New Distribution Capability: How NDC Boosts Airline Retailing

Summary

TLDRThe video script discusses the conflict between American Airlines and the American Society of Travel Advisers (ASTA) over the airline's shift to New Distribution Capability (NDC), which aims to modernize flight booking akin to online shopping. Traditional EDIFACT systems are criticized for their limitations in ancillary sales and customer experience. NDC, leveraging XML for rich content and real-time offers, promises a more efficient and personalized booking process. Despite the advantages, the transition faces challenges due to legacy infrastructure and resistance from established players, with a gradual industry shift towards NDC expected.

Takeaways

- 🛫 The conflict between American Airlines and the American Society of Travel Advisers (ASTA) arose due to the airline's shift to New Distribution Capability (NDC), which left many agencies unprepared and facing challenges with access to lower fares.

- 📈 NDC is an initiative aimed at modernizing the way flights are shopped and booked through travel agencies, offering a more personalized and detailed customer experience similar to online retail giants like Amazon.

- 📚 NDC was introduced by the International Air Transport Association (IATA) in 2012 and is based on XML, allowing airlines to present their products on third-party platforms with more flexibility and detail.

- 🕰 The traditional system, EDIFACT, has been in use for nearly 40 years and is considered outdated for the current internet era, limiting the information and services airlines can offer through it.

- 💼 The rigid structure of EDIFACT restricts airlines to a minimal amount of information sharing and does not support rich content like images and detailed descriptions, impacting the sale of ancillary services.

- 💡 NDC overcomes EDIFACT's limitations by enabling continuous pricing, allowing airlines to set prices based on demand and market conditions, potentially increasing revenue from ancillary sales.

- 🚀 NDC's use of XML facilitates a streamlined booking process, reducing the traditional multi-step EDIFACT process to just three steps: shop, order, and pay.

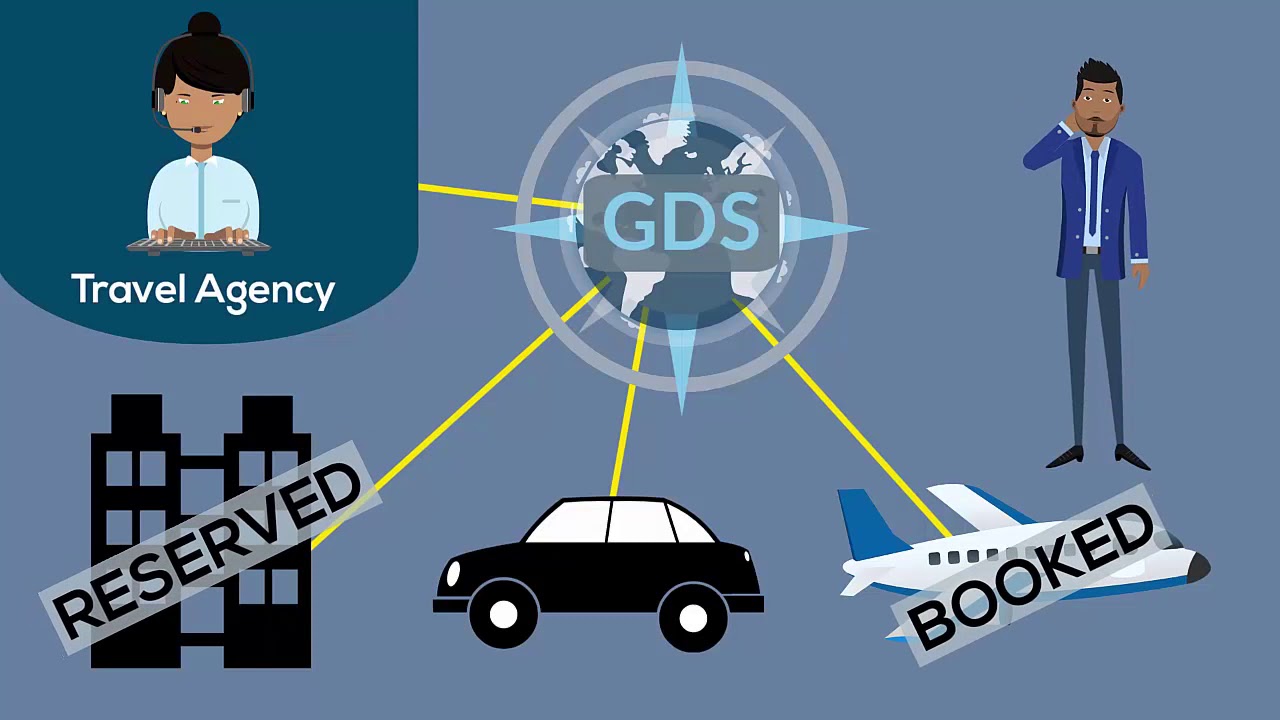

- 🌐 The shift to NDC empowers airlines to distribute their products directly via online travel agencies, bypassing Global Distribution Systems (GDS) and their associated fees.

