How to Smartly Save Taxes on Stock Market Gains? | CA Rachana Ranade

Summary

TLDRIn this informative video, Rachna Randare explores various strategies for tax-saving on stock market gains, including short-term and long-term capital gains, intraday trading, and F&O segment gains. She explains the tax implications based on different scenarios and offers insights on deductions, basic exemption limits, and the concept of profit and loss harvesting. The video also touches on dividend taxation for both residents and NRIs, aiming to educate viewers on smart tax planning in the stock market.

Takeaways

- 📈 Stock market gains can be categorized into five types: short-term capital gains, long-term capital gains, gains from dividends, intraday equity transactions, and gains from the F&O (Futures and Options) segment.

- 📊 Taxation of these gains depends on factors such as the time period of the investment, availability of deductions, and the individual's tax bracket.

- 💡 The presenter emphasizes the importance of understanding tax implications for financial planning and encourages viewers to like and share the video for educational purposes.

- 🎓 The video provides a shout-out to active viewers as a form of appreciation and community engagement.

- 💼 Intraday trading in the cash segment is considered a speculative business and taxed at the individual's applicable tax rate, with losses being carry-forward for four years.

- 📉 Losses from intraday trading can be offset against gains from other sources, but there are limitations on what can be set off against salary income.

- 🏦 Gains from F&O trading are treated as normal business income and are taxed at the individual's tax rate, with the ability to deduct business-related expenses.

- 🏠 Deductions for F&O trading include office rent, utilities, and depreciation on equipment, similar to any other business.

- 💡 The presenter introduces a strategy called 'profit harvesting' to minimize tax liability by selling and immediately repurchasing shares to realize gains in smaller amounts over time.

- 📉 'Loss harvesting' is another strategy mentioned, where investors book a loss to reduce tax liability and then repurchase the same shares to maintain their investment while potentially benefiting from a lower tax rate in the future.

- 💰 Dividend income is taxed at the individual's normal tax rate, with a flat 20% rate for Non-Resident Indians (NRIs), and a 10% TDS (Tax Deducted at Source) if the dividend exceeds 5000 rupees.

Q & A

What is the main focus of the video?

-The main focus of the video is to explain how to smartly save taxes on different types of stock market gains, including short-term capital gains, long-term capital gains, dividends, intraday transactions, and F&O (futures and options) segment gains.

What are the five aspects of taxation covered in the video?

-The five aspects of taxation covered in the video are short-term capital gain, long-term capital gain, dividend income tax, intraday transaction tax, and F&O segment gain tax.

How does the video suggest to reduce tax on intraday trading profits?

-The video suggests that intraday trading profits are treated as speculative business income and taxed at the individual's tax slab rate. It also mentions that losses from intraday trading can be carried forward for up to four assessment years.

What is the tax implication for gains from the F&O segment?

-Gains from the F&O segment are treated as normal business income and taxed at the individual's tax slab rate. The video explains that these gains can be offset against other income streams and that business expenses related to F&O trading can be deducted.

How are short-term and long-term capital gains on listed equity shares taxed differently?

-Short-term capital gains on listed equity shares are taxed at 15%, while long-term capital gains are taxed at 10%. Additionally, long-term capital gains may qualify for an additional exemption of one lakh rupees.

What is the basic exemption limit for capital gains?

-The basic exemption limit for capital gains is such that if the total long-term capital gain on listed equity shares is up to two lakh rupees, no tax is required to be paid.

What is the concept of 'profit harvesting' mentioned in the video?

-Profit harvesting is a strategy where an investor sells shares to realize a gain, and then immediately repurchases the same shares. This allows the investor to book profits while maintaining the same investment, potentially reducing tax liability.

What is the tax treatment for dividend income if it exceeds 5,000 rupees?

-If the dividend income exceeds 5,000 rupees, the company paying the dividend will deduct tax at source (TDS) at the rate of 10 percent.

