Dividendos - EP186 Excluir Empresas em 10 Passos

Summary

TLDRThis video script offers a 10-step guide for investors to quickly assess a company's quality before investing. It emphasizes long-term revenue growth, revenue diversification, healthy profit margins, efficient capital use, strong financial position, sufficient short-term debt coverage, positive free cash flow, shareholder dilution awareness, competitive advantage, and industry understanding. The script also discusses recent economic news, including bank fines for price-fixing, China's economic struggles, US interest rate cuts, and their potential impacts on the market.

Takeaways

- 📈 Invest in companies with a history of long-term revenue growth, ideally showing an annual increase of at least 5%.

- 🌐 Ensure revenue diversification by understanding the variety of a company's revenue sources across products, markets, or regions.

- 💰 Look for healthy profit margins, with a good rule of thumb being a gross margin over 40% and a net profit margin over 10%.

- 🔑 Focus on capital efficiency by examining Return on Invested Capital (ROIC), aiming for companies that can grow revenue and optimize business models.

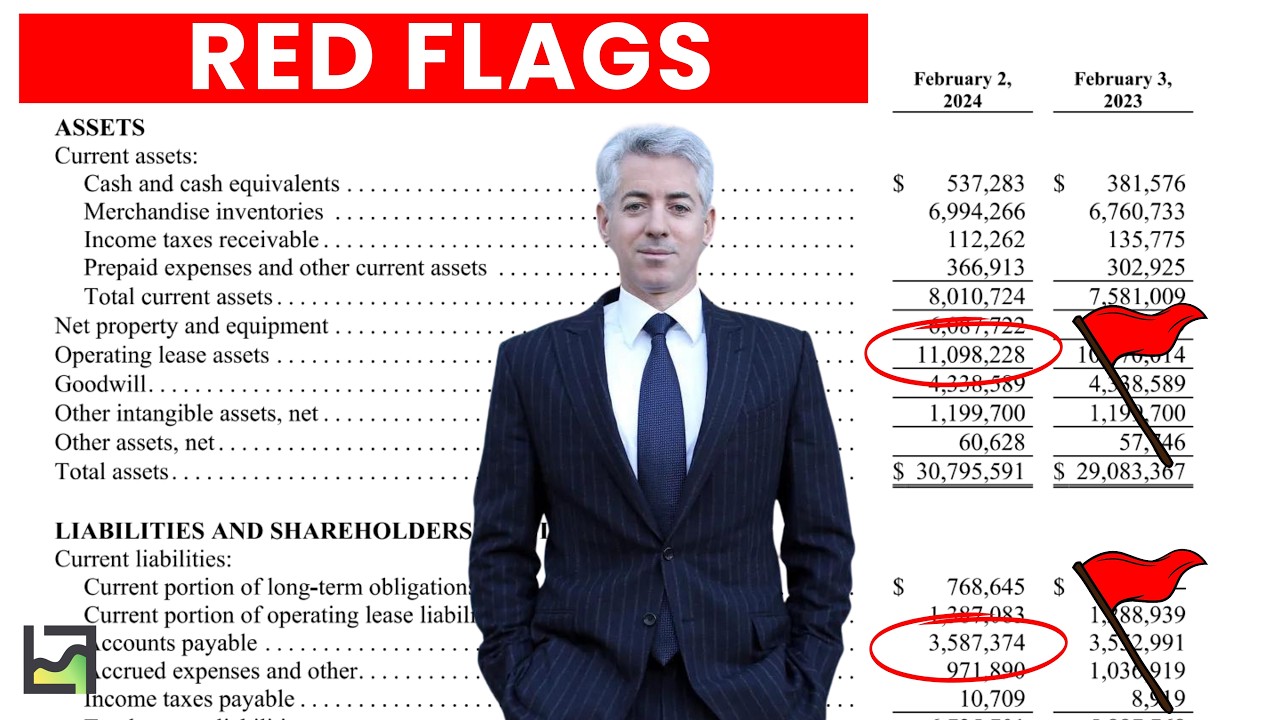

- 💼 Check the financial strength by assessing leverage, with a net debt to EBITA ratio ideally not exceeding three times.

- 💵 Ensure the company can cover its interest expenses with operating profits, aiming for a multiple of at least four times.

- 🚀 Prioritize companies with positive and increasing free cash flow, which indicates the ability to fund growth and return value to shareholders.

- 📉 Be wary of shareholder dilution from excessive stock-based compensation and focus on companies that manage this effectively.

- 🆚 Compare the company's financials and performance metrics with industry peers to understand its competitive advantage.

- 🏭 Understand the industry dynamics affecting the company to make informed decisions about potential risks and opportunities.

Q & A

What is the first step in evaluating a company's quality for investment mentioned in the script?

-The first step is to look at the company's revenue growth history with a focus on the long term, aiming to invest in companies that can increase their sales annually.

What is considered an acceptable annual revenue growth rate for a company?

-An acceptable annual revenue growth rate is at least 5%, with values above 10% being excellent.

Why is revenue diversification important when analyzing a company?

-Revenue diversification is important because companies with multiple revenue sources are less vulnerable to shocks in a single market or economy, providing protection against risks.

What do healthy profit margins indicate about a company?

-Healthy profit margins, both gross and net, indicate that a company is generally more efficient and has better control over its costs.

What is the significance of Return on Invested Capital (ROIC) in evaluating a company?

-ROIC indicates the ability of a business to generate more value for its shareholders and is a measure of the efficiency at which a company can grow its revenue and optimize its business model.

How does a company's balance sheet strength reflect its financial health?

-A strong financial position with low debt relative to equity and high liquidity indicates that a company can withstand economic difficulties with relative ease.

What is the significance of short-term interest coverage ratio in a company's financial health?

-The short-term interest coverage ratio, measured by operating profits to interest expenses, should be at least four times. Anything below this indicates a potentially unsustainable situation.

Why is free cash flow important for a company?

-Free cash flow is the money a company has left after all operational and capital expenses. A company with positive and increasing free cash flow can finance its own growth and pay dividends or repurchase shares, returning value to shareholders.

How does stock-based compensation affect a company's free cash flow?

-Stock-based compensation can dilute existing shareholders and inflate free cash flow figures, making them appear better than they actually are. Ideally, this expense should not exceed about 5% of revenue.

What is the importance of understanding the industry a company operates in when evaluating it?

-Understanding the industry is crucial because it provides context for the numbers and helps anticipate how external forces can affect the company's performance. Without this understanding, investors might react impulsively to market events without fully grasping the reasons behind them.

What recent economic challenges has China been facing that could present investment opportunities?

-China has been facing economic difficulties, particularly in the luxury segment, leading to negative ratings for several companies. However, this situation is not permanent, and it could present temporary investment opportunities for those who believe in the eventual recovery of the Chinese market.

What was the Federal Reserve's recent action regarding interest rates, and what does it imply for the markets?

-The Federal Reserve cut interest rates for the first time since 2020 to near 0%. This is seen as a positive sign for assets like stocks because it lowers the risk-free rate of return, causing valuations to rise. However, the reason for the rate cut is concern over the labor market and potential recession, which could affect all asset classes.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

5.0 / 5 (0 votes)