BREAKING: Trump to End "Double Taxation" of US Expats? 🇺🇸

Summary

TLDRThis video explores the complexities of U.S. citizenship-based taxation, particularly for Americans living abroad. It examines potential changes in tax laws, including exemptions and tax treaties that might reduce tax burdens for expatriates. Key issues discussed include the U.S. exit tax, the possibility of increased exemptions, and how tax residency in certain countries may impact U.S. tax obligations. The video emphasizes the importance of planning ahead for those considering leaving the U.S. and the likelihood that full abandonment of citizenship-based taxation remains unlikely. Viewers are encouraged to consider their financial future when planning to move abroad.

Takeaways

- 😀 Boris Johnson renounced his U.S. citizenship after facing tax issues related to property sales in both the U.S. and the UK, highlighting the complications of dual taxation.

- 😀 U.S. citizenship-based taxation means citizens are taxed on worldwide income, even when living abroad, which can lead to significant tax burdens.

- 😀 Tax-friendly residency options, such as those in Malta, may reduce taxes for U.S. citizens living abroad, but exemptions for certain capital gains (e.g., Bitcoin) may still be unclear.

- 😀 U.S. tax treaties may offer some relief, but moving to a new country doesn’t automatically exempt citizens from U.S. taxation.

- 😀 The U.S. may introduce changes to the exit tax system, possibly triggering the tax when individuals move abroad rather than when they renounce citizenship.

- 😀 Strategic planning is essential for U.S. citizens looking to reduce tax burdens while living abroad, involving residency and tax treaty knowledge.

- 😀 Even under a potential change in U.S. tax laws, it’s unlikely that the U.S. will fully abandon its citizenship-based taxation system.

- 😀 U.S. citizens might be able to benefit from exemptions or exclusions based on their country of residence, but these benefits vary depending on the country and specific tax treaties.

- 😀 The speaker suggests that long-term planning to minimize exit tax obligations should involve getting out of the U.S. sooner rather than later if possible.

- 😀 The U.S. taxation system may encourage Americans to secure second passports or make moves to tax-friendly countries as part of a proactive tax strategy.

- 😀 There is frustration with the principle of U.S. taxation, where citizens are penalized for leaving the country, even if they don’t owe significant taxes while abroad.

Q & A

What is U.S. citizenship-based taxation and how does it impact American citizens living abroad?

-U.S. citizenship-based taxation means that U.S. citizens are taxed on their global income, regardless of where they live. This can affect American citizens living abroad, as they may be subject to both U.S. taxes and taxes from the country they reside in. However, they can sometimes reduce their U.S. tax burden through credits, exemptions, and tax treaties.

How can U.S. citizens living abroad reduce their tax burden?

-U.S. citizens living abroad can reduce their tax burden by utilizing provisions like the Foreign Earned Income Exclusion (FEIE), foreign tax credits, and tax treaties. These options can help minimize the double taxation they might face from both the U.S. and the foreign country where they live.

What is the Foreign Earned Income Exclusion (FEIE) and how does it work?

-The Foreign Earned Income Exclusion (FEIE) allows U.S. citizens who meet certain residency requirements to exclude a certain amount of their foreign-earned income from U.S. taxation. This can be an important tool for reducing the tax burden for those living abroad.

Why is Boris Johnson mentioned in this discussion?

-Boris Johnson is mentioned because he renounced his U.S. citizenship after facing taxation on a property sale in London. He was born in New York, and the U.S. taxes its citizens on worldwide income, including capital gains, even if the property is in another country.

What is an 'exit tax' and how could it affect U.S. citizens moving abroad?

-An 'exit tax' is a tax that may be imposed when a U.S. citizen renounces their citizenship or gives up their permanent resident status. It is calculated based on the unrealized gains of assets owned at the time of departure. This could be a significant financial hurdle for U.S. citizens considering renunciation.

Could the U.S. change how it handles the exit tax in the future?

-Yes, there is a possibility that the U.S. could adjust the exit tax rules. The U.S. might trigger the tax when someone departs the country rather than when they renounce their citizenship. This could make it harder to leave without incurring a tax liability.

How does the U.S. tax system differ from countries that don't impose citizenship-based taxation?

-Countries that don't impose citizenship-based taxation generally only tax individuals based on their residency. This means that if a person moves abroad, they may no longer be subject to the country's taxes. In contrast, the U.S. taxes its citizens no matter where they reside, which leads to the potential for double taxation unless exclusions or credits are applied.

