Accurate Desktop ke 7 : Uang muka penjualan

Summary

TLDRThis tutorial guides users on how to use down payments (uang muka) in Accurate Desktop software for sales transactions. It covers two methods: applying down payments during sales orders and invoices, and managing payment receipts. The video explains step-by-step how to create sales orders, apply down payments, adjust payments, and process refunds or credits. It also demonstrates how to track remaining balances, handle excess payments, and ensure all transactions are accurately recorded in the system. This practical guide is ideal for users looking to streamline their sales and payment processes in Accurate Desktop.

Takeaways

- 😀 Down payments (uang muka) can be used in both the Sales Order and Sales Invoice sections of Accurate Desktop.

- 😀 In the Sales Order, down payments are linked to the selected customer and item before being processed.

- 😀 Before applying a down payment, ensure that a customer and product are selected in the Sales Order section.

- 😀 The system allows you to enter a down payment amount (e.g., 1 million) and process it through the Payment section.

- 😀 After the down payment is processed, the amount will be reflected in the Sales Invoice automatically.

- 😀 When customers make a down payment without specifying items, you can use 'Opening Balance' as a placeholder for the down payment.

- 😀 In cases where a customer wants to make a prepayment but hasn't chosen items yet, the down payment amount is recorded as an Opening Balance item.

- 😀 The 'Payment' section allows you to confirm and calculate the down payment. Make sure to click 'Calculator' to finalize the amount.

- 😀 If the customer later decides to buy a product, the down payment can be directly applied to the final sales invoice.

- 😀 If a customer requests a refund of the down payment, you can reverse the transaction by creating a new Sales Invoice and using the 'Opening Balance' item to process the refund.

Q & A

What is the main purpose of this tutorial?

-The tutorial explains how to use down payments (uang muka) in Accurate Desktop for sales transactions. It covers two methods: applying a down payment to a sales order and to a sales invoice.

What is the first step in using a down payment in a sales order?

-The first step is to create a sales order by selecting the customer and the products they want to purchase. Then, the down payment section is used to enter the required advance payment.

Can the down payment feature be used for both sales orders and sales invoices?

-Yes, the down payment feature can be used for both sales orders and sales invoices. The tutorial demonstrates two methods: one using the down payment in the sales order and the other in the invoice.

What happens when a down payment is applied to a sales order?

-When a down payment is applied to a sales order, the system reflects the advance payment as part of the total sale. The customer pays the down payment, and the remaining balance is due at a later time.

How does the down payment affect the sales invoice?

-In the sales invoice, the down payment is automatically reflected as a credit, reducing the total amount due. The invoice will show the remaining balance to be paid after the down payment is subtracted.

What should you do if the customer overpays their down payment?

-If the customer overpays, the extra amount can be applied to future invoices or refunded. The system will reflect the overpayment as a credit balance.

How can you refund a down payment if a customer cancels the purchase?

-To refund a down payment, create a new transaction in the system to process the refund. The excess payment is returned to the customer, and the system updates the transaction history.

Can you adjust the down payment amount in the system after it's been entered?

-Yes, the down payment amount can be adjusted in the system. You can change the amount in the sales order or invoice before finalizing the transaction, as long as it's not yet completed.

How do you handle a situation where the customer has paid more than the total invoice?

-If the customer has paid more than the invoice total, the excess payment is credited to their account and can be used for future purchases or refunded. You can handle this by updating the payment records in the system.

What happens if there is a remaining balance after the down payment is applied?

-If there is a remaining balance after the down payment is applied, the customer will need to pay the difference. The system will reflect this balance in the sales invoice, and the customer can settle it accordingly.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

