1. Market Structure | Full Forex course you will ever need [Free]

Summary

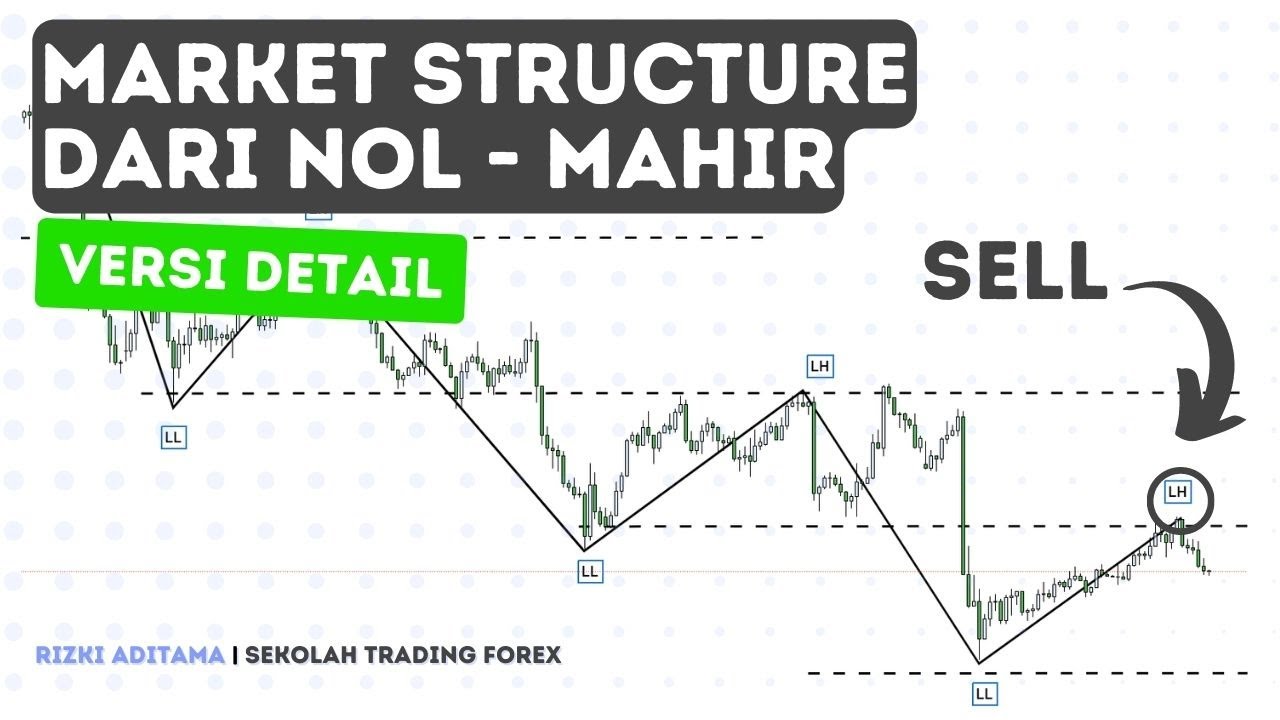

TLDRThis video focuses on the fundamental concept of Market Structure, which is vital for building trading strategies. It explains how market trends, both bullish and bearish, are identified through patterns of higher highs, higher lows, lower highs, and lower lows. The script also covers the significance of 'breaks of structure' and 'minor breaks of structure' for determining market sentiment and trading decisions. Additionally, the importance of recognizing shifts in market bias and momentum is emphasized, with insights into applying this knowledge for both long-term and intraday trading. The video concludes by setting up future lessons on more advanced strategies.

Takeaways

- 😀 Market structure is essential for understanding trading strategies and identifying whether a market is trending or ranging.

- 😀 A bullish market features consistent higher highs and higher lows, while a bearish market features lower highs and lower lows.

- 😀 Breaks in market structure help identify directional bias, which informs whether to buy or sell.

- 😀 A change in market sentiment occurs when price trades below a higher low (bullish to bearish) or above a lower high (bearish to bullish).

- 😀 Breaks of structure (BOS) indicate when the market has surpassed a key high or low, signaling a potential shift in momentum.

- 😀 Minor breaks of structure are smaller price movements within the overall trend that can provide early signs of market changes, especially useful for intraday scalping.

- 😀 To trade efficiently, it's important to differentiate between major and minor breaks of structure, both of which help identify potential entry points.

- 😀 In a bullish market, once major breaks of structure occur, it is advisable to focus on buying positions and not look for short trades unless sentiment changes.

- 😀 Minor breaks of structure provide early warning signs of changes in market sentiment, but confirmation through full body candlesticks is necessary before changing market bias.

- 😀 Candlestick formations and momentum should be analyzed in real-time to assess whether a break of structure is valid, particularly for determining entry and exit points.

- 😀 Advanced traders can use minor breaks of structure on lower time frames (like 1-minute or 5-minute charts) for more aggressive scalping strategies, though this is a higher-risk approach.

Q & A

What is market structure, and why is it important in trading?

-Market structure refers to the overall trend and order flow in the market, such as bullish or bearish trends. Understanding market structure is crucial for traders because it helps them identify the direction of the market, allowing for more informed decisions on whether to buy, sell, or stay out of the market.

What does 'break of structure' (BOS) mean in trading?

-A 'break of structure' (BOS) occurs when the price breaks a previous high (in a bullish trend) or a previous low (in a bearish trend). This indicates a potential shift in market direction and can signal the start of a new trend or continuation of the existing trend.

How can a minor break of structure help traders?

-A minor break of structure occurs when there is a smaller break in the market, typically within a lower timeframe. These minor breaks can provide early signals that a larger break of structure is approaching, offering traders an opportunity to enter a position before the main trend shift happens.

How does understanding market sentiment help in trading?

-Market sentiment refers to the overall mood or attitude of traders towards a particular asset. By observing breaks in market structure, such as the price breaking above a lower high or below a higher low, traders can gauge shifts in sentiment, which helps in anticipating reversals or continued trends.

What is the importance of identifying higher highs and higher lows in a bullish market?

-In a bullish market, identifying higher highs and higher lows is crucial because they confirm that the market is trending upward. Traders look for these patterns to time their buy entries and follow the trend, increasing the likelihood of a profitable trade.

What role do lower highs and lower lows play in a bearish market?

-In a bearish market, lower highs and lower lows indicate that the market is trending downward. Traders can use this pattern to identify sell opportunities, as the market continues to make new lows, signaling further downward movement.

What should a trader do if they notice a break of structure?

-When a trader notices a break of structure, they should assess whether it indicates a change in market direction. If the break suggests a trend reversal or continuation, the trader can adjust their trading strategy accordingly—entering a position that aligns with the new trend.

How can minor breaks of structure help traders catch early moves?

-Minor breaks of structure can give traders an early indication that the price might be preparing for a larger break in the future. By acting on these early signals, traders can enter positions before the major trend shift, potentially catching more profitable moves.

Why is it important to wait for confirmation when trading breaks of structure?

-Waiting for confirmation ensures that the break of structure is valid and not a false signal. Confirmation can come in the form of a full-body candle closing above or below a key level, which gives traders more confidence that the break is genuine and that the market is likely to continue in the predicted direction.

What is the significance of using real charts to analyze market structure?

-Using real charts allows traders to apply theoretical concepts like market structure and break of structure to actual price action. By analyzing live charts, traders can better understand how market structure plays out in real-time and make more informed decisions based on current market conditions.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)