- 🏦 The resistance to NDC adoption is largely due to the significant investment in legacy infrastructure by major players and the costs associated with transitioning to new technology.

- 🌍 Despite the challenges, the industry is gradually moving towards NDC, with over 70 airlines, 20 resellers, and 70 system providers participating in the IATA's Airline Retailing Maturity (ARM) Index program.

- 🔄 GDS providers are also adapting to the NDC trend by adding new connections and offering rich content from airlines, indicating a potential shift from blockers to drivers of NDC implementation.

Q & A

What was the conflict between American Airlines and the American Society of Travel Advisers (ASTA) in 2023?

-The conflict arose when American Airlines decided to move 40% of its fares from traditional systems to new distribution capability (NDC) channels. Many agencies were unprepared for this change, losing access to low prices and accusing American Airlines of discriminatory practices that led to higher airfares and reduced competition.

What is New Distribution Capability (NDC)?

-NDC is an initiative by the International Air Transport Association (IATA) introduced in 2012 to modernize the way airlines present their products on third-party platforms, similar to how they do on their own websites, using a modern data communication standard based on XML.

Why is the traditional airline retailing system considered outdated?

-The traditional system, which relies on the EDIFACT protocol from the 1980s, is outdated because it limits the amount of information airlines can share about flights and related services, does not support rich content like images and detailed descriptions, and operates on an inflexible and minimalistic structure.

How does NDC address the limitations of EDIFACT?

-NDC uses XML, which allows for the easy addition of data by creating new markups or tags. This enables airlines to distribute their products via online travel agencies, bypassing Global Distribution Systems (GDSs), and take back control over their offerings, including personalized services and dynamic pricing.

What is the primary issue with the EDIFACT infrastructure in the context of air travel?

-The EDIFACT infrastructure is outdated and does not support real-time updates or the distribution of rich content. It also limits airlines' ability to offer personalized services or dynamic pricing, which are essential in the modern e-commerce era.

How does NDC benefit travelers and the travel industry?

-NDC benefits travelers by providing a more personalized and efficient booking experience with access to a wider range of options and real-time pricing. For the travel industry, it offers cost-cutting opportunities, increased control over product distribution, and the ability to offer a better customer experience.

What is the role of Global Distribution Systems (GDSs) in the traditional airline distribution model?

-GDSs aggregate air information such as schedules, fares, business rules, and availability to create air products for resellers. They act as intermediaries between airlines and travel agencies, and airlines have little control over what they sell via indirect channels through GDSs.

Why has the adoption of NDC been slow and controversial despite its advantages?

-The slow adoption of NDC is due to barriers such as legacy infrastructure, resistance from major players who have heavily invested in GDS-centric distribution systems, and the costs associated with transitioning to a new paradigm. Additionally, resellers may lack the motivation to invest in the transition if they perceive reduced incentives.

What is the ARM Index program by IATA, and how does it relate to NDC?

-The ARM Index program by IATA verifies NDC readiness against 76 capabilities. It allows companies to choose, develop, and certify the most critical NDC functionality, saving money on less important or unnecessary features. It replaced the previous four-level NDC certification.

How are GDSs adapting to the shift towards NDC?

-GDSs are becoming active participants in the NDC implementation process by adding new NDC connections and delivering rich content from major airlines alongside traditional EDIFACT offers. They are transitioning from being NDC blockers to NDC drivers, leveraging their extensive distribution networks.

What does the future hold for the transition to NDC in the air travel industry?

-The transition to NDC is expected to be gradual, with larger airlines and GDSs leading the way. Smaller players may struggle and take longer to adapt. The industry will likely exist in a parallel world with both EDIFACT and NDC for some time, but the trend towards NDC adoption is inevitable.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

How airline distribution works | Global Distribution Systems | New Distribution Capability (NDC)

Amadeus vs Travelport vs Sabre: Explaining Main Global Distribution Systems

New Travel Route to Cuba

What is a Global Distribution System

Vietjet Air SCAM || Please BEWARE

Singapore Airlines' HUGE Plans For Their A380 SHOCKS The Entire Aviation Industry!

5.0 / 5 (0 votes)