La Estrategia De Trading Con Fibonacci Explicada

Summary

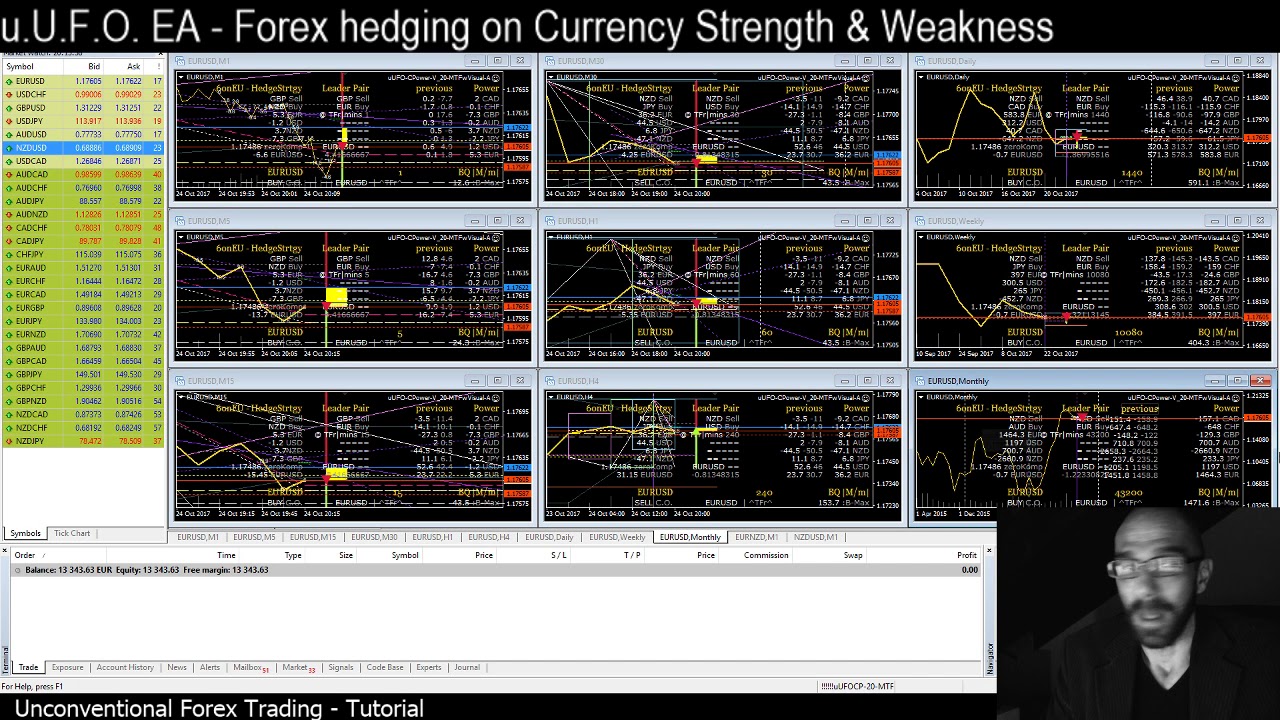

TLDRIn this video, the trader explains a systematic strategy for executing trades, focusing on the EUR/USD pair. The approach involves identifying key support levels on higher timeframes, detecting trend reversals on smaller timeframes, and waiting for a pullback to Fibonacci retracement levels. Once the trade is executed, a moving average is used for trade management to minimize emotional decisions. The video provides clear steps for entry, exit, and risk management, emphasizing the repeatability of the strategy for consistent profits.

Takeaways

- 😀 Identifying a support level on a larger timeframe (weekly chart) is crucial to understanding price behavior and potential entry points.

- 😀 A triple bottom pattern on a smaller timeframe (4-hour chart) signals a trend change, marking the start of a potential upward movement.

- 😀 The 0.618 Fibonacci retracement level is commonly used as an entry point when a pullback occurs after a trend change.

- 😀 The speaker prefers to manually execute the trade when the price shows signs of reversal, rather than setting a limit order in advance.

- 😀 After executing the trade, the stop loss should be placed between the 0.618 and 0.75 Fibonacci levels, offering protection against potential losses.

- 😀 The take profit level is ideally set at the 1.618 Fibonacci extension level, maximizing potential profits.

- 😀 A moving average can be used to manage the trade, adjusting the stop loss as the price moves in a favorable direction.

- 😀 The strategy emphasizes minimal emotional involvement during the trade, using objective methods like Fibonacci levels and moving averages to guide decisions.

- 😀 The trading strategy is repeatable and adaptable to different market conditions, allowing for consistent execution and profit potential.

- 😀 The speaker highlights the importance of studying past trades to understand how the strategy works and refine execution for future trades.

- 😀 The strategy is designed to be beginner-friendly, with free resources and tutorials available to help traders learn and apply it effectively.

Q & A

What is the first step in the trading strategy described in the video?

-The first step is to identify a support level on the larger time frame, such as the weekly chart. The price has rejected this level multiple times, indicating strong support.

How does the speaker identify the change in market trend?

-The change in market trend is identified by a triple bottom pattern on the 4-hour chart, where the price rejects the support level three times, followed by a breakout and the formation of higher highs.

What is the role of Fibonacci levels in this strategy?

-Fibonacci levels, particularly the 0.618 retracement, are used to find entry points after a pullback in the price. The 1.618 extension level is also used to set a take profit target, as it represents a common price target for trend continuation.

Why does the speaker prefer executing trades on a 'reversal' instead of using a limit order?

-The speaker prefers executing trades on the reversal because they have the time to monitor the trade, allowing them to react in real-time rather than setting a limit order and waiting for the market to reach that price.

In which time frame should a trader focus on identifying the trend reversal for execution?

-A trader should focus on the 15-minute chart to identify the precise moment of trend reversal before executing the trade.

Where should the stop loss be placed according to the strategy?

-The stop loss should be placed between the 0.618 and 0.75 Fibonacci levels to allow for some market fluctuations while minimizing risk.

What is the recommended take profit level in this strategy?

-The take profit level is set at the 1.618 Fibonacci extension level, which is a common target for a trend continuation after a pullback.

What role do moving averages play in managing the trade?

-Moving averages help manage the position by acting as a dynamic support or resistance level. As the price moves in the direction of the trend, the moving average follows. If the price breaks through the moving average, it could signal a potential change in trend.

How does the strategy help in reducing emotional involvement in trading?

-The strategy minimizes emotional involvement by using clear rules for entry, stop loss, and take profit. The use of moving averages also allows traders to manage positions objectively without constant emotional decision-making.

Why does the speaker mention that the strategy is repeatable and reliable?

-The speaker emphasizes that the strategy is repeatable because it is based on consistent market patterns and Fibonacci levels, which occur regularly. This reliability allows traders to use the same method for similar setups in the future, ensuring a consistent approach to trading.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

AM FOST APROAPE SA PIERD TOT!

Where to Place your Stop Loss and Take Profit Tutorial

تطبيق على إستراتيجية رينج الشمعة السابقة "PCR"

COMO TRAÇAR o seu CANAL DE ABERTURA no GAP? | FOREX | FIMATHE

Predict Price Direction Up To 80% Correctly

Forex math based formula application - MT4 - uUFO-EA: foreign currency hedging strategy explained.

5.0 / 5 (0 votes)