PENJELASAN MUDAH!!!! SIKLUS AKUNTANSI PERUSAHAAN DAGANG BAGIAN 1 (KELAS 12)

Summary

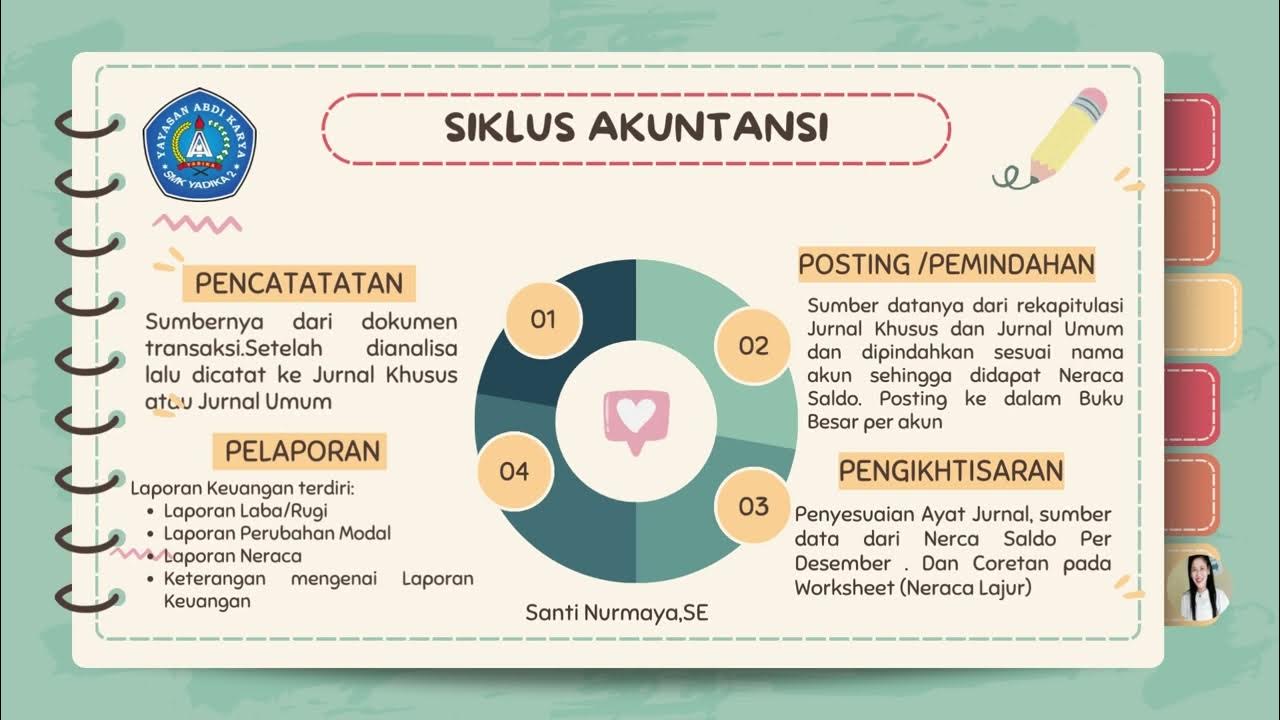

TLDRThis video discusses the accounting cycle for trading companies, focusing on three key areas: recording, summarizing, and reporting. It explains the difference between trading and service companies, highlighting the key activities of a trading company such as purchasing, selling, and handling inventory. The speaker outlines important concepts like cost of goods sold, profit margins, and inventory management, and provides an overview of trading company accounts. These include purchase and sales accounts, inventory, and specific expenses like marketing and administrative costs. The video is an introduction to accounting principles for trading businesses.

Takeaways

- 📚 The topic is about the accounting cycle for trading companies, focused on semester 2 material.

- 🛒 Trading companies operate between producers and consumers, buying and selling goods without further processing.

- 💸 There are four main activities in trading companies: purchasing goods, spending money, selling goods, and receiving money.

- 🏪 Unlike service companies, trading companies focus on the purchase and sale of goods for profit.

- 📈 Profit in trading companies comes from the difference between the cost price and the selling price of goods.

- 📊 Key characteristics of trading companies include purchasing goods for resale, earning revenue from sales, and classifying unsold goods as inventory under current assets.

- 📂 There are various types of accounts in trading companies, including purchase, sales, inventory, and cost of goods sold accounts.

- 🧾 Special accounts like sales returns, purchase returns, and sales discounts track adjustments and discounts related to transactions.

- 📢 Marketing expenses include a range of costs such as staff salaries, advertising, and depreciation on marketing assets.

- 🏢 Administrative and general expenses encompass operating costs like staff salaries, legal fees, and utility bills for administrative operations.

Q & A

What is the primary topic of this video?

-The video covers the accounting cycle for trading companies, including recording, summarizing, and reporting processes.

What are the four main activities of a trading company discussed in the video?

-The four main activities of a trading company are purchasing goods, spending money, selling goods, and receiving money.

How does a trading company differ from a service company in terms of transactions?

-The key difference is in purchasing and selling goods, which only occurs in trading companies and not in service companies.

What is the main goal of a trading company according to the video?

-The goal of a trading company is to earn a profit by buying goods from suppliers and selling them to customers without processing them.

How is profit calculated in a trading company?

-Profit is calculated as the difference between the cost of goods sold and the selling price of the goods.

What are the six characteristics of a trading company?

-The six characteristics are: 1) buying goods to sell, 2) selling goods without processing them, 3) earning revenue through buying and selling, 4) setting the cost of goods sold as the price of purchased goods, 5) unsold goods are considered inventory and part of current assets, and 6) the goods sold are tangible.

What is the role of inventory in a trading company?

-Inventory refers to goods that have not been sold and is considered a current asset because it can be quickly converted into cash.

What is the 'cost of goods sold' in the context of a trading company?

-The cost of goods sold refers to the original purchase price of the goods bought by the company.

What is an 'account for sales returns' used for?

-The account for sales returns is used to track items that were sold but then returned by the customer due to issues such as receiving the wrong quantity or defective goods.

What are some examples of marketing expenses in a trading company?

-Marketing expenses include salaries of sales staff, commissions for salespeople, advertising costs, telephone and electricity expenses for the marketing office, and depreciation of marketing vehicles.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

"CARA MUDAH MEMAHAMI SIKLUS AKUNTANSI PERUSAHAAN DAGANG "

2 Konsep Dasar Akuntansi Keuangan 1

86.Overviu PMK 212/2019 tentang Jurnal Akuntansi Pemerintah Pusat

MGT101_Topic004

Akuntansi Sebagai Sistem Informasi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

5.0 / 5 (0 votes)