Basics of Futures and Options (F&O) | Futures and Options explained | Futures Trading for beginners

Summary

TLDRThis video offers a simple introduction to futures and options, two popular derivatives used for speculation and hedging in the stock market. It discusses how these financial instruments can protect investments, maximize profits, and minimize losses. The presenter encourages viewers to use futures and options strategically to safeguard their investments and enhance their trading experience.

Takeaways

- 📚 Futures and options are types of derivatives that derive their value from an underlying asset.

- 🎁 The video aims to provide a simple introduction to futures and options for beginners.

- 💡 Futures and options are popular for speculation and can be used to hedge investments against market movements.

- 📉 They can be used to protect investments from potential losses, especially when the market is expected to move in an unfavorable direction.

- 💼 The speaker suggests that understanding futures and options is crucial for investors to maximize profits and minimize losses.

- 🔍 The video mentions the use of technical analysis to make decisions about when to buy or sell options.

- 🚫 The importance of not getting caught up in the 'buy and sell' cycle due to low average prices is highlighted.

- 📈 Discusses the potential for profit by selling options after a significant rise in the price of the underlying asset.

- 🌐 The video will cover more details about how futures and options work in future episodes.

- 👍 Encourages viewers to like the video if they found it helpful and to subscribe for more content on the topic.

Q & A

What are derivatives in the context of finance?

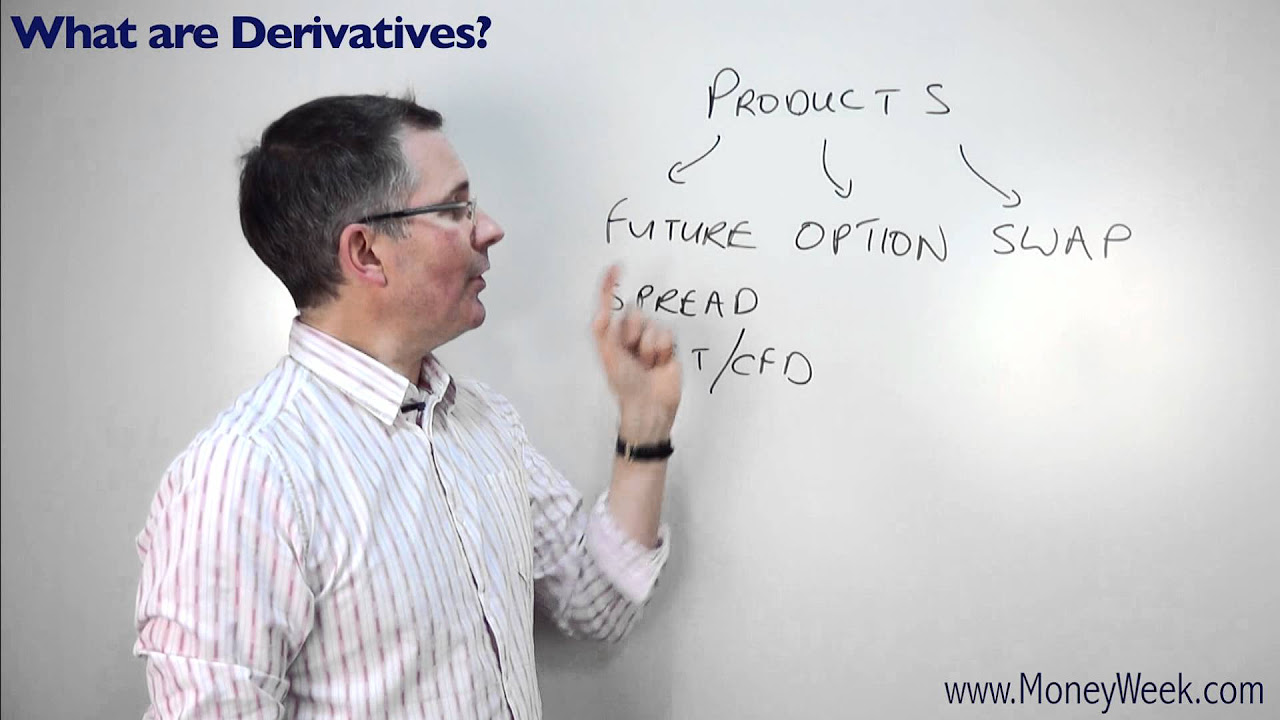

-Derivatives are financial instruments whose value is derived from an underlying asset, such as stocks, commodities, or currencies.

What are the two most popular types of derivatives?

-The two most popular types of derivatives are futures and options.

How are futures and options different from other investments?

-Futures and options are primarily used for hedging and speculation, allowing investors to protect their investments or profit from market movements without directly owning the underlying asset.

