EPFO 3.0 Explained: Withdraw PF From ATM, No 12% Contribution Cap For Employees & More | EPFO

Summary

TLDREPFO 3.0, set to launch in 2025, introduces significant changes to India’s Provident Fund system. Key updates include removing the 12% contribution cap for employees, allowing voluntary contributions for higher pension benefits. A new debit card will enable easy ATM withdrawals of Provident Fund amounts (up to 50% of total funds). Employees will also be able to contribute directly to the Employees' Pension Scheme (EPS 95) for increased pension benefits, while the wage ceiling for EPF eligibility may rise from ₹15,000 to ₹21,000. These changes aim to enhance flexibility, accessibility, and future security for EPF members.

Takeaways

- 😀 EPFO (Employees Provident Fund Organization) manages retirement plans, Provident Fund, and Pension Schemes for employees in India.

- 😀 EPFO 3.0 aims to introduce significant changes to the EPF system, impacting current and future employees.

- 😀 Under EPFO 3.0, employees will no longer be capped at a 12% contribution to their EPF account, allowing voluntary contributions beyond this threshold.

- 😀 The government will maintain a 12% employer contribution, which will be converted into higher pension benefits for subscribers who contribute more.

- 😀 A new debit-like card will be issued for easier EPF withdrawals, allowing subscribers to withdraw funds via ATMs (with a limit of 50% of total balance).

- 😀 Employees may directly contribute to the EPS 95 (Employees' Pension Scheme) under the proposed changes, boosting their pension benefits.

- 😀 The revision of EPS 95 will allow employees to shift more of their Provident Fund to the pension scheme at any time.

- 😀 The weight ceiling for EPF contributions may increase from ₹15,000 to ₹21,000, extending benefits to more people under the EPS pool.

- 😀 The changes are expected to be rolled out between May and June 2025, marking the launch of EPFO 3.0.

- 😀 Key features of EPFO 3.0 include: removal of the 12% contribution cap, direct PF withdrawals via ATM cards, direct contributions to EPS 95, and an increase in the wage ceiling for eligibility.

Q & A

What is EPFO and what does it manage?

-EPFO (Employees' Provident Fund Organization) is a social security agency in India that manages retirement plans for employees. It oversees Provident Fund (PF), Pension Schemes (EPS), and other related instruments.

How does the EPF system work?

-In the EPF system, both the employee and employer contribute a portion of the employee's salary to the Provident Fund account. This fund can be withdrawn later, either after retirement or under specific circumstances.

What is EPFO 3.0 and how will it impact EPFO members?

-EPFO 3.0 is a new framework being introduced by the government that will bring significant changes to the EPF system. Key changes include removing the contribution cap for employees, simplifying PF withdrawals, and allowing direct contributions to the EPS 95 scheme.

What change is being proposed regarding employee contributions to EPF?

-The government plans to remove the 12% contribution cap for employees, allowing them to contribute as much as they want to their EPF accounts. The 12% threshold for employer contributions will remain unchanged.

Will employees be able to withdraw PF money easily under EPFO 3.0?

-Yes, the government plans to introduce a debit card-like system for PF withdrawals, allowing employees to withdraw their Provident Fund amount via ATMs. However, the withdrawal limit will still be capped at 50% of the total corpus.

What changes are being proposed for the EPS 95 under EPFO 3.0?

-The government is considering allowing employees to directly contribute to the EPS 95 scheme, which would increase their pension benefits. Currently, employee contributions to EPF are split between EPF and EPS.

How will the new changes impact pension schemes?

-Under the new changes, employees could contribute directly to EPS 95, increasing their pension benefits and potentially converting their Provident Fund balance into pension at any time.

Is there any change planned regarding the salary ceiling for EPS contributions?

-Yes, the salary ceiling for EPS contributions may be increased from ₹15,000 to ₹21,000, allowing more employees to join the EPS pool and benefit from the pension scheme.

When is EPFO 3.0 expected to be implemented?

