Belajar Pajak untuk UMKM (PPh Final/PP23 2018)

Summary

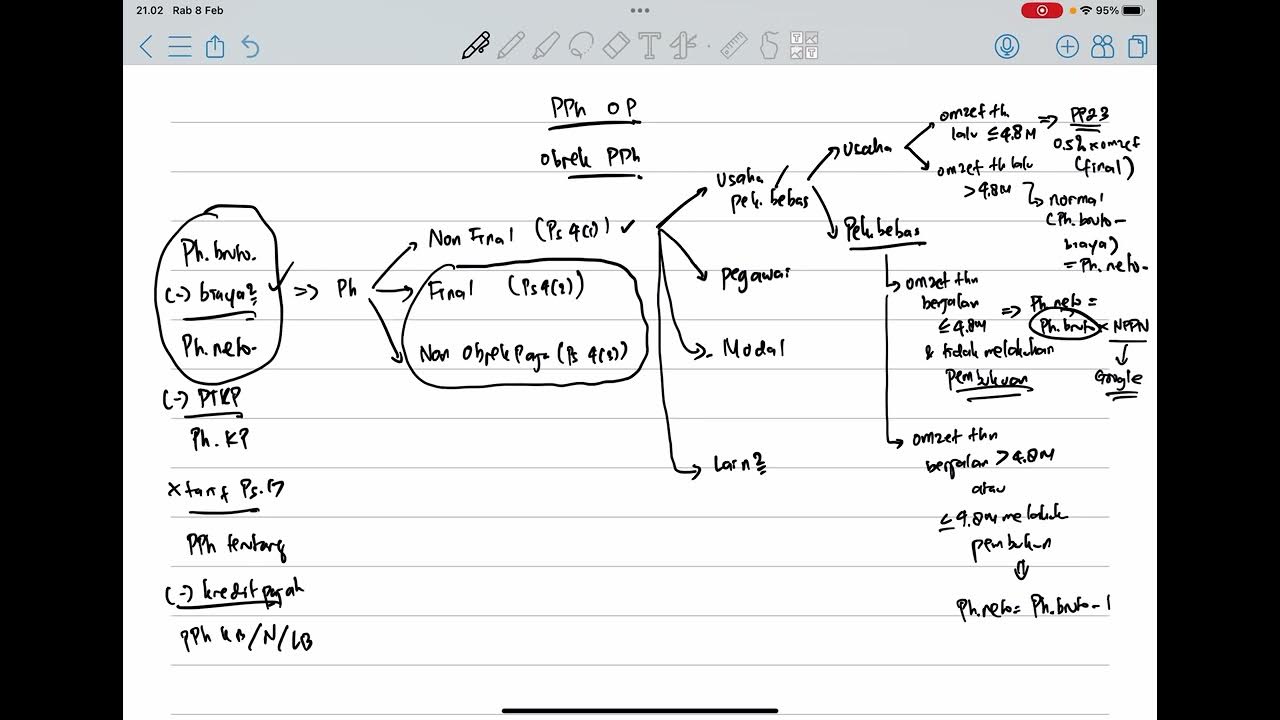

TLDRIn this video, Faris Yustian explains the process of calculating Personal Income Tax (PPh) for Micro, Small, and Medium Enterprises (UMKM) in Indonesia under the PP 23/2018 regulation. He covers key details such as the final tax rate of 0.5%, applicable turnover limits (under 4.8 billion IDR annually), and the exemptions for certain professionals and businesses. Faris also discusses the duration for which businesses can utilize this simplified tax system, how to report and pay taxes, and the transition to regular tax mechanisms after exceeding the turnover threshold. The video is aimed at helping UMKM owners understand tax calculations and their obligations.

Takeaways

- 😀 PPH (Personal Income Tax) for individuals in Indonesia can be simplified for UMKM (Micro, Small, and Medium Enterprises) under the PP 23/2018 regulation.

- 😀 UMKM can be taxed with a final rate of 0.5% or 1% on gross revenue (turnover) without the need for calculating taxable income, as the tax is based on gross revenue.

- 😀 PP 23/2018 applies to individuals, CVs (partnerships), and cooperatives with certain revenue thresholds, and is effective from July 2018.

