Should you sell overvalued stocks? (Analyse PE ratio)

Summary

TLDRThe video discusses the recent correction of HDFC Bank's stock and advises viewers on fundamental analysis to identify undervalued or overvalued stocks. It emphasizes the importance of understanding PE ratios and growth potential, especially when dealing with micro-cap and small-cap companies. The speaker uses HDFC Bank and Nandan Denim as case studies, highlighting the need for a multi-layered analysis, including industry trends, promoter credibility, and technical patterns, to make informed investment decisions.

Takeaways

- 📉 The HDFC Bank stock corrected by 4.5%, causing panic in the market, but the fundamentals of the bank are still strong according to the speaker.

- 📈 The speaker emphasizes the importance of fundamental analysis over panic reactions to stock market movements.

- 🤔 The speaker advises against making investment decisions based solely on the P/E ratio, especially for micro-cap stocks, and to consider other factors such as growth potential and industry analysis.

- 🔢 The P/E ratio is explained as a measure of how much you pay for each unit of earnings, with a lower ratio typically indicating a more 'inexpensive' stock.

- 📊 The speaker discusses the difference in P/E ratio significance between large-cap and micro-cap companies, noting that for large-caps, a P/E of 20-25 is not considered high.

- 💡 The concept of 'forward-looking P/E' is introduced, which considers the potential growth in a company's earnings rather than just current earnings.

- 🚀 The speaker uses Nandan Denim as a case study to illustrate how to analyze a micro-cap stock's P/E ratio in the context of its fundamentals.

- 💼 The importance of understanding the industry in which a company operates is highlighted, as it can influence the company's growth potential and profit margins.

- 🔍 The speaker advises investors to conduct thorough research on the promoters of micro-cap companies, as their actions and credibility can impact the stock's performance.

- 📉 The speaker suggests caution with stocks like Par Defense, which have a very high P/E ratio and stagnant revenue growth.

- 💡 The final takeaway is the importance of applying a multi-layered analysis framework when evaluating stocks, especially in the micro-cap space, and not to rely on a single metric like P/E ratio.

Q & A

What happened to HDFC Bank's stock price recently?

-HDFC Bank's stock price corrected by 4 to 4.5%, causing panic in the market, but fundamentally, there was nothing wrong with the stock.

What is the significance of a stock's PE ratio?

-The PE (Price-to-Earnings) ratio indicates how much investors are willing to pay for each unit of a company's earnings. A higher PE ratio suggests a higher valuation, while a lower PE ratio may indicate an undervalued stock.

What is the current PE ratio of HDFC Bank according to the video?

-The current PE ratio of HDFC Bank is trading around 19.6, which is considered not very high.

What is the general rule of thumb for PE ratio in the stock market?

-A stock with a PE ratio below 25 is typically considered inexpensive, but this is not a hard and fast rule and should be considered in the context of the company's fundamentals and industry.

How should investors approach the analysis of micro-cap stocks?

-Investors should focus on the earning potential and growth prospects of micro-cap companies rather than just the PE ratio, as these companies can experience rapid changes in revenue and profits.

What is the importance of industry analysis when evaluating a stock?

-Industry analysis helps investors understand the profit margins and growth potential of a company within its sector, which can influence the company's stock performance.

What should investors consider when analyzing the actions of company promoters?

-Investors should consider the reasons behind a promoter's decision to sell shares, their credibility, and the impact of their actions on the company's stock price and reputation.

Why is it important to look at a company's market cap when evaluating its stock?

-The market cap provides an indication of the company's size and can influence the stock's volatility and growth potential. It's particularly important when comparing different types of companies, such as micro-caps versus large caps.

What is the role of fundamental analysis in stock investing?

-Fundamental analysis helps investors understand the underlying financial health and performance of a company, which can inform investment decisions and identify potential opportunities or risks.

How does the video suggest managing risk in micro-cap and small-cap investments?

