What is the Neutrality of Money?

Summary

TLDRThe neutrality of money theory asserts that changes in the money supply only affect nominal variables, like wages and prices, without influencing real economic factors such as employment or GDP. This concept, rooted in classical economics and proposed by David Hume, suggests that while nominal variables adjust in the short-term, real variables remain unchanged. Monetarists, however, argue that in the short run, changes in the money supply can impact real variables like employment, but in the long run, the effects of money supply adjustments wear off. The theory emphasizes the distinction between nominal and real economic variables.

Takeaways

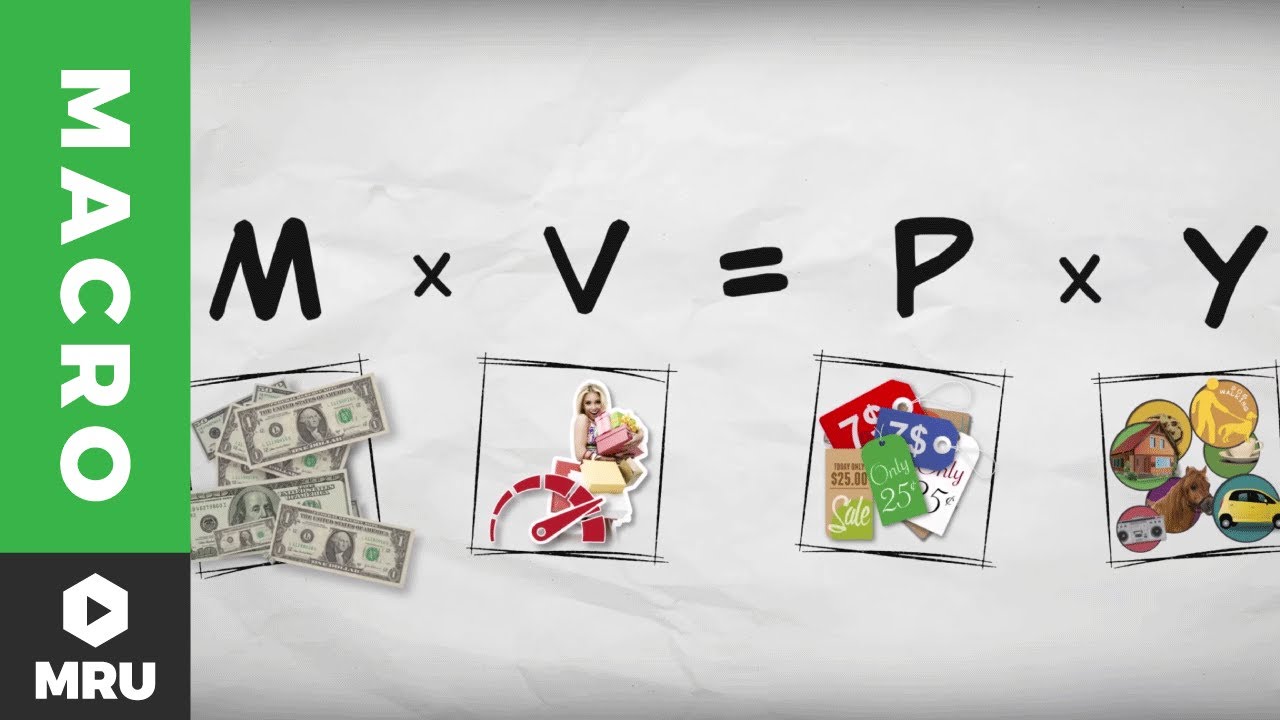

- 😀 The neutrality of money suggests that changes in the money supply only affect nominal variables like prices, wages, and exchange rates, but not real variables such as GDP, employment, and real investment.

- 😀 Real variables are measured at constant prices, accounting for inflation, while nominal variables are measured at current prices and do not account for inflation.

- 😀 According to the neutrality of money theory, real economic variables like interest rates, employment, and consumption remain unaffected by changes in the money supply.

- 😀 Nominal variables, such as prices and wages, rise when the money supply increases, but real economic factors remain unchanged, according to proponents of the neutrality of money.

- 😀 The neutrality of money theory was first proposed by David Hume, a Scottish philosopher and economist, as part of his classical dichotomy between real and nominal variables.

- 😀 Monetarists argue that pure monetary neutrality does not exist in the short run, as changes in the money supply can temporarily affect real variables like employment.

- 😀 In the long run, after the money supply circulates through the economy, the effects of money supply changes on real variables dissipate, and neutrality is restored.

- 😀 The neutrality of money is a core belief of classical economics, but it has been challenged by modern economists who see its effects as more short-term than long-term.

- 😀 Proponents of the neutrality of money believe that monetary policy primarily affects nominal variables and has no lasting effect on real output or employment.

- 😀 The debate between classical economists and monetarists centers on the duration and impact of changes in the money supply on real economic variables.

Q & A

What is the concept of monetary neutrality?

-Monetary neutrality is the idea that changes in the money supply only affect nominal economic variables (like wages, prices, and exchange rates), not real economic variables (such as employment, real consumption, or GDP).

What are nominal and real economic variables?

-Nominal variables are measured at current prices and do not account for inflation, such as wages, prices, and exchange rates. Real variables are adjusted for inflation and are measured at constant prices, such as employment, real consumption, and GDP.

Why is the neutrality of money considered a core belief of classical economics?

-The neutrality of money is a central belief in classical economics because it asserts that changes in the money supply do not impact real economic outcomes, but only influence nominal variables like prices and wages.

Who first proposed the concept of monetary neutrality?

-The concept of monetary neutrality was first proposed by David Hume, a Scottish historian, economist, philosopher, and essayist, in his work on the classical dichotomy.

What is the classical dichotomy?

-The classical dichotomy is the idea that there are two types of economic variables: nominal variables, which are influenced by the money supply, and real variables, which remain unaffected by changes in the money supply.

How do proponents of monetary neutrality view the relationship between money supply and real economic variables?

-Proponents of monetary neutrality believe that changes in the money supply affect only nominal variables (such as wages, prices, and exchange rates), but do not influence real economic variables like output, employment, or real investment.

What do monetarists argue about the neutrality of money in the short run?

-Monetarists argue that in the short run, changes in the money supply can affect real economic variables, such as employment and investment. However, over time, after the money circulates throughout the economy, the neutrality of money is restored.

What role does inflation play in distinguishing nominal and real variables?

-Inflation is what differentiates nominal and real variables. Nominal variables are measured at current prices and do not account for inflation, while real variables are adjusted for inflation to reflect the true value of economic activity.

What happens when a central bank increases the money supply during a recession, according to the neutrality of money theory?

-According to the neutrality of money theory, increasing the money supply during a recession will raise nominal variables like prices and wages, but real variables such as investment, employment, and GDP will remain unchanged.

What do proponents of the neutrality of money believe about the impact of money supply changes on real output and employment?

-Proponents of the neutrality of money believe that changes in the money supply do not affect real output or employment in the long run. They argue that only nominal variables, like prices and wages, are impacted by such changes.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)