Which Countries Will Charge You To LEAVE?

Summary

TLDRThis video explores the taxes levied on international travelers, including expatriation, departure, and tourist taxes. It highlights how countries like Eritrea and the USA tax residents based on citizenship, not just location. The script delves into Aviation taxes, with examples from the UK and Europe, and discusses the variability and complexity of these fees. It also addresses the controversial nature of tourist taxes, which can be high in places like Houston and are often a point of contention between local residents and the tourism industry. The video concludes by questioning the fairness of these taxes and their impact on tourism, inviting viewers to consider if such taxes are beneficial or detrimental.

Takeaways

- 🌍 There are three main types of taxes that can be charged to international travelers: expatriation tax, departure tax, and tourist tax.

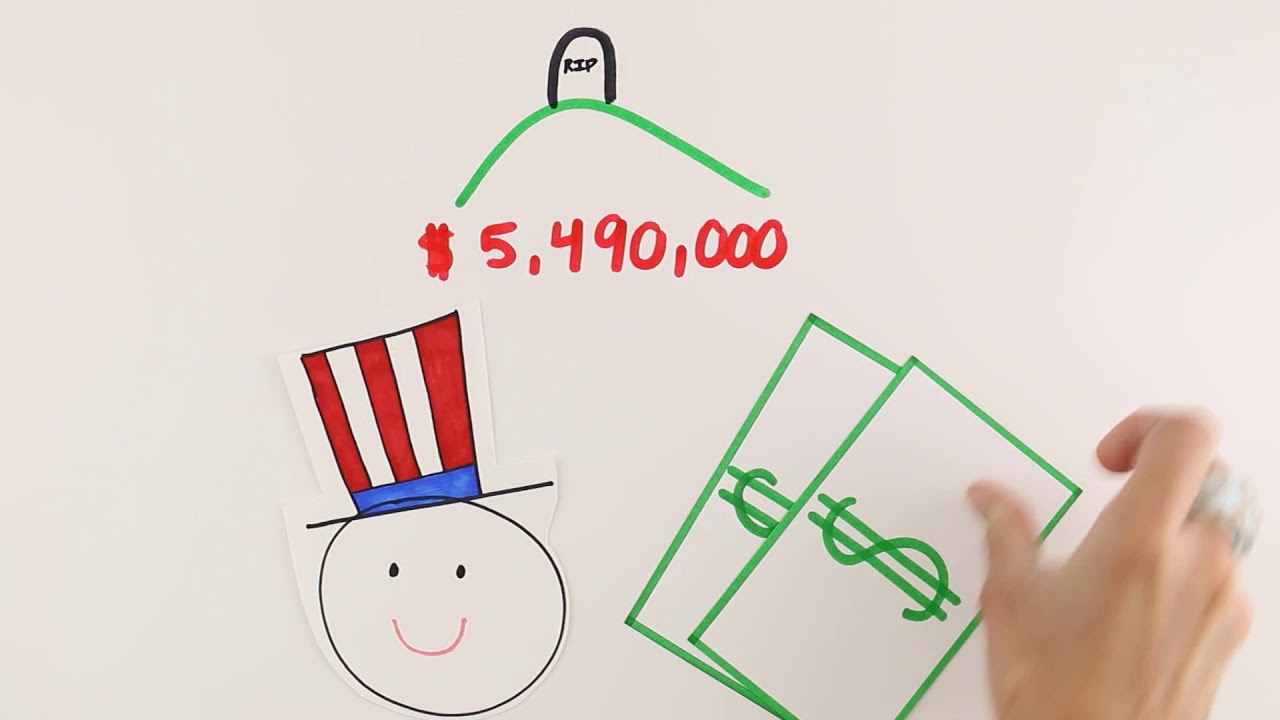

- 🏦 Expatriation tax is significant for citizens of Eritrea and the United States, as they are taxed on worldwide income regardless of residency.

- 💼 The foreign tax credit helps mitigate double taxation for US citizens and Eritreans, but the exact amount changes annually and isn't explicitly listed by the IRS.

- ✈️ Departure taxes vary widely by country and can be based on factors like distance traveled, class of service, and the number of passengers on the flight.

- 🇬🇧 The UK has a complex system for departure taxes, with rates that depend on the distance from London to the destination capital city and the seat class.

- 🌆 Tourist taxes are charged by some cities and countries to fund local services and can range from a small percentage of the accommodation cost to a significant amount.

- 🏙️ Some cities, like Barcelona, have introduced or increased tourist taxes as a measure to manage tourism and its impact on local communities.

- 🗺️ France receives the highest number of tourists globally, followed by Spain and the United States, indicating the popularity of these destinations.

- 💸 Tourist taxes are not only a revenue source but also a tool to manage tourism and ensure that visitors contribute to the cost of services they use.

- 🌐 The script suggests a trend of countries and cities becoming more selective about the type of tourism they encourage, favoring higher-value tourists over mass tourism.

Q & A

What are the three major ways countries charge fees when you travel internationally?

-The three major ways countries charge fees for international travel include expatriation tax, departure tax, and tourist tax.

What is an expatriation tax and which countries are known for having it?

-An expatriation tax is a tax on individuals who are leaving their country of residence. The United States and Eritrea are known for having this type of tax, where citizens are taxed on their worldwide income regardless of where they live.

How does the foreign tax credit work for US citizens living abroad?

-The foreign tax credit allows US citizens living abroad to claim a credit for taxes paid to foreign governments on foreign income. The amount of the credit can change yearly, but the IRS does not list the exact amount on their website.

What is a departure tax and how does it vary by country?

-A departure tax is a fee charged when leaving a country. It varies by country and can be based on factors like distance traveled, class of service, and the number of passengers on the flight.

Which country has the highest aviation tax and what is the amount?

-Mexico has the highest aviation tax, which can be up to $65 for non-Mexican nationals without permanent resident status.

How are tourist taxes implemented in different cities and what is their purpose?

-Tourist taxes are implemented differently in various cities, often as a percentage of the accommodation cost. Their purpose is to raise funds for local services and to manage the impact of tourism on the local community.

What is the significance of the tourist tax in Houston, and how much is it?

-The tourist tax in Houston is significant because it is one of the highest at 17% of the lodging cost. It is used to fund public services and amenities.

Why are some countries and cities adopting anti-tourist measures and taxes?

-Some countries and cities are adopting anti-tourist measures and taxes due to the negative impacts of mass tourism on local communities, such as increased housing prices and strain on public services.

Which countries receive the highest number of tourists according to the UN World Tourism Organization?

-According to the UN World Tourism Organization, France, Spain, and the United States receive the highest number of tourists.

What is the speaker's opinion on the effectiveness of tourist taxes in managing tourism?

-The speaker suggests that tourist taxes can be a double-edged sword, raising funds for local services while also potentially deterring tourists, which can affect the local economy.

What is the speaker's view on the countries with the lowest tourist taxes?

-The speaker seems surprised that some countries have very low tourist taxes, implying that they might be missing out on potential revenue or that they might be more tourist-friendly.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)