Cara Lapor Spt Online Tahun 2025

Summary

TLDRThis video provides a clear, step-by-step guide for Indonesian taxpayers to file their 2025 annual tax return (SPT) online via DJP Online. It covers accessing the DJP website, logging in with NIK or NPWP, selecting the appropriate SPT form, filling in necessary data, reviewing the SPT summary, and completing the verification process. The guide emphasizes the ease and convenience of submitting taxes from home using mobile devices or computers, making the entire process straightforward and efficient. The video aims to assist users in navigating the e-filing system seamlessly.

Takeaways

- 😀 To report your 2025 annual tax (SPT), start by visiting the DJP Online website.

- 😀 You need a unique Evin code to authenticate online transactions. This code is issued by the Directorate General of Taxes (DJP).

- 😀 To activate your Evin code, visit the nearest KPP (Tax Office).

- 😀 On the DJP Online website, enter your NIK (National Identity Number) or NPWP (Taxpayer Identification Number) along with your password.

- 😀 If you have not registered before, you need to click 'Daftar di sini' (Register Here) to sign up.

- 😀 After logging in, click 'Lapor' (Report) and select 'eSPT' to start the filing process.

- 😀 You will be asked a series of questions based on the SPT form you select. Choose the appropriate form for your tax filing.

- 😀 Fill in the SPT form with details such as the tax year (2025) and SPT type (e.g., normal SPT).

- 😀 Include details from your company's tax withholding certificates in the form.

- 😀 After completing the form, you will receive a summary of your SPT. You will need to verify it using a code sent to your registered phone number or email.

- 😀 Once the verification code is entered, you can submit your tax report and will receive confirmation via email.

Q & A

What is the first step in the online SPT reporting process for 2025?

-The first step is to go to Google and search for 'DJP Online' to access the online reporting platform.

What is the purpose of the 'Kode Evin' in the online SPT reporting?

-The 'Kode Evin' is a unique identification code issued by the Directorate General of Taxes (DJP) to taxpayers. It is used as an authentication tool to encrypt electronic transactions and filings.

How can a taxpayer activate their 'Kode Evin'?

-To activate the 'Kode Evin,' taxpayers need to visit the nearest KPP (Tax Service Office) in person.

What should you do if you haven't registered for 'DJP Online' before?

-If you haven't registered, you should click 'Daftar di sini' (Register here) and complete the registration process using your NIK or NPWP and other details.

What should you do after logging in to the 'DJP Online' website?

-After logging in, click on 'Lapor' (Report), then choose 'E-filing,' and proceed to fill out your SPT form.

What are the different options available for completing the SPT form online?

-There are three options for completing the SPT form online: a form-based approach, a guided form approach, and the option to upload your own SPT file.

Which tax year should be selected when filling out the SPT for 2025?

-When filling out the SPT for 2025, you should select the tax year 2025 in the form.

What information should you include in the SPT form?

-You should include details such as your tax identification number (NPWP), personal data, and tax payment receipts (bukti potong) provided by your employer.

What happens after you complete the SPT form?

-Once you complete the SPT form, a summary of your SPT will appear. You will then need to verify and submit it by entering a verification code sent to your registered phone number or email.

How will you receive the confirmation of your SPT submission?

-After submitting the SPT, you will receive a confirmation email containing your tax report receipt.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

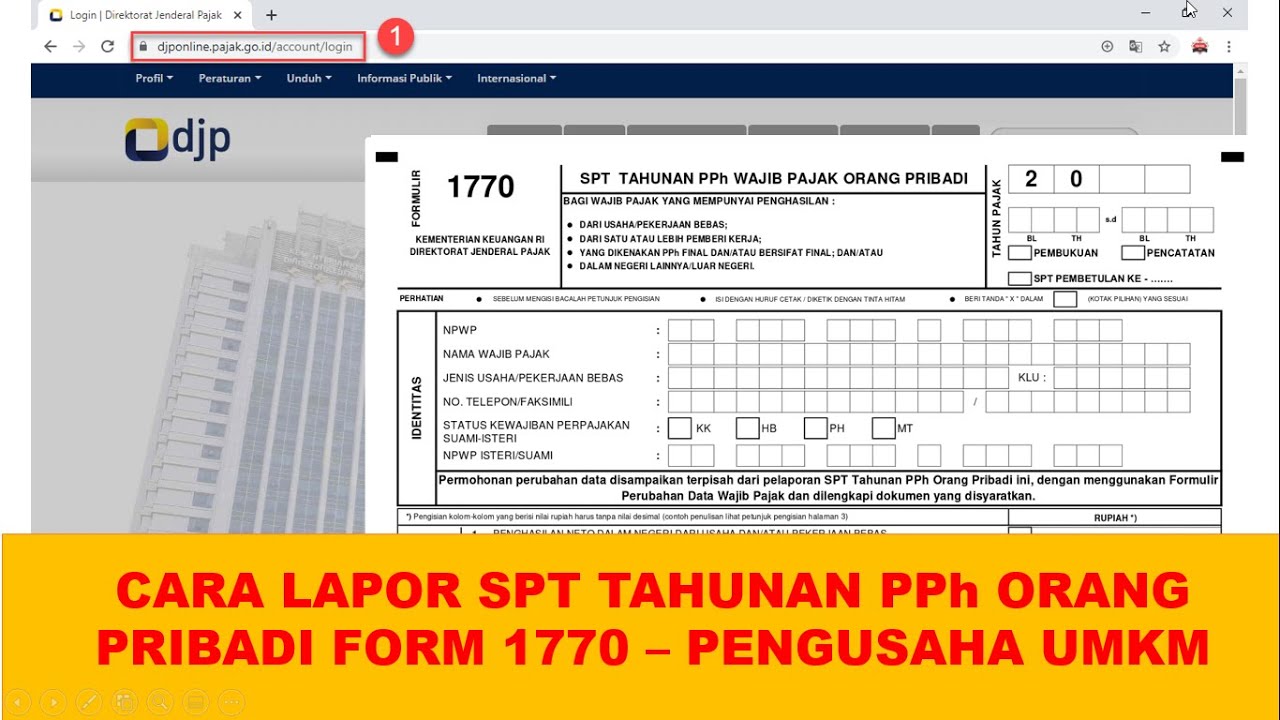

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Cara Pelaporan (SPT) Pajak Tahunan PNS diatas 60 juta tahun 2023

Tutorial Efiling 2022: Cara Lapor Pajak SPT Tahunan Secara Online Penghasilan Dibawah Rp 60 Juta

Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha UMKM | Tutorial Lengkap

Cara Lapor eBupot Unifikasi Full Lengkap

PPh Orang Pribadi (Update 2023) - 11. Panduan Pengisian SPT 1770SS

5.0 / 5 (0 votes)