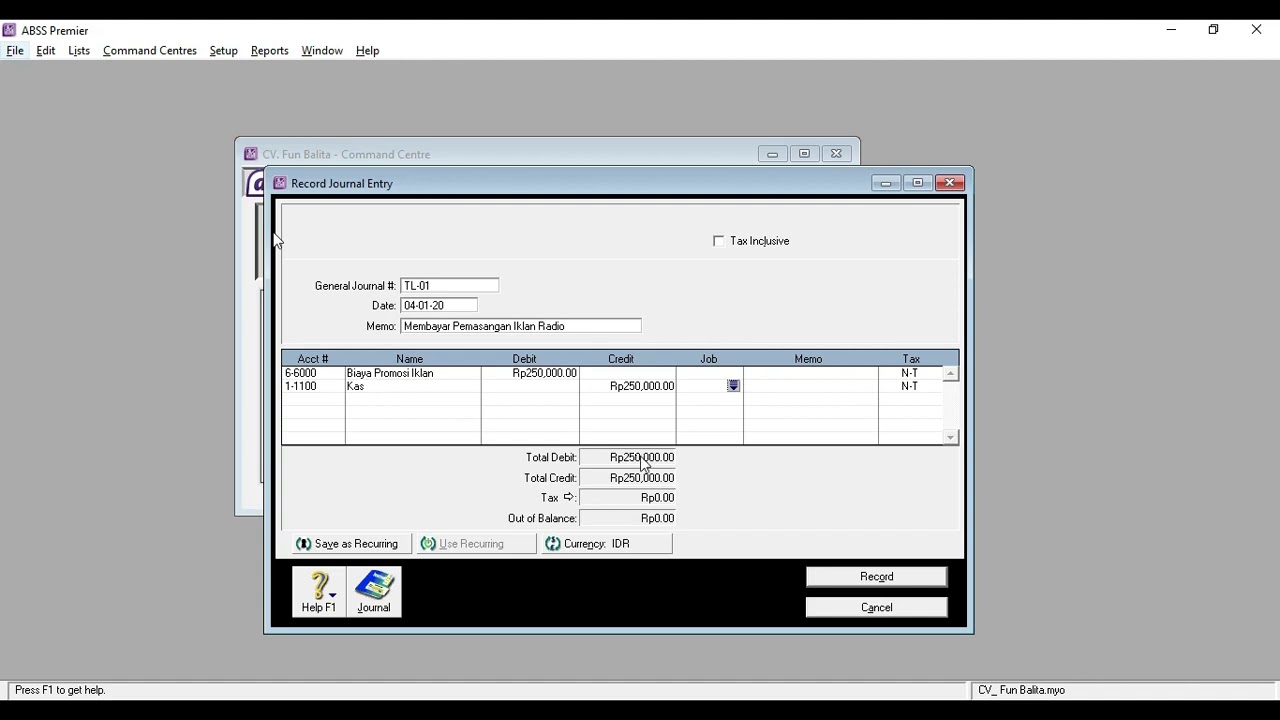

028 Aplikasi Komputer Akuntansi II (ABSS) Pertemuan 3 (Part3)

Bagaimana Cara Input Kas Masuk & Keluar di IPOS Laundry?? Cek Caranya di Sini! #laundry #tutorial

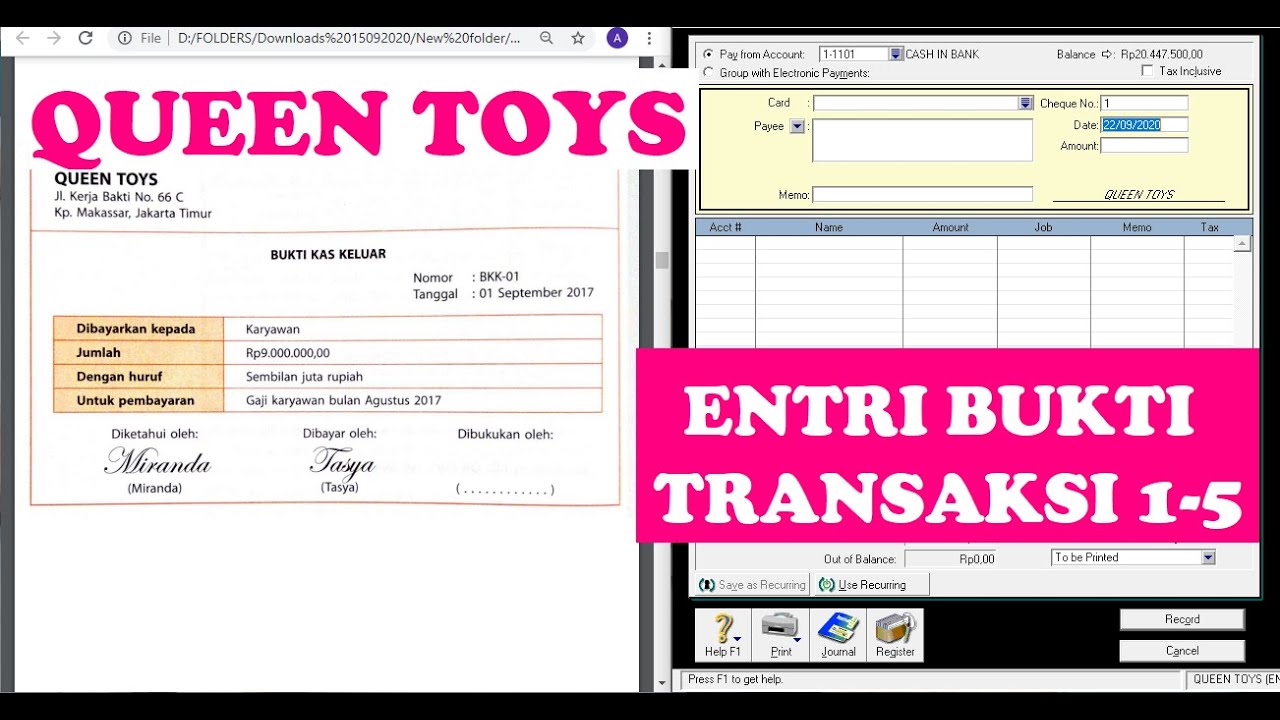

(9-QT) MENGENTRI BUKTI TRANSAKSI 1-5 | MYOB Accounting Plus V18 ED (Queen Toys)

BELAJAR ACCURATE ONLINE 1 - MENYIAPKAN DATA USAHA PERUSAHAAN DENGAN ACCURATE ONLINE

Instalasi GDevelop

Penjelasan Menu-Menu MYOB

5.0 / 5 (0 votes)