How does the video suggest reducing tax on capital gains?

-The video suggests using strategies like profit harvesting and loss harvesting, where losses are booked to offset against gains, thus reducing the overall tax liability.

What is the tax rate for dividend income for Non-Resident Indians (NRIs)?

-For Non-Resident Indians (NRIs), the tax rate on dividend income is a flat 20 percent.

What is the time period for carrying forward capital losses?

-Both short-term and long-term capital losses can be carried forward for eight assessment years.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Gain from Stock market? Pay Zero tax | LTCG | STCG | Save Capital Gain Tax on Stock market gain

1 1 5 Different Direct Tax Laws 2

MCQ Solutions: CA Final DT Paper Nov 24

Budget 2024 impact on financial planning - Latest Income tax changes | Tax on stocks & mutual funds

3 Money Moves You Must Make BEFORE 2026

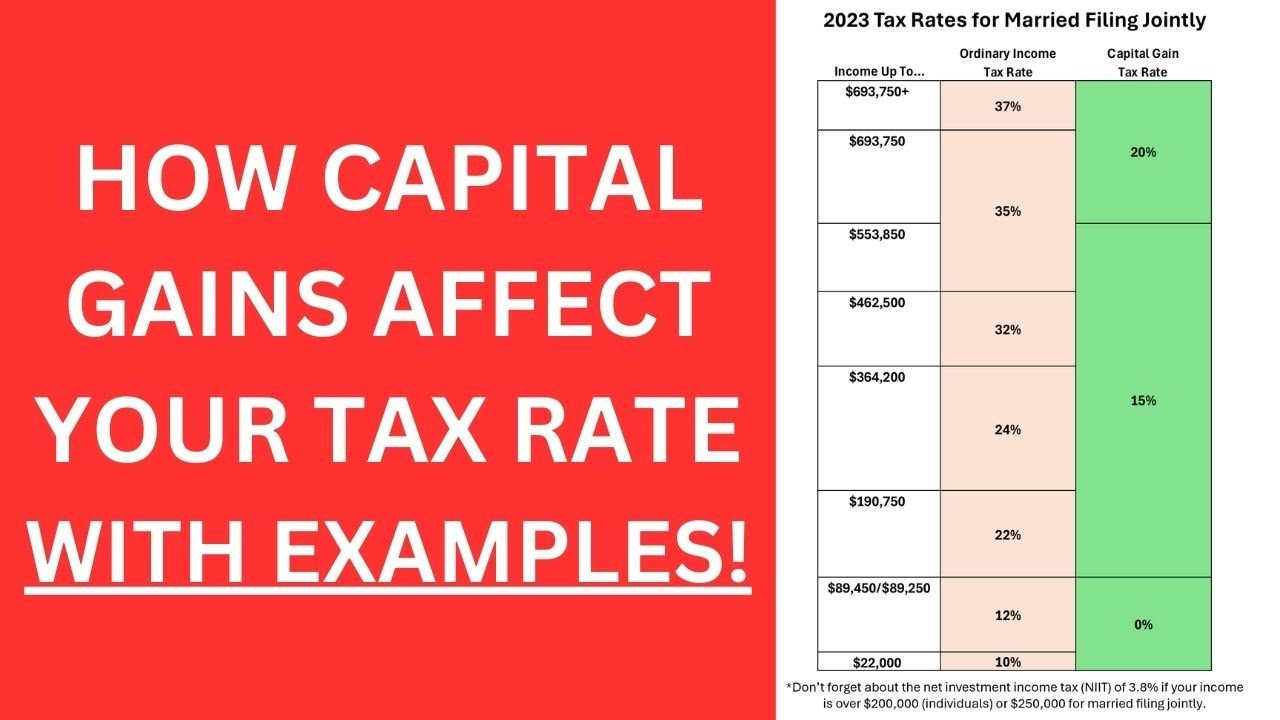

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

5.0 / 5 (0 votes)