Bitcoin: Market Value to Realized Value Z-Score

Summary

TLDRIn this video, the host delves into the Bitcoin Market Value to Realized Value Z-score (MVRV Z-score), a tool used to identify market cycle tops and bottoms. The host explains how the MVRV Z-score has historically helped pinpoint euphoric market phases and potential market bottoms, with examples from past cycles like 2011, 2015, 2018, and 2022. The video also contrasts midcycle tops with true cycle tops, emphasizing the Z-score's role in distinguishing between the two. The host highlights key insights into market cycles and suggests the MVRV Z-score as a valuable metric for navigating Bitcoin’s price action.

Takeaways

- 😀 The MVRV Z-Score is a key metric for identifying Bitcoin market cycle tops and bottoms.

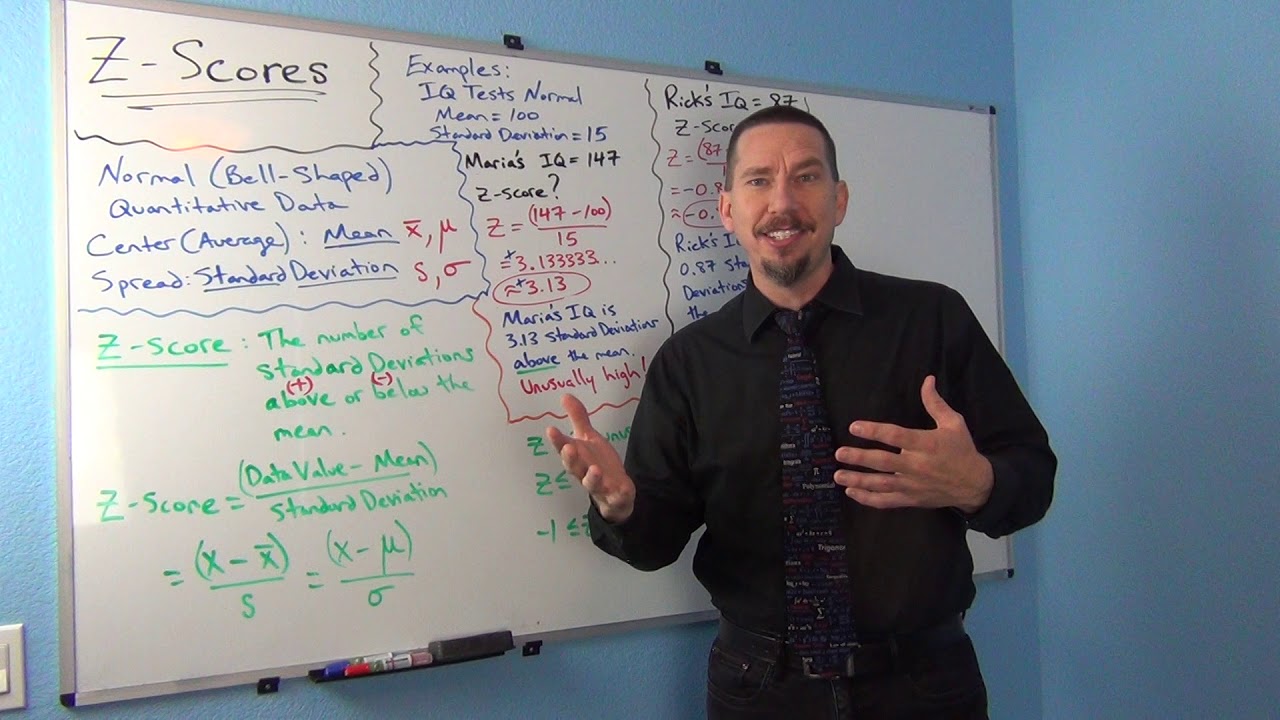

- 😀 The MVRV Z-Score is calculated by subtracting the realized cap from the market cap and dividing by the standard deviation of the market cap.

- 😀 When Bitcoin's market cap falls below the realized cap, it typically signals a market cycle bottom, as seen in 2011, 2015, 2018, and 2022.

- 😀 A low MVRV Z-Score below zero is historically a strong indicator of market cycle bottoms.

- 😀 The MVRV Z-Score can also help identify euphoric market phases, with scores above 7 indicating possible market tops.

- 😀 In 2019, the MVRV Z-Score reached around 2.67, signaling a mid-cycle top rather than a full market cycle top.

- 😀 In 2021, the MVRV Z-Score peaked at 7, which was a warning signal of an overheated market and a potential top.

- 😀 The MVRV Z-Score's role is crucial in distinguishing between temporary market highs and actual market cycle tops.

- 😀 The MVRV Z-Score reached 3 in March 2024, suggesting a mid-cycle top, not the ultimate market peak.

- 😀 Understanding the MVRV Z-Score can provide additional insights when navigating Bitcoin market cycles and improve decision-making for investors.

Q & A

What is the MVRV Z-Score and how is it calculated?

-The MVRV Z-Score is a metric that compares Bitcoin's market cap to its realized cap. It is calculated by subtracting the realized cap from the market cap, then dividing by the standard deviation of the market cap.

How can the MVRV Z-Score help identify market bottoms?

-The MVRV Z-Score can identify market bottoms by showing when Bitcoin's market cap falls below its realized cap. Historically, this has often marked the start of a market cycle bottom, as seen in 2011, 2015, 2018, and 2022.

Why is the MVRV Z-Score useful in identifying euphoric market tops?

-The MVRV Z-Score spikes during periods of market euphoria. A high Z-Score indicates an overheated market, suggesting that the market may be at or near a peak, as seen in the 2021 rally when the score reached 7.

What does an MVRV Z-Score below zero indicate?

-An MVRV Z-Score below zero generally indicates that Bitcoin is undervalued and could signal a market bottom. It suggests that the market capitalization is lower than the realized cap, historically marking an opportunity to buy at a low.

How does the MVRV Z-Score help distinguish between mid-cycle tops and market cycle tops?

-The MVRV Z-Score helps differentiate mid-cycle tops from cycle peaks by showing lower values during mid-cycle tops. For instance, in March 2024, the score reached 3.29, indicating an overheated market but not the ultimate top, as true market cycle tops are typically above 7.

How did the MVRV Z-Score behave during past market cycles?

-In previous cycles, the MVRV Z-Score reached notable highs and lows. For example, during the 2011, 2015, 2018, and 2022 bottoms, the score dropped below zero. In 2019, a mid-cycle top was marked by a score of 2.67, while the 2021 top saw the score rise to 7.

Why was the March 2024 market top considered a mid-cycle top rather than a full cycle top?

-The March 2024 top was considered a mid-cycle top because the MVRV Z-Score only reached 3.29, much lower than the typical 7-10 range seen in market cycle tops. This suggested that the market was overheated but not yet at a true cycle peak.

What other factors should be considered alongside the MVRV Z-Score for market analysis?

-While the MVRV Z-Score is a helpful tool, it should be used alongside other factors, particularly price action. Price movements provide the ultimate confirmation of market trends, as the Z-Score alone may not fully capture market dynamics.

How can the MVRV Z-Score be used in real-time trading decisions?

-In real-time trading, the MVRV Z-Score can help identify potential buy or sell signals. A Z-Score below zero could suggest a buying opportunity, while a high score might warn of an overheated market, indicating potential selling or caution.

Why is understanding Bitcoin's market cycle important for investors?

-Understanding Bitcoin's market cycle helps investors make informed decisions about when to enter or exit the market. By recognizing the signals provided by the MVRV Z-Score, investors can potentially capitalize on market bottoms and avoid buying during euphoric tops.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)