- 😀 If a business exceeds a certain turnover (IDR 4.8 billion per year), it will no longer qualify for the final tax rate under PP 23, and must switch to regular bookkeeping and reporting.

- 😀 Businesses subject to PP 23 can be taxed for 3 to 7 years depending on their business type. After this period, businesses must keep full financial records.

- 😀 Businesses can opt to switch from PP 23 to the regular tax calculation system if they choose not to use the final tax regime. This must be reported to the tax office.

- 😀 The final tax rate for UMKM is applicable to various business activities as long as the revenue does not exceed the specified threshold (IDR 4.8 billion).

- 😀 Specific business types, such as professionals (doctors, lawyers) and some other types of service providers, are excluded from using the PP 23 scheme.

- 😀 Taxable income is based on the gross revenue and cannot be combined with income that is exempt, like inheritance, scholarships, or certain types of compensation.

- 😀 Businesses that fall under PP 23 must report their tax payments annually, summarizing the total paid tax for each month within the fiscal year.

Q & A

What is the main focus of this video script?

-The video script primarily discusses the Personal Income Tax (PPh) for individuals, specifically focusing on the tax regulations for Micro, Small, and Medium Enterprises (UMKM) under the PP 23/2018 rule.

What is PP 23/2018 and how does it apply to UMKM?

-PP 23/2018 is a regulation that applies to UMKM in Indonesia, where income from business activities is subject to a final income tax of 0.5% or 1%, depending on the business's turnover. It simplifies tax calculations by applying this fixed percentage directly to gross income (revenue) each month, without needing to calculate net income or other adjustments.

How is the tax calculated under PP 23 for UMKM?

-The tax under PP 23 is calculated by multiplying the business's gross income (revenue) by the applicable tax rate (0.5% or 1%) each month. There is no need to calculate net income or personal deductions.

What is the maximum revenue threshold for UMKM to apply PP 23/2018?

-The maximum annual turnover for an UMKM to be eligible for PP 23/2018 is 4.8 billion IDR. If the total revenue exceeds this amount, the business cannot apply the PP 23 rule.

How long can an individual business owner (Wajib Pajak Pribadi) use PP 23/2018?

-An individual business owner can use PP 23/2018 for up to 7 years, starting from the year they are registered as a taxpayer (Wajib Pajak). After 7 years, they must switch to using standard accounting methods.

What happens after the 7-year period for an individual using PP 23/2018?

-After 7 years, the individual is required to start maintaining proper accounting records (bookkeeping) and calculating tax based on regular income tax mechanisms, as opposed to the simplified final tax method under PP 23.

Who is not eligible to use PP 23/2018?

-Some taxpayers are not eligible to use PP 23, such as those involved in professional services (e.g., doctors, lawyers, notaries, etc.), companies listed on the stock exchange, or those with certain specialized business activities like those in art or entertainment.

What is the tax rate under PP 23/2018 for UMKM?

-The tax rate under PP 23/2018 for UMKM is either 1% or 0.5% of gross income, depending on the business's classification and revenue. This is a final tax, meaning no further deductions or adjustments are needed.

How can a business owner switch from PP 23 to the general tax mechanism?

-A business owner who wishes to switch from PP 23 to the general tax mechanism must inform the Directorate General of Taxes (DJP) by submitting a notification at the beginning of the fiscal year, typically during the annual tax filing (SPT).

What are the two payment methods for the final income tax under PP 23?

-The final income tax under PP 23 can be paid either by the business owner directly (self-payment) or by being deducted at source by a third party (e.g., a business partner or government agency). If deducted at source, the business owner needs to provide a letter of tax status (Surat Keterangan) to avoid duplicate tax deductions.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

PPh Orang Pribadi (Update 2023) - 8. PPh UMKM (PP 23) untuk WPOP

Aspek Pajak Koperasi (Part 1)

Lembaga Keuangan Mikro-IKNB | Ekonomi Kelas X (Kurikulum Sekolah Penggerak) | EDURAYA MENGAJAR

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

PPH Orang Pribadi (Update 2023) - 2. Objek Pajak

5.0 / 5 (0 votes)