-The video suggests managing risk through diversification, staggered investing, and conducting thorough research on the company, including its growth potential, industry position, and promoter credibility.

What is the context of the discussion about Par Defense in the video?

-Par Defense is mentioned as an example of a stock with a very high PE ratio of 2011, and the video discusses the need to evaluate such stocks based on their earning potential and industry analysis rather than just the PE ratio.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

These 5 stocks are in strong momentum. Good time to add?

Come FARE l'ANALISI FONDAMENTALE di un'AZIONE PARTENDO da ZERO | Lezione 6

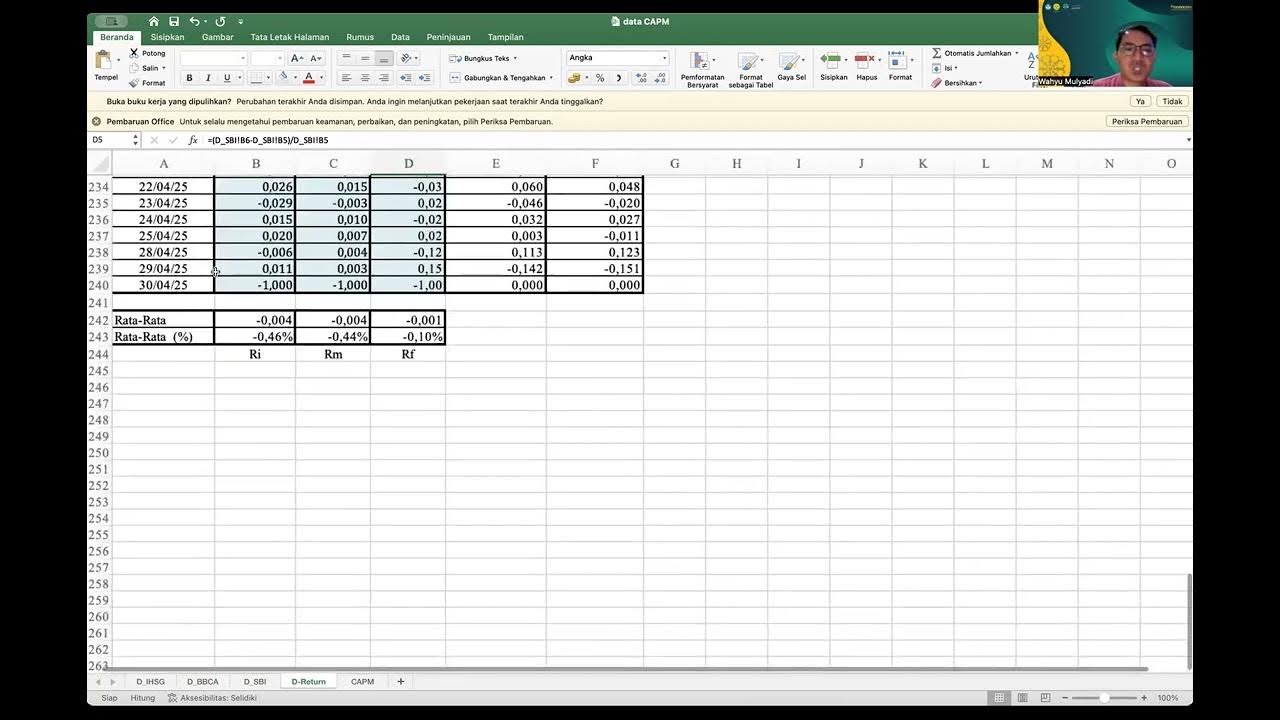

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

MY FAVORITE STOCK FOR LONGTERM !! THE DOJI

Finding Undervalued Gems in an All Time High Market

HDFC Bank vs ICICI Bank Q1 FY26 Earnings | Aditya Shah Analyses Banking Giant's Q1 Results

5.0 / 5 (0 votes)