-EPFO 3.0 is expected to be announced between May and June of 2025, with the new framework set to be implemented soon after.

What are the four major changes under EPFO 3.0?

-The four major changes under EPFO 3.0 are: 1) Removal of the 12% contribution cap for employees, 2) Introduction of a card for PF withdrawals via ATM, 3) Direct employee contributions to EPS 95, and 4) Increase in the salary ceiling for EPS from ₹15,000 to ₹21,000.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

EPFO Alert: What’s New In Pension | EPFO Pension Rules Updated: 5 Major Changes For Account Holders

Can You Crack UPSC EPFO in 4 Months? | Strategy & Clarity Inside

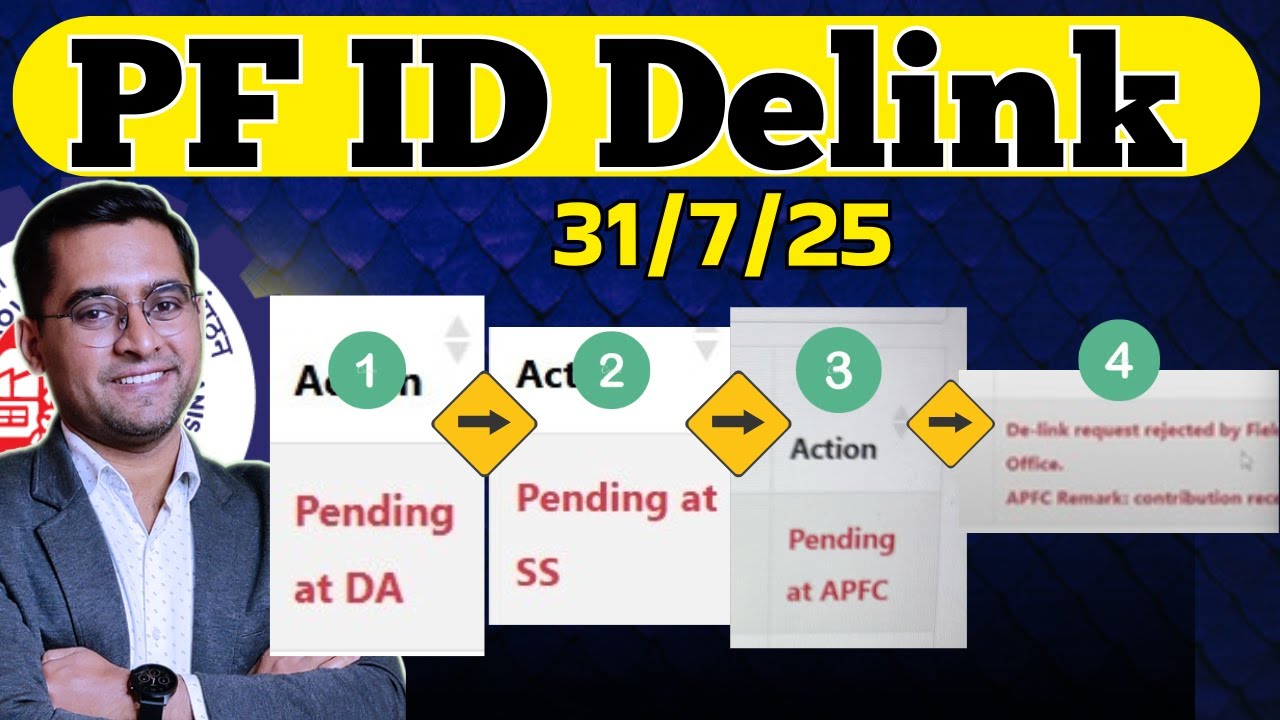

🔥PF Delink Pending at DA /SS / APFC Complete information | Wrong PF member id delink

Ubicar varias fracciones en la recta numérica

Factoring Sums and Differences of Perfect Cubes

The Impact Of Low Omega-3s On Your Health - Dr Rhonda Patrick

5.0 / 5 (0 votes)