This Is The Only Type Of Order Block That Works - SMC

Summary

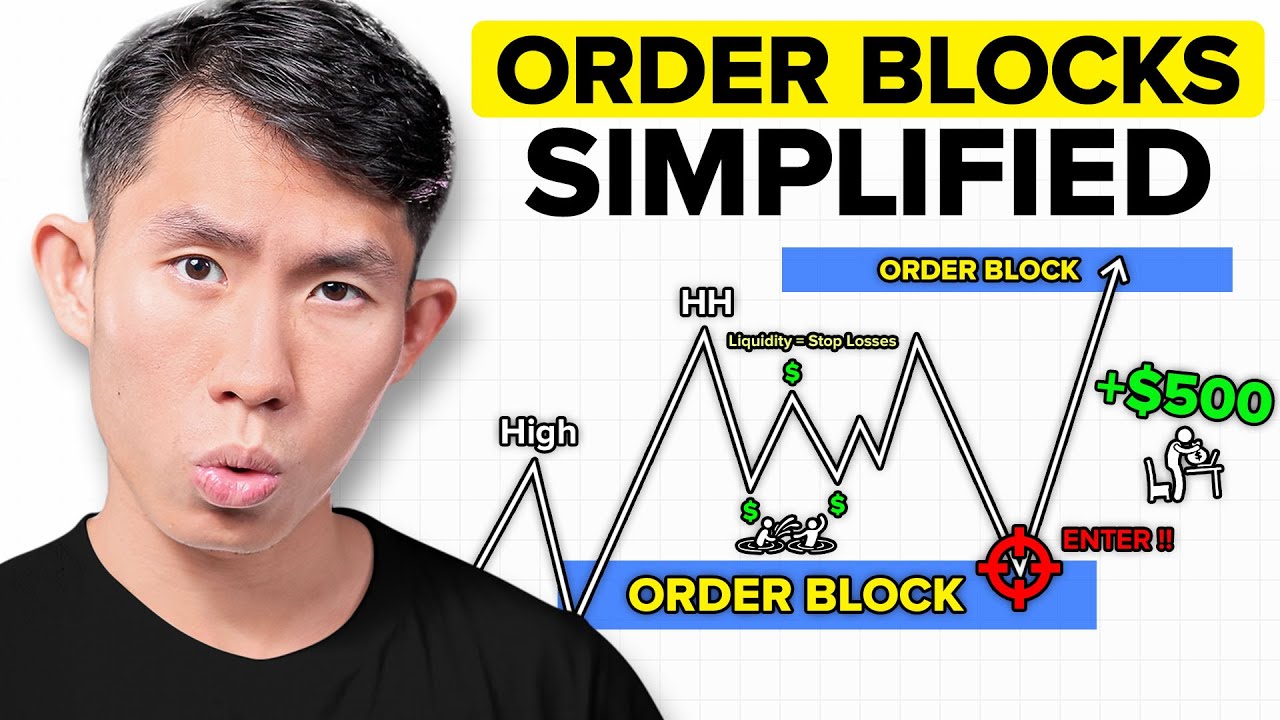

TLDRThis video explains the concept of order blocks in trading, focusing on how to identify and use them effectively. It emphasizes understanding the behavior of price around significant institutional-level transactions and spotting the right order blocks. Key concepts like imbalance, mitigation, and liquidity are discussed, showing how they influence the validity of an order block. The video also highlights common mistakes traders make when using order blocks and provides practical examples to help viewers refine their strategy. Mastering these techniques can lead to more successful trades by filtering out bad setups.

Takeaways

- 😀 An order block represents a large institutional transaction in the financial market, often found at key levels where price tends to react.

- 😀 Price often returns to the level of an order block due to institutional activity, and these levels can be used as memory points for future trades.

- 😀 It's crucial to distinguish between valid and invalid order blocks by identifying imbalances and avoiding mitigated levels.

- 😀 When identifying a bearish order block, use the red candle that took out the high of the previous green candle, not the green candle itself.

- 😀 A valid order block should have an imbalance, meaning that the low of one candle does not connect with the high of the next, creating a fair value gap.

- 😀 In a downtrend, the last green candle before the price moves downward can serve as the bearish order block if it is not violated by the next red candle.

- 😀 The failure to identify the right order block, such as using mitigated or connected candles, can lead to poor trade entries and unnecessary stop-outs.

- 😀 Order blocks should be identified with respect to liquidity and market structure, not merely by the color of the candles.

- 😀 A valid order block often contains a fair value gap that can act as an entry point for high-probability trades.

- 😀 For large order blocks, use tools like the Fibonacci retracement to find optimal entry levels, particularly around the 50% level of the candle's body.

Q & A

What is an order block in trading?

-An order block is a key level in the market where institutional traders have placed large buy or sell orders. These levels act as reference points where price is likely to react, either by reversing or consolidating.

How do you spot an invalid order block?

-An invalid order block occurs when the price has already traded through the level, mitigating the order block, meaning the institutional liquidity at that level has already been used up. This typically happens when the low of a candle touches or connects with the high of the next candle.

What makes an order block valid for trading?

-A valid order block is characterized by the presence of an imbalance, meaning that the low of a bearish candle and the high of the next candle do not connect, creating a fair value gap. Additionally, the order block should not have been mitigated, which means price has not already traded through it.

Why should you avoid trading order blocks that have been mitigated?

-Trading mitigated order blocks is risky because the liquidity has already been absorbed, making it less likely that price will react strongly when it returns to that level. This typically results in false signals and increased chances of stop-loss being hit.

How can you identify a strong order block on a chart?

-A strong order block is typically marked by a high-volume candle that has not been fully mitigated. It should have a fair value gap, meaning there is no price overlap between the preceding and succeeding candles, and price reacts significantly when it revisits the level.

What is an imbalance, and why is it important for order blocks?

-An imbalance, or fair value gap, occurs when there is a noticeable difference between the high of one candle and the low of the next candle, without overlap. This gap represents areas of liquidity where price is likely to return and react, making it a key feature in determining valid order blocks.

How do you use the Fibonacci tool in trading with order blocks?

-The Fibonacci tool can be used to measure the range of a large order block by setting the 50% level as a key threshold. Traders can look for price reactions around the 50% retracement level of the order block to confirm a trade entry.

Why is the concept of liquidity important when identifying order blocks?

-Liquidity refers to the amount of capital and market orders at a specific price level. When an order block takes out liquidity, it means the price has moved past a significant level of buy or sell orders. The absence or presence of liquidity above or below an order block affects the strength and validity of that level.

What does it mean if price pushes beyond the high or low of an order block?

-If price pushes beyond the high or low of an order block, it typically indicates that the order block has been mitigated, and there is no longer significant institutional interest at that level. This suggests the order block is invalid and not reliable for trading.

How can you filter out bad order blocks in your trades?

-To filter out bad order blocks, focus on those with imbalances (fair value gaps) and ensure that the order block has not been mitigated. Avoid order blocks where the price has already moved past the level, and always look for price action confirmation that shows a strong reaction when it revisits the level.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

How to Identify Best Order Blocks to Trade?

Master Order Blocks to Trade like Banks (no bs guide)

High Probability Order Blocks Secrets | ICT/SMC Concepts [Full In-Depth Guide]

Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

Order flow Trading and Analysis That Works! - ICT Trading

Simplifying Key Order Blocks in Forex Trading

5.0 / 5 (0 votes)