Making Money in a Crypto Crash: Futures Trading Explained | PART 1

Summary

TLDRThis video explains how traders can make money in the cryptocurrency market, even when prices are falling, by using futures contracts. Futures allow traders to agree on a buy or sell price for a cryptocurrency at a future date, regardless of price changes. The video covers different types of futures, including Bitcoin, Ethereum, altcoin, and open-ended futures, offering strategies for both rising and falling markets. While futures trading presents opportunities for financial growth, the video also highlights associated risks. Viewers are encouraged to subscribe for more insights on cryptocurrency and trading.

Takeaways

- 📉 You can make money in the cryptocurrency market even when it's falling, using Futures.

- 📜 Futures are agreements to buy or sell cryptocurrency in the future at a predetermined price, regardless of market changes.

- 🔄 A long position is a bet that the price will rise, while a short position is a bet that the price will fall.

- 💰 If you predict market direction correctly, you can profit; otherwise, you may incur losses.

- 🔗 Cryptocurrency Futures include Bitcoin, Ethereum, and other altcoins, offering opportunities beyond well-known assets.

- 📊 Altcoin Futures are ideal for those looking to explore the broader cryptocurrency market.

- ⏳ Open-ended Futures have no expiration date, allowing traders to hold positions for as long as desired.

- 🛡️ Open-ended Futures are convenient for long-term strategies and offer the ability to profit from market declines.

- ⚠️ Trading Futures carries risks, including market unpredictability, so strategies should match personal goals and risk tolerance.

- 🎥 More content about cryptocurrency and money-making strategies is available on the channel.

Q & A

What is the common misconception about earning in the cryptocurrency market?

-The common misconception is that traders can only make money when the cryptocurrency market is rising. However, experienced traders know they can also earn during a falling market using specific tools like Futures.

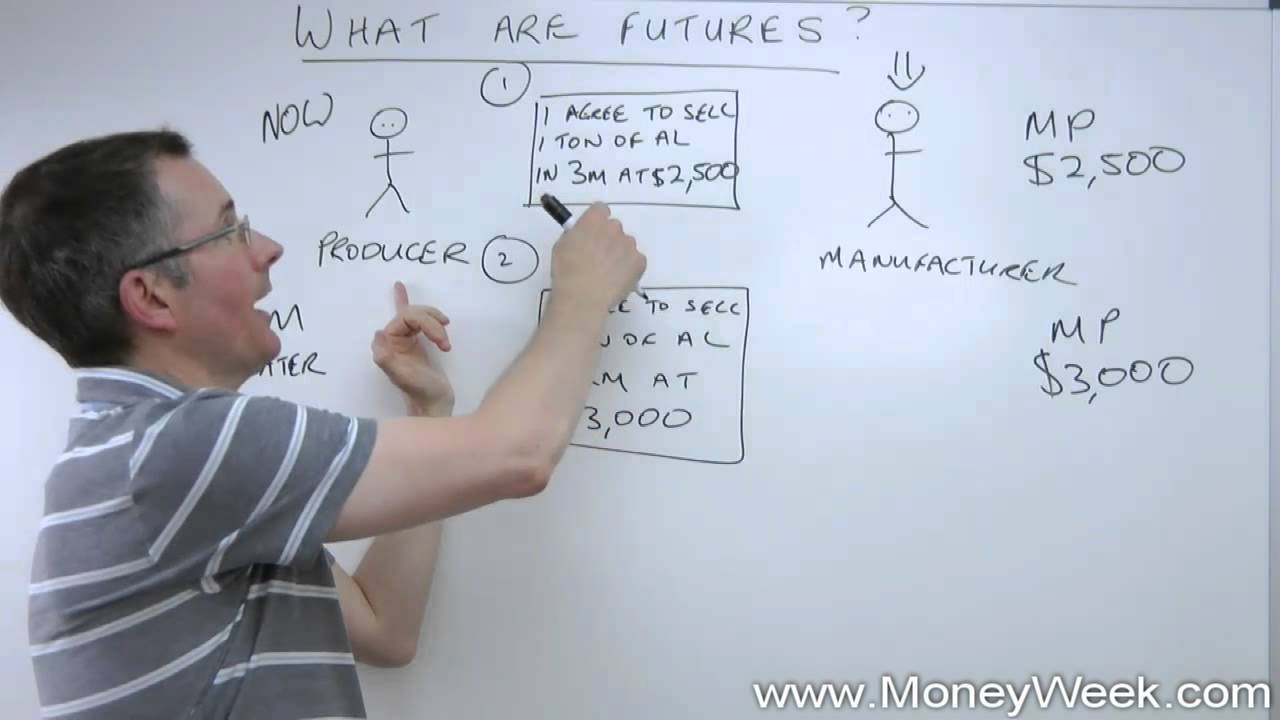

What are cryptocurrency futures?

-Cryptocurrency futures are agreements to buy or sell a cryptocurrency at a predetermined price in the future. The actual buying or selling happens later, regardless of whether the price changes, at the agreed-upon price.

What does going 'long' in cryptocurrency mean?

-Going 'long' means betting that the price of a cryptocurrency will rise. If the price increases as predicted, the trader can make a profit.

What does going 'short' in cryptocurrency mean?

-Going 'short' means betting that the price of a cryptocurrency will fall. If the price decreases as expected, the trader can make a profit.

How can traders earn in a falling cryptocurrency market?

-Traders can earn in a falling cryptocurrency market by opening a short position using futures, where they bet that the price of the cryptocurrency will fall.

What are cryptocurrency derivatives?

-Cryptocurrency derivatives are financial contracts whose value is derived from the price of an underlying asset, such as Bitcoin or Ethereum. These derivatives include futures, which allow traders to speculate on future price movements.

What types of cryptocurrency futures are available?

-There are three main types of cryptocurrency futures: Bitcoin and Ethereum futures, altcoin futures, and open-ended futures. Each type allows traders to speculate on different cryptocurrency assets and strategies.

What are open-ended futures, and how do they differ from standard futures?

-Open-ended futures are a special type of futures contract that has no expiration date, allowing traders to hold their positions for as long as they want. This makes them ideal for long-term strategies, unlike standard futures which have a fixed expiration date.

What are the risks involved in cryptocurrency futures trading?

-The main risk in cryptocurrency futures trading is the unpredictability of the market. Prices can move in unexpected directions, and without proper risk management, traders can suffer significant losses.

What should traders consider when choosing a futures trading strategy?

-Traders should consider their personal goals, knowledge, and risk tolerance when choosing a futures trading strategy. There is no one-size-fits-all approach, and strategies should align with the trader’s specific financial objectives and market outlook.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

What are futures? - MoneyWeek Investment Tutorials

The Truth About Inducement In ICT Concepts

How I Analyze Futures Intra-Day | Break & Retest Flag Patterns (/ES /NQ)

3w FinEcon 2024fall v1

ESSA ESTRATÉGIA DE OPÇÕES PODE TE DEIXAR RICO ENQUANTO O CIRCO PEGA FOGO 🔥(4X rápido)

Indicateur Technique en OR : Open Interest | Funding!

5.0 / 5 (0 votes)