Myob : UD. Buana || Memorial Evidence & Financial Statements || Parts. 6

Summary

TLDRThis transcript provides a detailed walkthrough of the process for preparing financial statements, from recording initial journal entries to making necessary adjustments for interest income, expenses, and depreciation. It covers key adjustments like inventory valuation, bad debt estimations, and corporate income tax, explaining how to properly record them in journals. The script also outlines how to prepare and save the final financial reports, including the profit and loss statement, balance sheet, and cash flow statement. The video aims to help users understand the steps involved in completing and finalizing financial reports for a business.

Takeaways

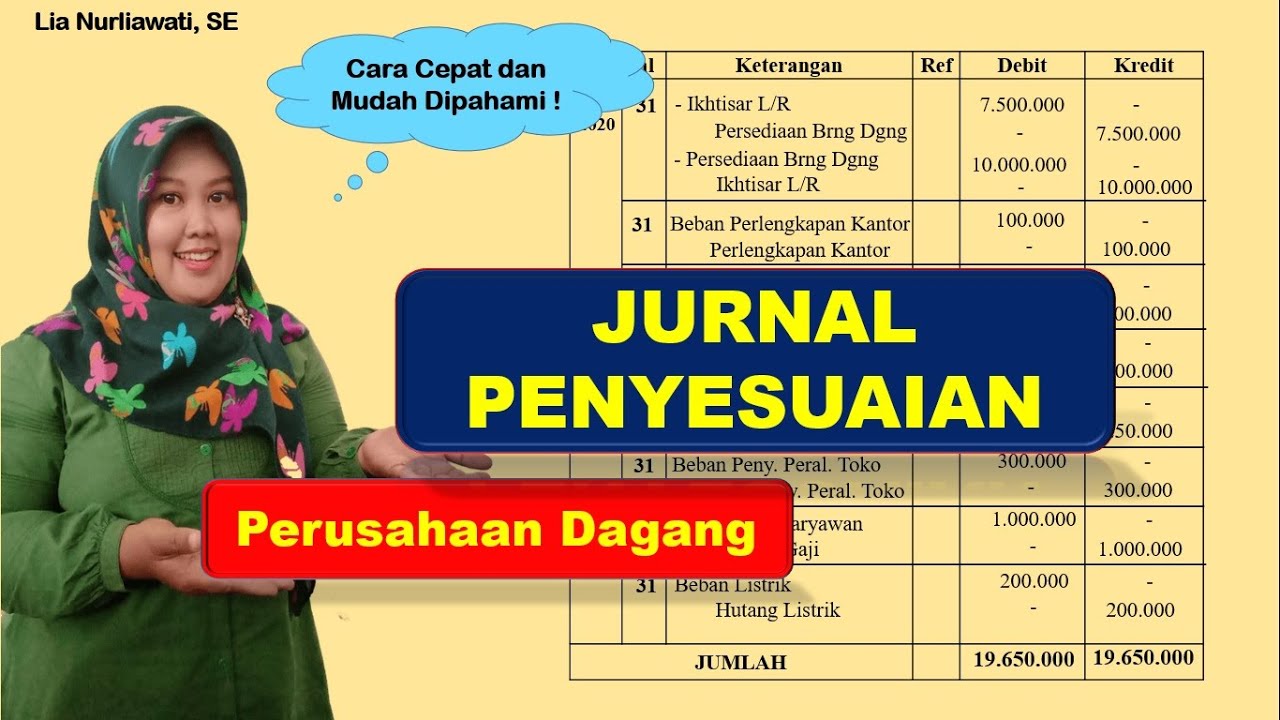

- 😀 Journal entries are crucial in financial statement preparation, such as recording interest income, rental expenses, and depreciation.

- 😀 It is important to adjust inventory values by accounting for the ending inventory to ensure accurate financial reporting.

- 😀 Rental expenses need to be recorded on a monthly basis, such as the 2,550,000 rental cost for December.

- 😀 Insurance expenses for the month, like the 1,250,000 for December, should also be included in the journal entries for the period.

- 😀 Bad debt expense is calculated by multiplying the receivables balance by a fixed percentage (e.g., 5%) to estimate uncollectible amounts.

- 😀 Depreciation expenses should be recorded, such as the 1,250,000 depreciation for equipment in December, to reflect the asset's reduced value.

- 😀 Salaries that will be paid in the following period (e.g., 3,500,000 salary in January) should be accounted for as liabilities in the current period.

- 😀 Utility costs, like electricity and telephone expenses, should be recorded in the month incurred (e.g., 2,200,000 in December).

- 😀 VAT income and receivables need to be closed and journaled as per standard tax invoices to ensure correct tax accounting.

- 😀 Corporate income tax should be calculated based on the company's gross income, and adjustments for the tax liability should be made accordingly.

- 😀 Financial reports, including the Profit and Loss Statement, Balance Sheet, and Cash Flow Statement, must be accurately prepared and saved in PDF format for final submission.

Q & A

What is the first step in the process of preparing financial statements?

