Market Maker Models (COMPLETE GUIDE) - Ep. 10

Summary

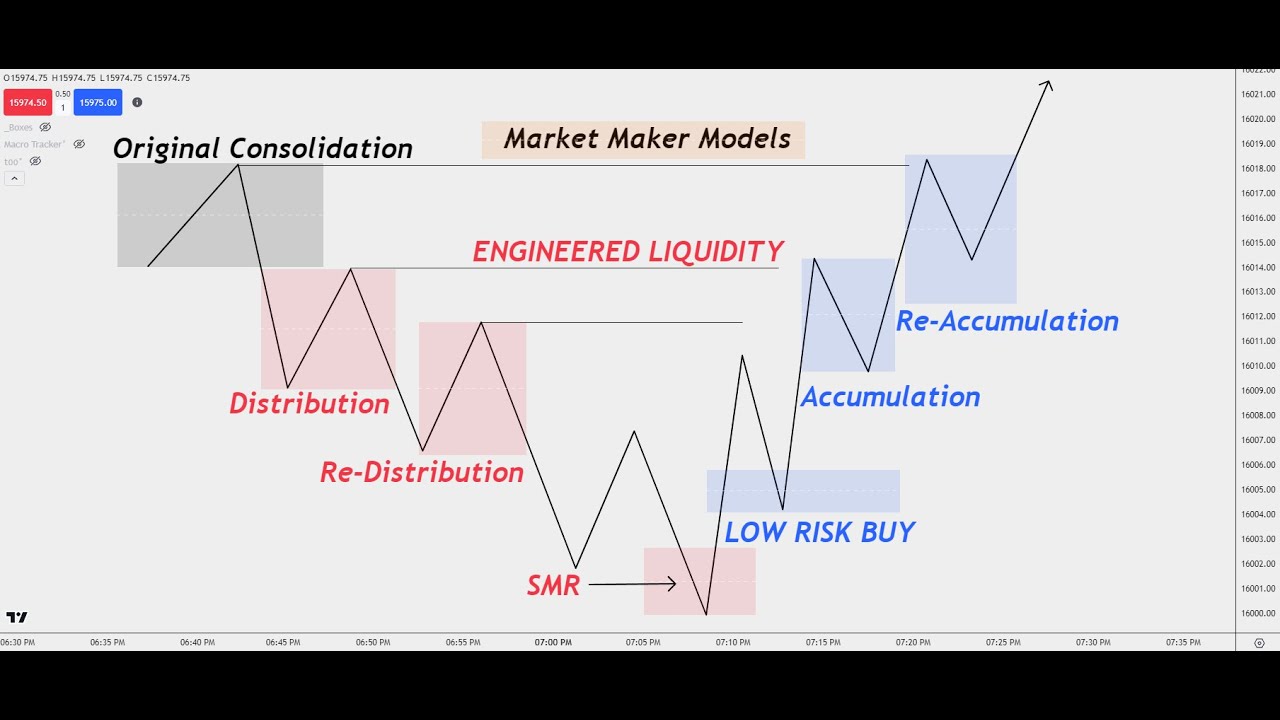

TLDRThis video explains the market maker models, focusing on fair value gaps, sharp turns, and entry strategies across different timeframes. It teaches how to identify key context areas for potential market movements, emphasizing patience and precise timing. The tutorial includes examples of both buy and sell models, offering actionable trade setups with risk management strategies, such as taking profits at 1:2 risk-to-reward ratios. By highlighting the importance of timing, context, and execution, it provides traders with practical insights into effective market navigation, and invites further mentorship for deeper learning.

Takeaways

- 😀 The Market Maker Model is a critical trading strategy, which involves identifying buy and sell models based on fair value gaps (FVGs).

- 😀 Fair Value Gaps (FVGs) represent price action breaks, where no trades occur, and traders aim to enter trades when price returns to these gaps.

- 😀 The concept of 'sharp turns' is essential for identifying price reversals, which can help traders determine the ideal entry points.

