REGRESSION AND CORRELATION ANALYSIS

Summary

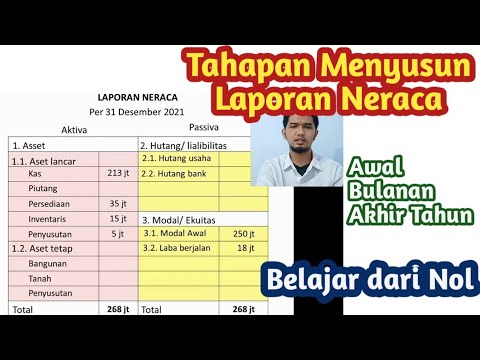

TLDRThis video delves into a regression analysis of five small businesses, exploring the relationship between business capital and monthly profit. Through calculations of correlation (r = 0.762) and the coefficient of determination (r² = 58%), it reveals a positive correlation: as capital increases, so does profit. The analysis concludes that capital accounts for 58% of the profit variability, with the remaining 42% influenced by other factors like marketing, location, and product quality. This insight is crucial for business owners seeking to understand how investments in capital affect their financial success.

Takeaways

- 😀 The video discusses a regression analysis to examine the relationship between business capital and monthly profit.

- 😀 The analysis involves calculating key components such as Sigma XY, Sigma X², and Sigma Y² to derive the correlation coefficient (r).

- 😀 The formula for calculating the correlation coefficient (r) is introduced, focusing on Sigma values and averages.

- 😀 Sigma XY represents the sum of all the products of corresponding X and Y values, while Sigma X² and Sigma Y² represent the sums of squared X and Y values respectively.

- 😀 The value for the correlation coefficient (r) is calculated as 0.762, indicating a positive relationship between capital and profit.

- 😀 A positive r value (greater than 0) means that as the capital increases, the profit tends to increase as well.

- 😀 The coefficient of determination (r²) is computed as 0.58, suggesting that 58% of the variation in profit can be explained by the capital invested.

- 😀 The remaining 42% of profit variation is influenced by other factors, such as marketing strategies, location, or product quality, that are not included in the analysis.

- 😀 The video also emphasizes the importance of understanding the relationship between capital and profit for small businesses.

- 😀 The analysis highlights that while capital plays a significant role, other factors still contribute to the business's overall profitability.

Q & A

What is the main focus of the analysis in this video?

-The analysis focuses on examining the relationship between business capital (modal usaha) and monthly profit (keuntungan bulanan) through regression analysis, specifically using the correlation coefficient (r) and the coefficient of determination (r²).

What is the formula used for calculating the correlation coefficient (r)?

-The formula for the correlation coefficient (r) involves using the sums of products of corresponding X and Y values (Sigma XY), as well as the sums of squared X values (Sigma x²) and squared Y values (Sigma y²).

How is Sigma XY calculated in the script?

-Sigma XY is calculated by summing up the product of corresponding values of X and Y. For example, for X = 2 and Y = 10, the product is 2 * 10 = 20. This is repeated for all the data points, and the sums are added together to get the total Sigma XY.

What does the coefficient of determination (r²) represent in this analysis?

-The coefficient of determination (r²) represents the proportion of the variation in the dependent variable (profit) that can be explained by the independent variable (capital). In this case, r² is 0.58, meaning that 58% of the variation in profit can be explained by the capital invested.

What does a positive correlation coefficient (r = 0.762) indicate?

-A positive correlation coefficient of 0.762 indicates a strong, positive relationship between business capital and monthly profit. As the capital invested in a business increases, so does the monthly profit.

How is the mean of the X and Y values (X Bar and Y Bar) calculated?

-X Bar (the mean of X values) is calculated by summing all X values and dividing by the number of data points. Similarly, Y Bar (the mean of Y values) is calculated by summing all Y values and dividing by the number of data points.

What does the value of 58% in the coefficient of determination imply?

-The 58% value in the coefficient of determination implies that 58% of the variation in business profits is explained by the variation in capital investment. The remaining 42% of the variation in profits is due to other unexamined factors.

What is the significance of the square of the correlation coefficient (r²)?

-The square of the correlation coefficient (r²) is significant because it quantifies the strength of the relationship between the two variables. It represents the proportion of variance in the dependent variable (profit) that can be explained by the independent variable (capital).

Why is the value 42% important in this analysis?

-The 42% represents the portion of profit variation that cannot be explained by the capital investment. This suggests that other factors, such as marketing strategies, location, or product quality, may be influencing the profits but were not included in the analysis.

How would the analysis change if additional variables were considered?

-If additional variables were considered, such as marketing strategies or location, the coefficient of determination (r²) might increase, as more factors influencing the profit would be accounted for, leading to a more comprehensive understanding of profit variation.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)