-The first step is to recognize the adjustments that need to be made, which is the final stage before preparing the financial reports. These adjustments include various transactions and expenses that were not yet recorded.

What type of transactions are included in the journal entries for adjustments?

-The transactions include interest income from bank statements, rent and insurance expenses, depreciation on equipment, estimated loss on receivables (bad debt), and VAT adjustments, among others.

How is interest income recorded in the financial statement adjustments?

-Interest income is recorded as a journal entry where the debit goes to the bank, and the credit goes to interest income, reflecting the earned interest from the bank account.

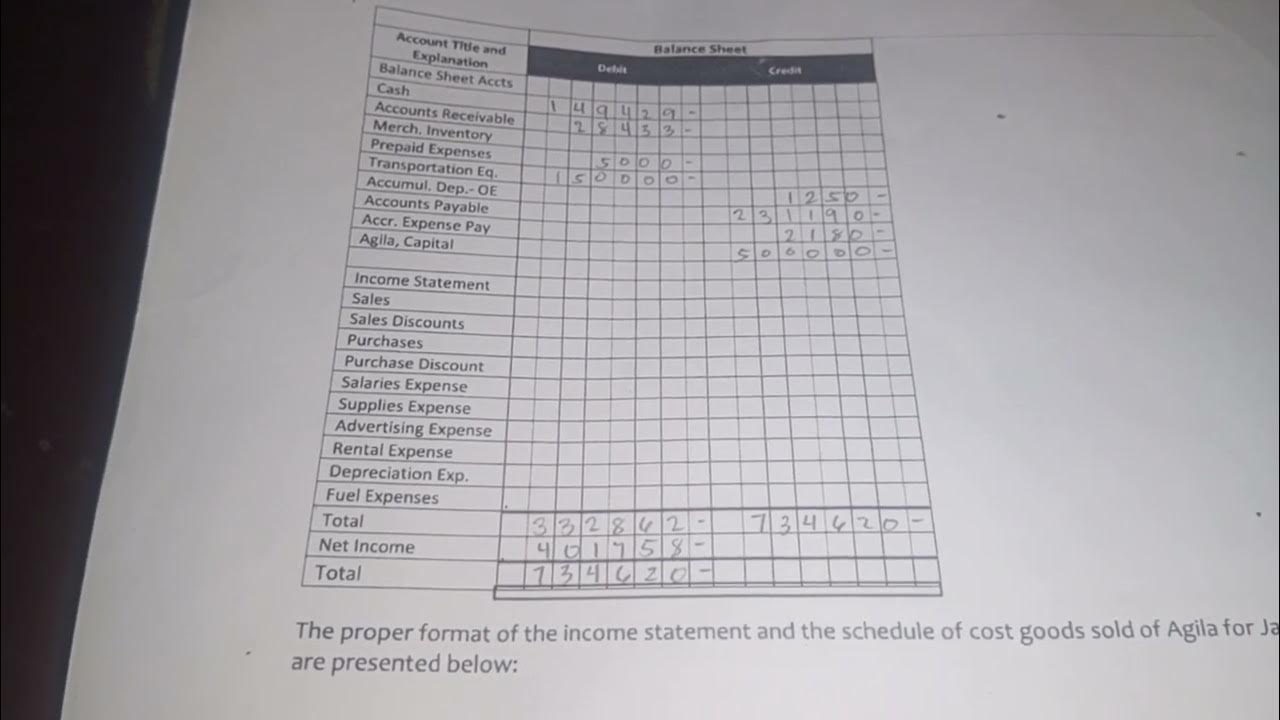

What is the method used to adjust for ending inventory in the financial statements?

-Ending inventory is adjusted by first determining its value, then making a journal entry to reflect the store inventory and its value in the balance sheet. The value of the inventory is subtracted from the total to calculate the remaining balance.

How is bad debt expense calculated and recorded?

-Bad debt expense is calculated by applying a percentage (typically 5%) to the balance of receivables. The estimated value is then adjusted by reducing the allowance for losses on receivables, and a journal entry is made for the adjusted value.

How is the depreciation of equipment accounted for in the journal entries?

-Depreciation is recorded by debiting depreciation expense and crediting accumulated depreciation for the amount specified (e.g., 1,250,000), which reflects the wear and tear of equipment over the period.

What are the steps to record the rent expense for December?

-To record the rent expense, the journal entry involves debiting rental expense and crediting prepaid rent. The value of the expense is provided (e.g., 2,500,000) and is based on the rental agreement.

What is the process for recording VAT income and VAT payable?

-The VAT income and VAT payable are recorded by closing the accounts and transferring the balance to the appropriate VAT project. VAT income is credited, and VAT payable is debited as per the standard tax invoices.

How is corporate income tax recorded for December in the financial adjustments?

-Corporate income tax is recorded based on a percentage of the gross circulation for December. The tax amount is calculated and then recorded as income tax expense, with the corresponding credit to income tax payable.

What is the final step after making all the necessary adjustments?

-The final step is to prepare the financial reports, which include the profit and loss statement, balance sheet, and cash flow statement. These reports are then saved in PDF format and filed appropriately.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)