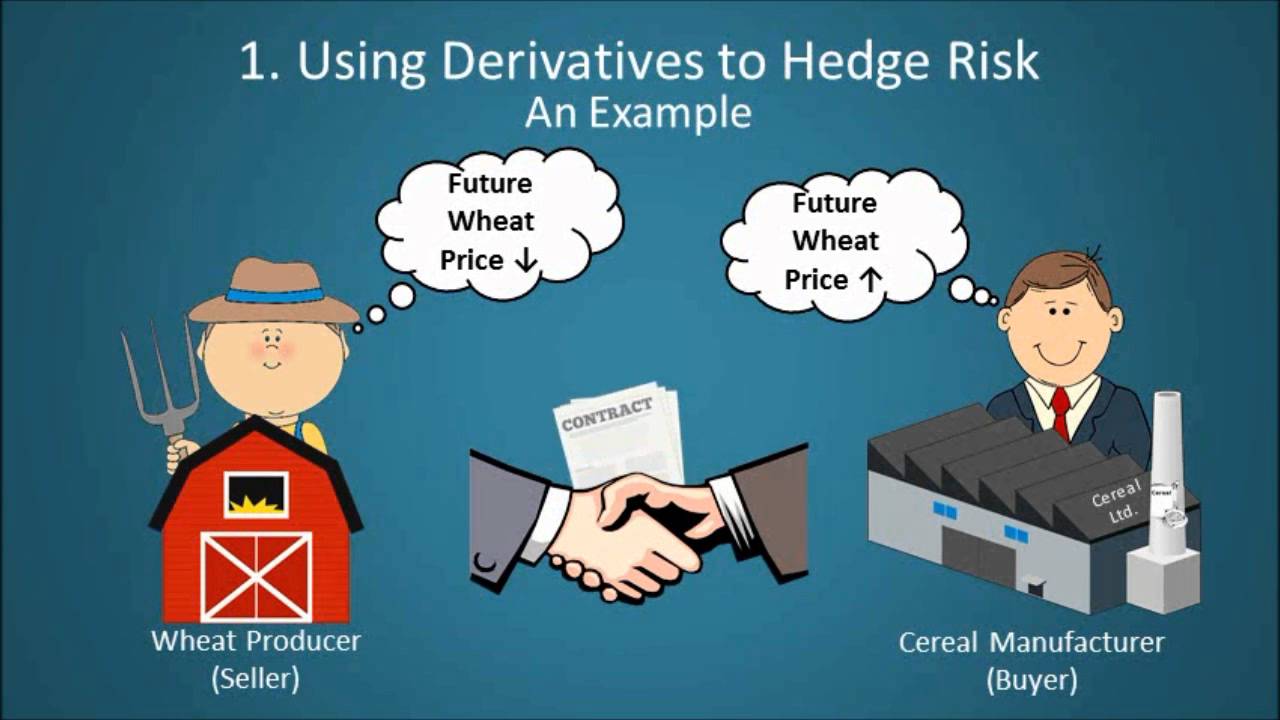

What is the role of futures and options in hedging?

-Futures and options can be used to hedge an investment by protecting against potential downside risk. Investors can lock in a price or mitigate losses if the market moves unfavorably.

How can an investor protect their profit using options?

-An investor can use options to protect their profit by buying a put option, which gives them the right to sell an asset at a specific price if the market declines, limiting potential losses.

What is the speculative use of futures and options?

-Speculative use of futures and options involves using these instruments to profit from market movements without the intention of holding the underlying asset, often focusing solely on potential gains.

What risk comes with trading futures and options?

-Trading futures and options carries the risk of loss, particularly if the market moves in the opposite direction of the investor's position. Speculators, in particular, may face significant losses.

Can you trade futures and options without owning the underlying asset?

-Yes, investors can trade futures and options without owning the underlying asset, which is one of the primary advantages for speculators looking to capitalize on price movements.

Why is technical analysis important in futures and options trading?

-Technical analysis helps traders predict market movements and make informed decisions. In futures and options trading, it can signal when to buy or sell to maximize profits or minimize losses.

How can margin requirements affect futures and options trading?

-Margin requirements are necessary to maintain a position in futures and options trading. Traders must have sufficient capital to cover potential losses, and if the market moves against them, they may need to provide additional funds.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Financial Derivatives Explained

Hedging - F&O - Futures and Options EXPLAINED | Derivates | Indian Economy for UPSC

Financial Derivatives Unit 2 Part 2 | Hedging Meaning | Market Index Application | Future Contract

什么是"金融赌场"? 它背后又有什么秘密?

What are derivatives? - MoneyWeek Investment Tutorials

🇵🇭 The Philippine Financial Market | The Foundation of Financial Literacy

5.0 / 5 (0 votes)