Road To Gloryy Day 4 : How to spot Liquidity Sweeps

Summary

TLDRIn 'Road to Glory Day Four', the host teaches viewers how to identify liquidity sweeps, a trading concept where market makers intentionally move prices past liquidity points to trigger stop losses. The video simplifies the Smart Money Concepts (SMC) by focusing on imbalance and liquidity sweeps, avoiding unnecessary complexity. Through examples, the host illustrates how to spot and capitalize on these sweeps for potential profitable trades, emphasizing the importance of confirmation and confidence in trading decisions.

Takeaways

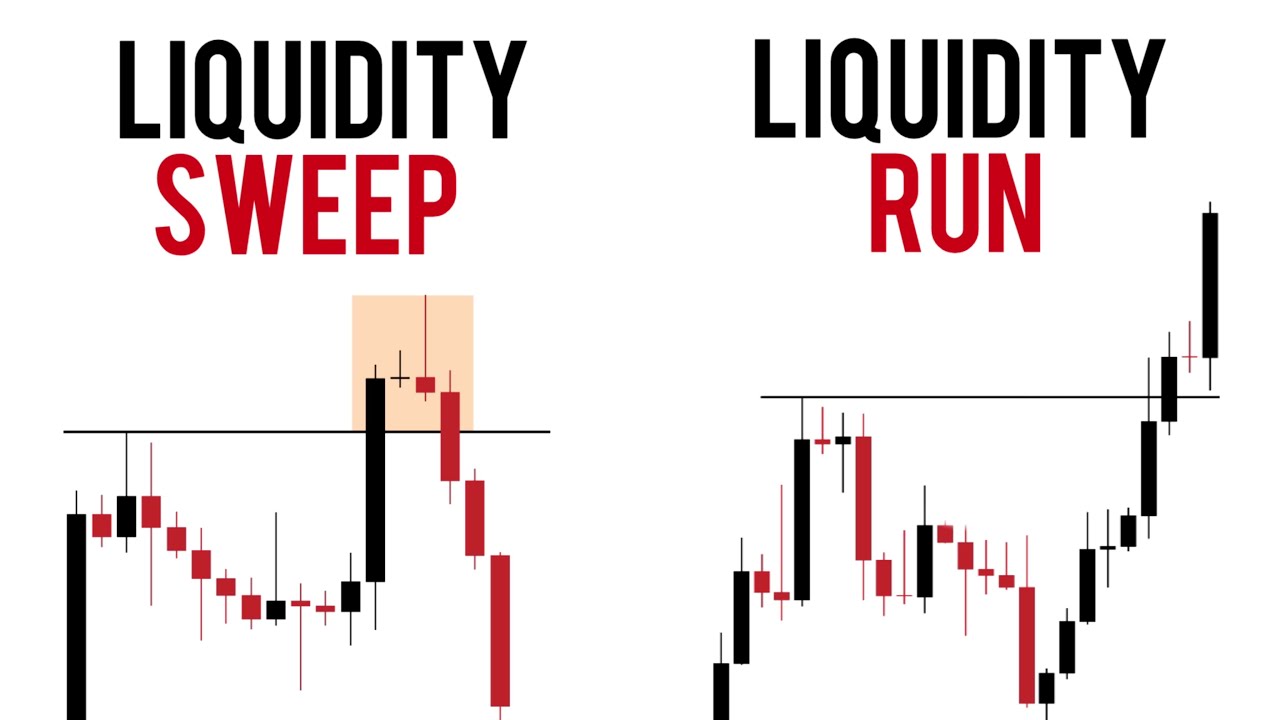

- 💡 Liquidity sweeps occur when the price moves towards liquidity (buy or sell-side) and slightly goes beyond it, then reverses direction.

- 📘 Liquidity sweeps are a key component of Smart Money Concepts (SMC), but the creator prefers to use only imbalance and liquidity sweeps for simplicity.

- 🔍 Liquidity is defined as areas where many stop losses are placed, and market makers intentionally target these areas to trigger orders.

- 📈 A buy-side liquidity sweep occurs when the price moves above liquidity, while a sell-side liquidity sweep happens when the price moves below it.

- 📊 The change of direction after a liquidity sweep presents an opportunity for traders to enter short or long positions depending on the sweep.

- ⏱️ Timing is crucial for a liquidity sweep; it should happen within one or two candles for a high-probability trade setup.

- 🔑 It's essential to distinguish between a liquidity sweep and a liquidity takeout—sweeps result in an immediate change of direction, while takeouts may not.

- 🛠️ Traders should backtest liquidity sweeps by marking liquidity areas on the chart and identifying sweeps in historical price action.

- 📉 The creator uses the long and short position tools to set stop losses and take profits based on liquidity sweeps for effective risk management.

- 🎯 A good risk-to-reward ratio is critical in trading. The example in the video shows a risk-to-reward ratio of 1:2, which is a solid target for successful trades.

Q & A

What is the main concept discussed in the video?

-The main concept discussed is 'liquidity sweeps,' which occur when the market intentionally moves towards liquidity, sweeps it, and then changes direction. This is part of the Smart Money Concepts (SMC) trading strategy.

What are the two main tools used by the trader in this video?

-The trader primarily uses 'imbalance' and 'liquidity sweeps' from Smart Money Concepts (SMC) in their trading strategy, while avoiding other complex tools they deem unnecessary.

How does the trader define a liquidity sweep?

-A liquidity sweep happens when the market price moves towards a liquidity zone, briefly surpasses it (either above for buy-side or below for sell-side liquidity), and then changes direction. It’s a move intended to trigger stop losses set by other traders.

Why are liquidity sweeps important in trading?

-Liquidity sweeps are important because they allow traders to identify moments when the market direction is about to reverse after hitting liquidity zones. These moments provide opportunities to enter trades in the opposite direction of the initial sweep.

What is the difference between a liquidity sweep and a liquidity takeout?

-A liquidity sweep results in an immediate change of direction after liquidity is taken, providing an opportunity to trade. A liquidity takeout, on the other hand, sees the price move past the liquidity zone without a strong reversal, making it less favorable for trading.

How does the trader use time frames when identifying liquidity sweeps?

-The trader looks for liquidity sweeps on lower time frames, such as the 5-minute or 15-minute charts, to find clear and quick liquidity sweeps that result in an immediate change of direction.

What is backtesting and how does the trader recommend using it?

-Backtesting is the process of going back in time on a chart to identify and mark liquidity zones and sweeps. The trader recommends using this method to practice spotting sweeps and learning how to predict changes in market direction.

What tools does the trader use to set up trade positions?

-The trader uses the 'long position' and 'short position' tools to set up trades. These tools help define the entry point, stop loss, and take profit levels, and calculate the risk-to-reward ratio for each trade.

What is the significance of risk-to-reward ratio in trading?

-The risk-to-reward ratio is critical in trading as it shows the potential reward compared to the risk being taken. For example, a 1:2 risk-to-reward ratio means the potential profit is double the amount being risked. The trader aims for a ratio of at least 1:2.

How does the trader suggest placing stop losses in relation to liquidity?

-The trader suggests placing stop losses on liquidity zones, as these are areas where market makers often trigger stop losses to cause liquidity sweeps. Being aware of these zones helps traders protect their positions and avoid getting swept out prematurely.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)