New GST Registration Process GST Registration Process 2024 | GST Registration Kaise Kare |

Summary

TLDRThis video provides a step-by-step guide to registering for GST (Goods and Services Tax) in India, highlighting key changes such as mandatory biometric verification in certain states. It covers how to navigate the official GST website, select business categories, and enter personal and business details. The process includes entering a PAN card number, email, and phone number, generating a TRN (Temporary Reference Number), and completing the registration form. The video also explains the importance of address proof, supporting documents, and verification, whether online or through physical verification, ensuring that viewers can easily follow along and complete their GST registration.

Takeaways

- 😀 GST registration process has been updated, and biometric verification is now mandatory in several states and UTs.

- 😀 Visit the official GST website (www.gst.gov.in) to begin the registration process. The registration form is easy to fill if you have all the necessary documents ready.

- 😀 The first step in GST registration is selecting the correct category of business. You need to choose 'Taxpayer' for most types of businesses.

- 😀 You must select the state in which your business is registered. It doesn't matter if you are from another state or if your company has directors or partners from other states.

- 😀 Ensure you provide the legal name of your business as it appears on the PAN card. For individual proprietors, use your own PAN card details.

- 😀 Make sure to enter an active email ID and mobile number for all communications regarding the GST registration.

- 😀 After entering basic details, you will receive an OTP to verify your email and mobile number. Once verified, a Temporary Reference Number (TRN) will be generated.

- 😀 You must complete the GST registration process within 15 days of receiving the TRN. Failure to do so may result in rejection.

- 😀 For business address verification, you need to provide a utility bill (e.g., electricity bill) or property documents like a rent agreement or property tax receipt.

- 😀 If any of the entered information is incorrect, the application may be rejected. Double-check your details and upload the correct supporting documents.

Q & A

What is the new requirement for GST registration in certain states and UTs?

-In certain states and Union Territories (UTs), biometric authentication has been made mandatory for GST registration, which depends on the data associated with the individual's PAN card.

How long does it take to complete the GST registration process if all documents are ready?

-If all the required documents are ready and data is correctly entered, the GST registration process can be completed in less than 5 minutes.

What is the first step in the GST registration process on the official GST website?

-The first step is to visit the official GST website (www.gst.gov.in) and click on the 'Register' option. You will need to select your category, typically 'Taxpayer' for any type of business.

What should be selected after choosing 'Taxpayer' as the category in GST registration?

-After selecting 'Taxpayer', you need to select the state where your business operates, which will be based on your business address.

What is required for the 'Legal Name of Business' section during GST registration?

-You must enter the legal name as per your PAN card. For individual proprietors, the name from the PAN card must be entered, and for other entities like partnerships or companies, the name as per their PAN card should be used.

What happens after you verify the OTP during GST registration?

-Once the OTP is verified, you will receive a Temporary Reference Number (TRN) that is valid for 15 days. You must complete the application within this period.

What is the purpose of entering the 'Trade Name' during GST registration?

-The 'Trade Name' is optional. If not entered, the registration certificate will be issued under the legal name of the individual or entity. If you want to register a specific business name, you must provide it.

Do you need to attach documents for 'Trade Name' in GST registration?

-No, you do not need to attach any documents for the 'Trade Name' during the GST registration process.

What supporting documents are required for the 'Principal Place of Business' section?

-You will need to provide a utility bill (like an electricity bill) as proof of address, or if you do not own the property, you can submit a rental agreement or a consent letter from the property owner, along with the necessary supporting documents.

How is the business address verified in GST registration?

-The address is verified by using a geo-coded system. You will need to locate your address using the postal code, and once identified, you must mark it on the map. Supporting documents like a utility bill or property-related papers must also be uploaded.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

GST Registration | GST Registration Process in Hindi | How to Apply GST Registration

GST Cancellation Process | How to Cancel GST Registration | How to Close Surrender GST Number

How do I add a tax to my business tax account?

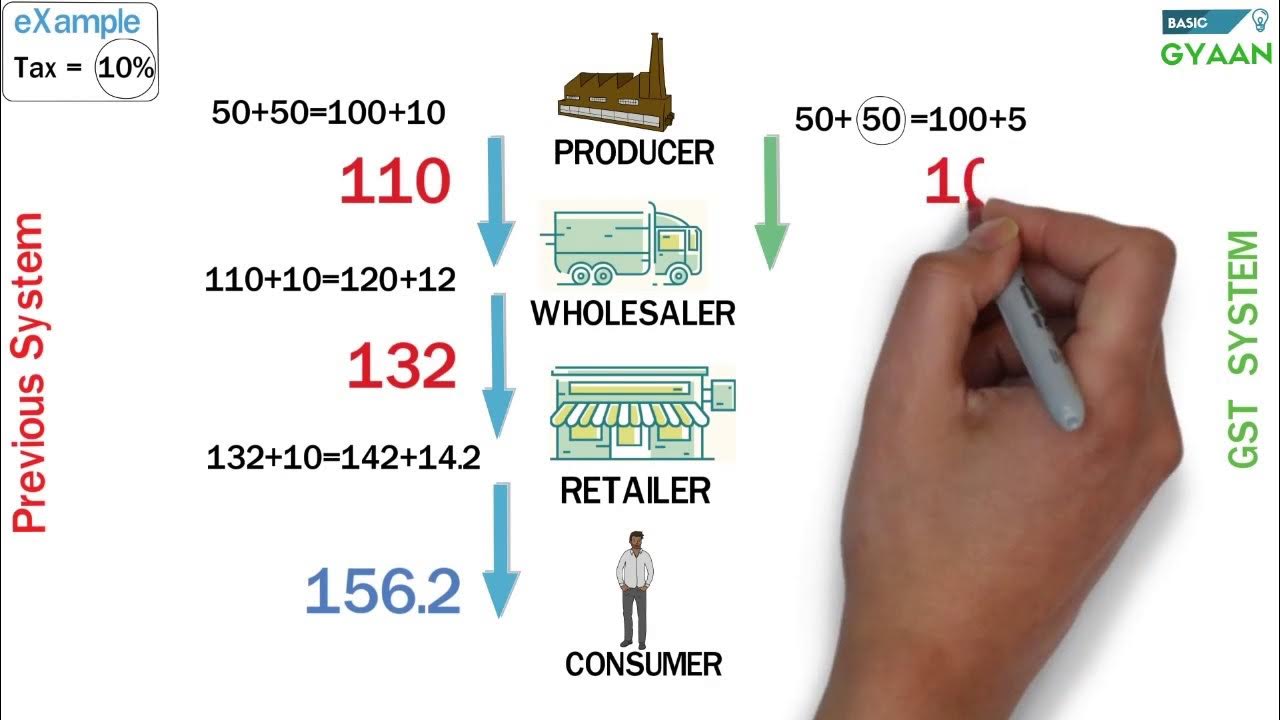

GST Easy Explanation (Hindi)

Goods Transport Agency under GST | What is GTA | Taxability | Exemptions | RCM for GTA | POS

Nirmala Seetharaman Point By Potluri నిర్మలమ్మ నిజంగా వేధిస్తోందా

5.0 / 5 (0 votes)