What is the Fed?

Summary

TLDRThe Federal Reserve, often known as 'the Fed,' is the central bank of the United States, established in 1913 to ensure a secure financial system. It comprises the Board of Governors in D.C. and 12 regional banks. The Fed's key roles include conducting monetary policy to influence interest rates and money supply, aiming for maximum employment and stable prices. It also supervises banks, promotes financial stability, addresses housing issues, and supports economic development. The Federal Open Market Committee makes monetary policy decisions, and the Fed serves as a bank for other banks, clearing checks and providing currency.

Takeaways

- 🏛️ The Federal Reserve, often called 'the Fed', is the central bank of the United States.

- 📜 Established by Congress in 1913, the Fed aims to promote a safe and sound monetary and financial system.

- 👥 Comprising the Board of Governors in Washington D.C. and 12 regional Federal Reserve Banks, the Fed is a comprehensive institution.

- 🌐 The Board of Governors includes seven members, including a Chairman and Vice Chairman, appointed by the President and confirmed by the Senate.

- 📊 The 12 regional banks serve as operating arms, gathering economic information to aid in formulating effective monetary policy.

- 💼 The Fed's key functions include conducting monetary policy, supervising banks, and promoting financial stability.

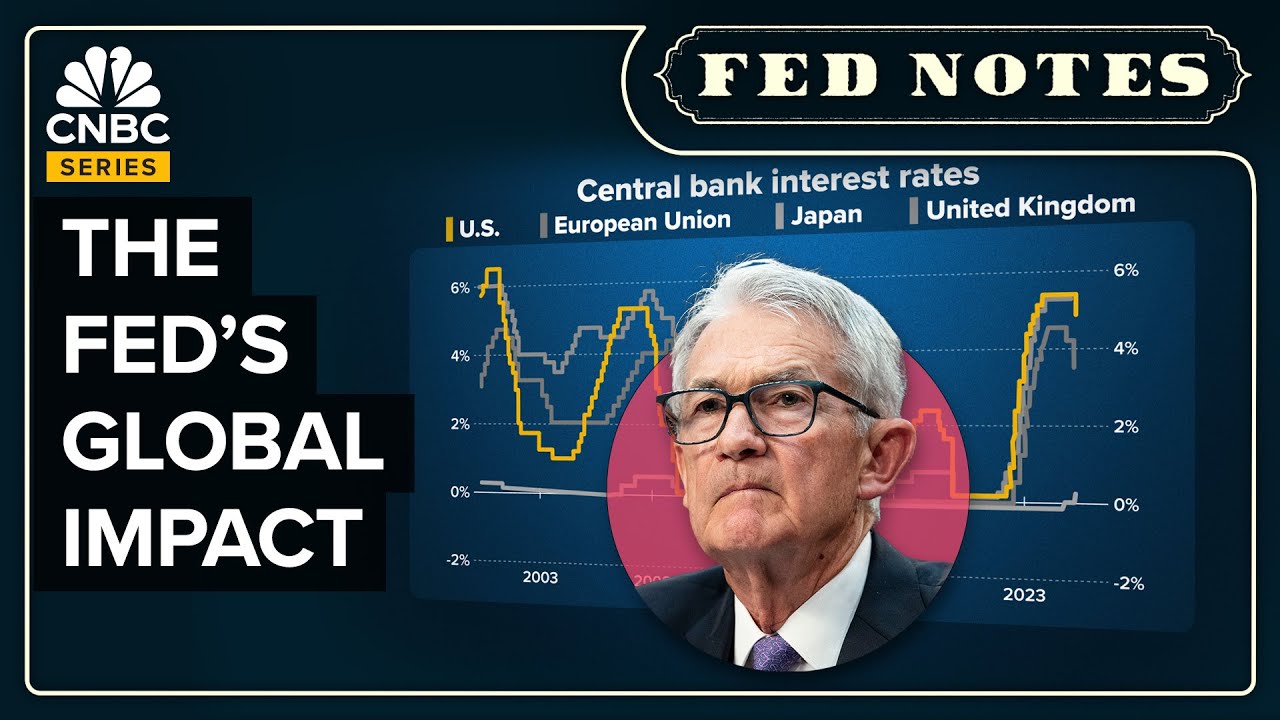

- 📈 Monetary policy involves influencing interest rates and the availability of money and credit to achieve maximum employment and stable prices.

- 🏦 The Federal Open Market Committee, comprising Board members and reserve bank presidents, makes monetary policy decisions.

- 🏗️ The Fed works with communities and organizations to address housing issues, promote credit access, and support economic development.

- 💡 Instability in the financial system is a threat the Fed works to mitigate to protect the broader economy and communities.

- 🏦 As a 'bank for banks', the Fed clears checks, processes electronic payments, and provides the currency used daily by Americans.

Q & A

What is the Federal Reserve, often referred to as the 'Fed'?

-The Federal Reserve, or 'the Fed,' is the central bank of the United States, created to promote a safe and sound monetary and financial system.

When was the Fed created and by whom?

-The Fed was created in 1913 by Congress to help maintain a stable financial system for the nation.

What are the main components of the Federal Reserve?

-The Fed includes the Board of Governors in Washington, D.C., which has seven members, and 12 regional Federal Reserve Banks located throughout the U.S.

How are the members of the Board of Governors selected?

-The members of the Board of Governors are appointed by the President of the United States and confirmed by the Senate.

What is one of the main functions of the Federal Reserve?

-One of the Fed's key functions is conducting U.S. monetary policy, which involves influencing interest rates and the availability of money and credit in the economy.

What goals has Congress tasked the Federal Reserve with in terms of monetary policy?

-Congress has tasked the Fed with promoting maximum employment and stable prices through its monetary policy.

Who makes monetary policy decisions at the Federal Reserve?

-Monetary policy decisions are made by the Federal Open Market Committee (FOMC), which includes all seven members of the Board of Governors and presidents from the reserve banks.

How does the Fed help promote financial stability?

-The Fed helps promote financial stability by supervising and regulating the nation's banks and working to maintain a stable financial system.

In addition to monetary policy, how does the Fed support communities and economic development?

-The Fed works with communities and organizations to address housing problems, promote equal access to credit, and advance economic and community development.

What role does the Fed play in the daily operations of the financial system?

-The Fed acts as a bank to other banks by clearing checks, processing electronic payments, and providing the currency Americans use daily.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)