- 😀 Patience is key: high probability setups happen quickly, and traders need to wait for the right opportunities without rushing.

- 😀 In a market maker sell model, understanding context areas, such as the previous day's low, is crucial for predicting price moves.

- 😀 A 1:2 risk-to-reward ratio is recommended, with traders advised to take 80% of their profits at this ratio and leave 20% to run for potential further gains.

- 😀 Timing plays a significant role in entering trades. The strategy involves waiting for specific events (e.g., FOMC releases) and time windows (e.g., Asia sessions) before executing trades.

- 😀 Breakers and overlapping FVGs serve as potential entry points, with traders looking for new price moves and sharp turns within these regions.

- 😀 Multiple timeframes are used to identify high probability setups, with entries typically taken on lower timeframes like 1-hour or 15-minute charts after confirming context on larger timeframes.

- 😀 The entry process includes identifying fair value gaps, understanding market structure, and adjusting position sizes according to the context area and market conditions.

- 😀 The mentorship program emphasizes learning by studying price action in real-time and paper trading before executing live trades, allowing for better understanding of the strategy.

Q & A

What is the main concept behind the Market Maker Sale Model discussed in the script?

-The Market Maker Sale Model involves identifying fair value gaps (FVGs) where a market maker might push the price lower, creating a sharp turn. Traders can enter trades after the creation of the fair value gap, targeting lower levels, and continuing to sell as the price moves downward.

How does the Market Maker Buy Model differ from the Sale Model?

-The Market Maker Buy Model is the inverse of the Sale Model. Instead of looking for lower price movements, traders focus on areas where the market creates fair value gaps on the upside, aiming to buy as the market moves higher, often targeting previous swing highs or specific resistance levels.

Why is patience emphasized in the trading strategy discussed?

-Patience is crucial because high-probability setups tend to happen very quickly. If a trader lacks patience, they may miss these opportunities. The strategy focuses on waiting for the right conditions, as the market will often provide better returns to those who wait for clear and valid setups.

What role do time frames play in determining entry points for trades?

-Time frames are used to analyze the market and determine the best points to enter trades. Traders start with higher time frames (like daily or weekly) to establish context and then zoom into shorter time frames (e.g., 15-minute or 1-hour) to find precise entry points that align with the larger trend or market structure.

How does the concept of 'sharp turn entries' apply to the strategy?

-Sharp turn entries occur when price action sharply changes direction, often after reaching a fair value gap. This change in direction is used to trigger entry, either at the creation of the gap or just after the market shows signs of reversing. The strategy relies on these sharp moves to capture profitable trades.

What is meant by 'market structure shift,' and why is it not prioritized in this strategy?

-A market structure shift refers to a change in the broader trend or market flow, such as a transition from higher highs and lows to lower highs and lows. The strategy discussed focuses more on fair value gaps (FVGs) rather than market structure shifts, as FVGs can provide a clearer and more direct signal for entering trades.

Why does the trader recommend taking profits at a 1:2 risk-reward ratio?

-The 1:2 risk-reward ratio ensures that for every unit of risk, the trader targets double the reward. It balances risk and reward, allowing traders to secure profits while leaving some position open to ride longer moves, improving the overall profitability of the strategy.

How does news, like the FOMC, impact the strategy and why should trades be executed after news events?

-News events like the FOMC can cause volatility in the market. The trader recommends waiting for the news to settle before executing trades, as the market can be unpredictable during such events. Entering trades after the news allows for more predictable price movement and clearer setups.

What is the importance of using both price and time in identifying valid trade setups?

-Both price and time are essential because they help confirm whether a fair value gap or other market event is valid. The timing of an entry, especially in relation to key events or market hours (like the Asia session), is crucial to ensuring that the market conditions align for a successful trade.

How does the trader recommend managing trades once a position is entered?

-The trader suggests taking 80% of the position off at a 1:2 risk-reward ratio and leaving 20% running to capture larger moves. This approach helps lock in profits while maintaining some exposure to the trade, allowing the trader to capture any further upside potential.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)