-The lesson uses a video game analogy where the 'rats' represent the company’s ability to handle debt. As more debt is taken on, the rats (representing tasks or challenges) move faster, making it harder for the company to remain productive and manage its obligations, leading to reduced performance and higher risk.

What role does knowledge play in reducing financial risk for investors?

-Knowledge is crucial in reducing financial risk because investors who lack understanding of an investment or market conditions are more likely to make poor decisions. By researching and understanding the value and potential risks of an investment, an investor can make more informed choices, avoiding unnecessary losses.

How can investors assess the amount of risk they are willing to take on an investment?

-Investors can assess their risk tolerance by comparing potential investments to a reliable benchmark, such as the 10-year Federal note. This allows them to gauge the relative risk of an investment and determine if the potential reward justifies the risk involved. It's important to assess personal risk tolerance and financial goals when making investment decisions.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

M1. L4. Power of your Investment Decisions

The Ultimate Crypto Portfolio For The 2025 Bull Run!

FRM Part 1 Book 1 Chapter 1 – Lecture 1

Strategi Alokasi Portofolio Crypto Untuk Bullrun 2025

Risk and reward introduction | Finance & Capital Markets | Khan Academy

ACCOUNTANT EXPLAINS: Mutual Fund vs Index Fund - Know the DIFFERENCE

5.0 / 5 (0 votes)