WACC (Weighted Average Cost of Capital) Formula and Definition | Learn With Finance Strategists

Summary

TLDRThe video explains the concept of Weighted Average Cost of Capital (WACC), detailing how it represents the average financing cost for a company, which includes both debt and equity. It discusses the calculation of WACC using a formula that incorporates the costs associated with each financing source, emphasizing its role as a discount rate for future cash flows and its comparison with the Return on Invested Capital (ROIC). A higher WACC than ROIC signals a potential issue for investors, prompting companies to consider adjustments to their capital structure or risk profiles to improve financial performance.

Takeaways

- 😀 WACC (Weighted Average Cost of Capital) reflects the calculated cost of a company's financing.

- 😀 Companies typically have a capital structure that includes both debt (e.g., bonds) and equity (e.g., common stock).

- 😀 Each source of financing has associated costs, which are weighted in WACC calculations according to their proportion in the capital structure.

- 😀 For example, a company with 50% debt and 50% equity will calculate its WACC based on the average costs of both sources.

- 😀 The formula for WACC includes the cost of equity and the cost of debt, adjusted for the corporate tax rate.

- 😀 The cost of equity can be estimated using models like the Capital Asset Pricing Model (CAPM) or the Dividend Capitalization Model.

- 😀 The total cost of debt accounts for the stated interest rate and the tax benefits from tax-deductible interest payments.

- 😀 WACC is often used as a discount rate for valuing future cash flows and is the required return for new investments.

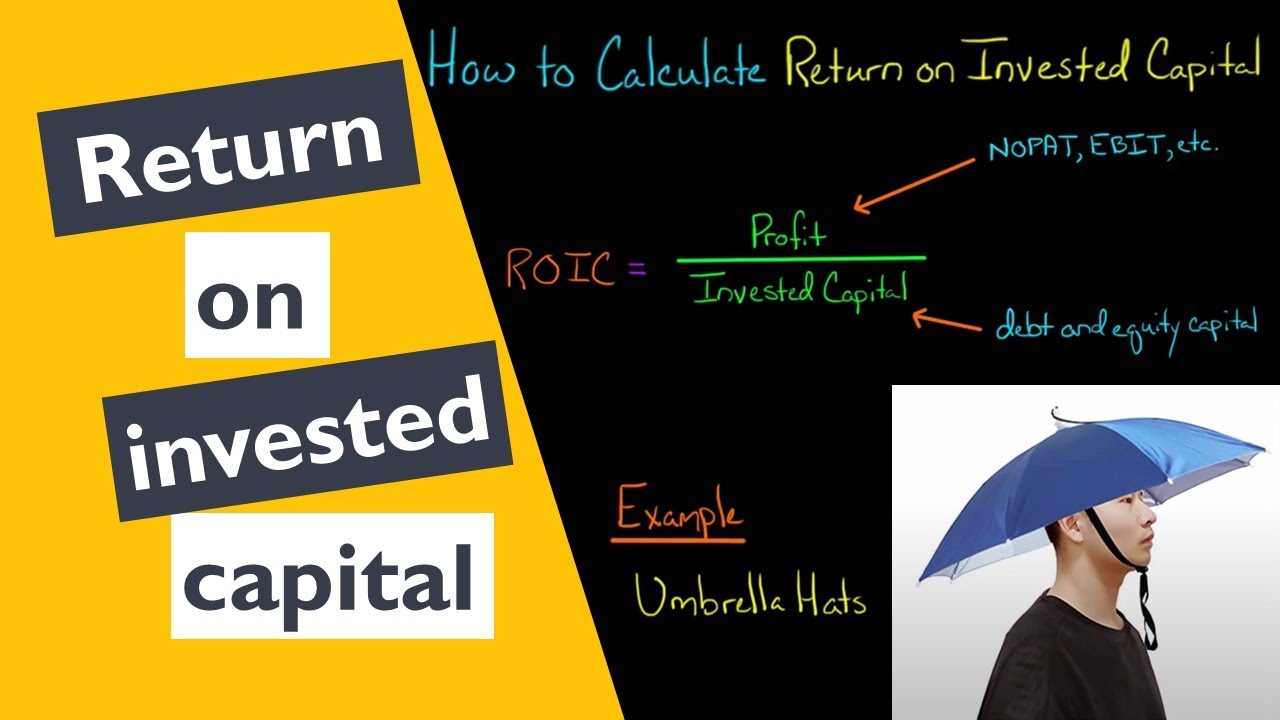

- 😀 A higher WACC compared to Return on Invested Capital (ROIC) indicates that a company's cost of capital exceeds its return on that capital.

- 😀 Companies with a high WACC may consider strategies to lower their equity costs or alter their capital structure to improve financial performance.

Q & A

What is the Weighted Average Cost of Capital (WACC)?

-WACC is the calculated cost of a company’s financing, reflecting the average rate that a company is expected to pay to finance its assets.

How is WACC calculated?

-WACC is calculated by weighting each source of capital proportionately to its percentage of the total capital structure and multiplying by the associated costs.

What components make up a company’s capital structure?

-A company’s capital structure typically includes a mix of debt (like bonds) and equity (such as common stock).

What is an example of a company's capital structure?

-For example, Half & Half has a capital structure of 50% debt and 50% equity.

What are the costs associated with debt and equity?

-The average cost of debt is the interest rate on bonds, while the cost of equity can be estimated using the Capital Asset Pricing Model or Dividend Capitalization Model.

How does tax impact the cost of debt?

-The total cost of debt is reduced by the tax benefit derived from interest payments being tax-deductible.

What role does WACC play in investment decisions?

-WACC is often used as the discount rate for calculating the value of future cash flows and serves as the required return for investing in new projects.

What does a WACC higher than the Return on Invested Capital (ROIC) indicate?

-A WACC higher than ROIC suggests that the cost of capital exceeds the return on that capital, which can be a warning sign for investors.

What actions can a company take if its WACC is too high?

-A company may lower its cost of equity, alter its capital structure to include more debt, or renegotiate existing debt to reduce WACC.

Why is WACC referred to as the 'hurdle rate'?

-WACC is considered the 'hurdle rate' because it represents the minimum return that a company must earn on its investments to satisfy its capital providers.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

MK2 MATERI 02 COST OF CAPITAL

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

Presupuesto de Capital

Decisões de financiamento e investimento

How to Calculate Return on Invested Capital

Financial Modeling Quick Lessons: Building a Discounted Cash Flow (DCF) Model (Part 2) [UPDATED]

5.0 / 5 (0 votes)