penilaian obligasi 1

Summary

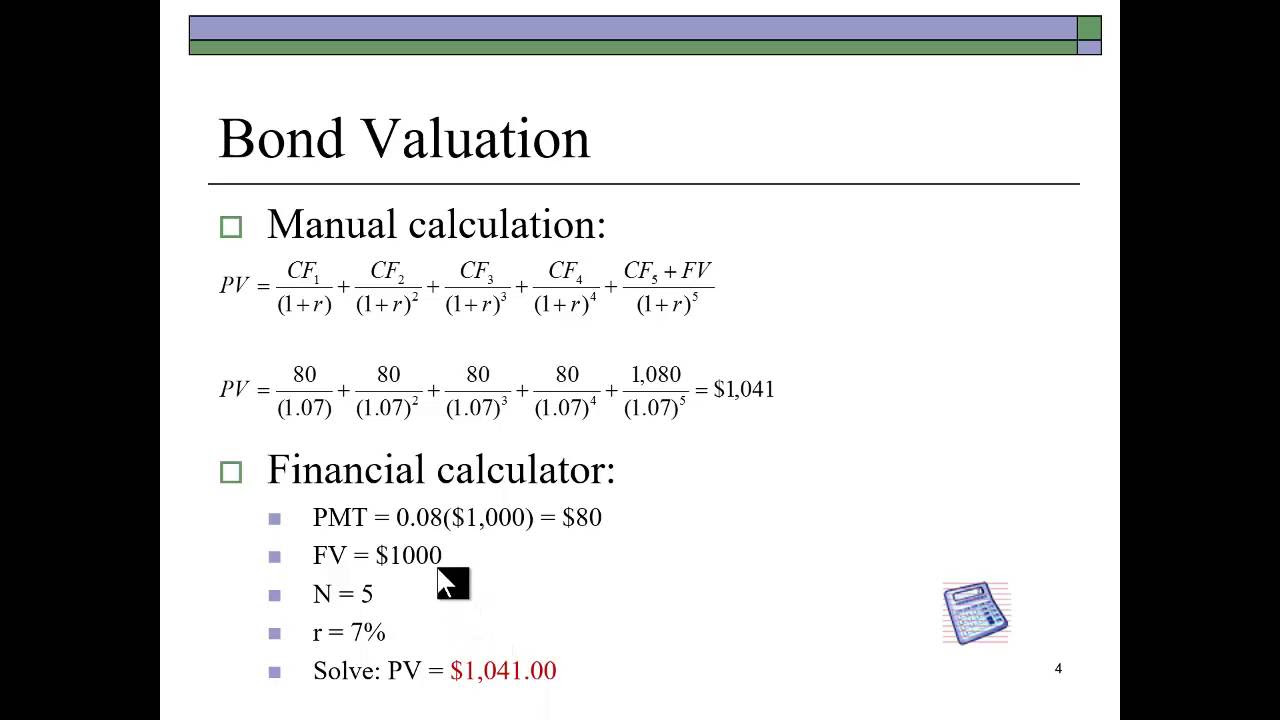

TLDRIn this educational video on bond valuation, the presenter explains the concept of fair value assessment for bonds using cash flow analysis. By illustrating the process through examples, including the calculation of interest payments and present value, viewers learn to differentiate between annual and semiannual coupon payments. The video covers essential formulas, discusses the time value of money, and provides practical examples to reinforce understanding, making complex financial concepts accessible. It encourages engagement with interactive elements and prepares viewers for more advanced topics in future lessons.

Takeaways

- 😀 Valuation of bonds is determining if a bond's price is fair, high, or low.

- 😀 Cash flow valuation of bonds is based on coupon payments and principal repayment.

- 😀 Bonds can pay interest annually or semi-annually, affecting calculation methods.

- 😀 The present value formula is used to calculate the fair price of bonds.

- 😀 The formula incorporates total coupon payments and the nominal value at maturity.

- 😀 Understanding the time value of money is crucial for bond valuation.

- 😀 Bond valuation requires knowledge of coupon rate, nominal value, and maturity period.

- 😀 Tables for present value factors help simplify calculations for annuities and single sums.

- 😀 If interest is paid semi-annually, the calculations for periods and rates must be adjusted.

- 😀 Practical examples illustrate how to apply the valuation methods effectively.

Q & A

What is bond valuation?

-Bond valuation is the process of assessing whether a bond is priced fairly based on its cash flows and market interest rates.

How are bond cash flows categorized?

-Bond cash flows are categorized into two types: annual coupon payments and semiannual coupon payments.

What does the term 'present value' mean in the context of bonds?

-Present value refers to the current worth of future cash flows discounted at a specific interest rate, reflecting the time value of money.

What formula is used for bond valuation?

-The formula for bond valuation is: Price = Σ (Coupon Payment / (1 + KD)^t) + (Nominal Value / (1 + KD)^n), where KD is the discount rate.

What does the variable 'KD' represent?

-KD represents the discount rate or the yield of the bond, expressed as a percentage.

How do you calculate coupon payments for a bond?

-Coupon payments are calculated by multiplying the bond's nominal value by its coupon rate.

What happens to the bond valuation formula if coupons are paid semiannually?

-If coupons are paid semiannually, the number of periods (n and t) is multiplied by 2, and the coupon payment and KD are divided by 2.

What is the significance of the final cash flow in bond valuation?

-The final cash flow includes both the last coupon payment and the return of the bond's nominal value at maturity, making it larger than the regular payments.

How can tables be used in bond valuation?

-Tables for present value factors (PVF) and present value of annuities (PVFA) can simplify calculations by providing pre-computed values for different interest rates and periods.

What is the price determined for the example bond in the script?

-In the example, the fair price of the bond with a nominal value of 1 million and a coupon rate of 20% was calculated to be 999,980.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Tips Menilai Harga Wajar Saham | feat. Rivan Kurniawan

Is Arm Stock an Undervalued AI Stock to Buy? | ARM Stock Analysis

Terry Smith explains: the free cash flow yield

Cara Mudah Menghitung Net Present Value ( NPV ) Metode Penilaian Investasi

Using a Python DCF Calculation to find the Intrinsic Fair Value of a Stock

Bond Valuation - A Quick Review

5.0 / 5 (0 votes)