What role do tax treaties play for U.S. citizens living abroad?

-Tax treaties are agreements between countries that can help prevent double taxation. These treaties often allow U.S. citizens to reduce or eliminate taxes on certain types of income, such as dividends or pension payments, that might otherwise be taxed both by the U.S. and the foreign country.

Is it advisable for U.S. citizens to wait for future tax reforms before leaving the country?

-It may not be advisable to wait for future tax reforms, as the U.S. is unlikely to completely abandon citizenship-based taxation. U.S. citizens should plan ahead, including considering tax implications and potential exit taxes, and think about relocating to tax-friendly countries where they can reduce their overall tax burden.

What is the main philosophical argument the speaker makes against U.S. citizenship-based taxation?

-The speaker argues that while the financial burden of U.S. citizenship-based taxation may not always be excessive, the principle of being penalized for leaving the U.S. is offensive. The speaker emphasizes that life is about principles, not just numbers, and views the U.S. government's attitude toward citizens leaving as unfair.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Vowel Sounds

For Oom Piet - Poem Analysis

Decoding Intel's Confusing Processor Names: Core i3, i5, i7, i9 Explained!

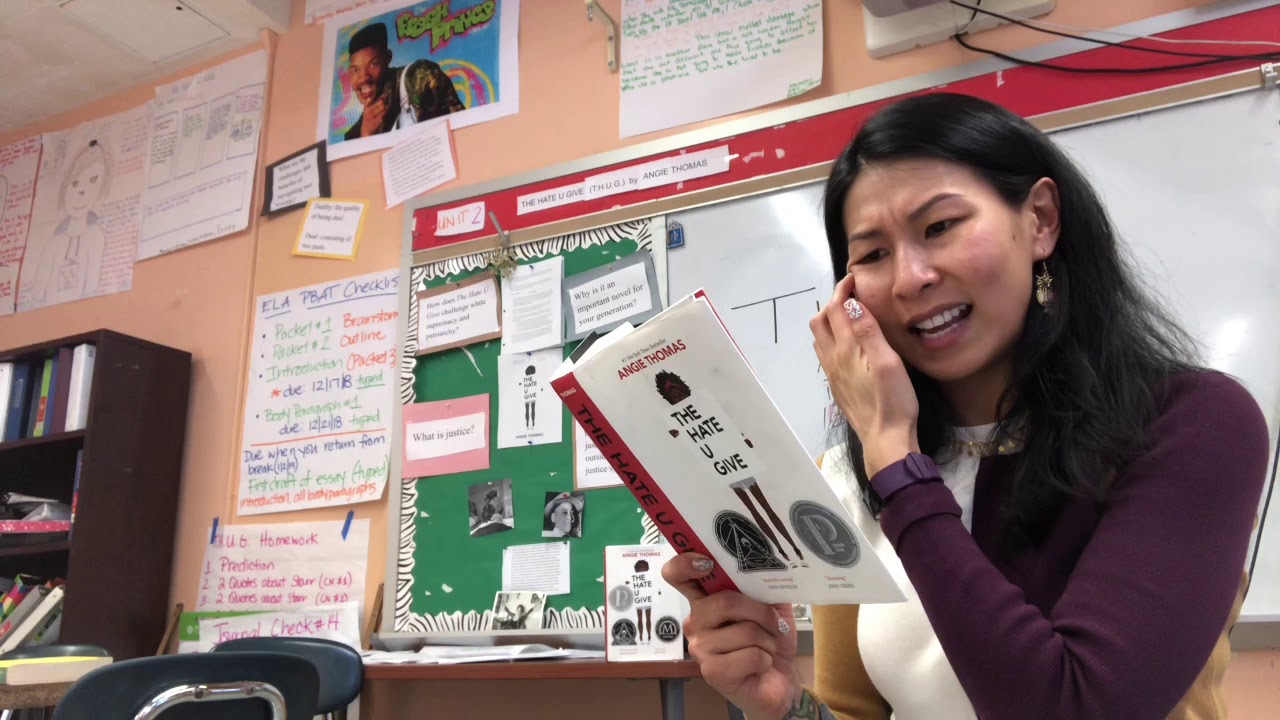

The Hate U Give Chapter 1 - Read by Ms. Nisa

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

5.0 / 5 (0 votes)