Why M&A deals are difficult in today's market

Summary

TLDRAccording to a recent KPMG survey, two-thirds of M&A decision-makers expect more deals in 2024 compared to 2023. However, Cameron Ansari, a venture partner, highlights the challenges, including regulatory hurdles, lengthy deal timelines, and antitrust risks. He suggests that the corporate M&A route has become less desirable, with private equity buyers capitalizing on public market opportunities. While the IPO market is expected to pick up, Ansari believes the tech M&A market will remain slow, with big tech companies hesitant due to antitrust concerns. In fintech and e-commerce sectors, he sees B2B payments as an underserved and promising area for investment.

Takeaways

- 😊 According to a recent KPMG survey, two-thirds of M&A decision makers expect more deals in 2024 compared to 2023.

- 😕 There are still some challenges to overcome for M&A activity to pick up, such as regulatory hurdles and lengthy approval processes.

- 🌐 Companies often have to go through multiple regulatory bodies across different countries for M&A deals, making the process complex and unpredictable.

- ⌛ The lengthy timelines for completing M&A deals, sometimes taking years, can discourage companies from pursuing them.

- 🤑 Private equity firms have been actively acquiring public software companies in the $1-$1 billion range due to the challenges with corporate M&A.

- 📉 The IPO market was also slow in 2023, limiting exit options for richly valued private companies.

- 📈 There is optimism for the IPO market to pick up in 2024, potentially allowing companies like Databricks, Arctic Wolf, and Stripe to go public.

- 🐢 M&A activity in the tech sector is expected to remain slow, with major tech companies hesitant to make acquisitions due to antitrust risks.

- 🛒 The B2B payments space in fintech is seen as an attractive area for investment due to its underpenetrated nature.

- 💼 The guest, a venture partner, is actively looking for investment opportunities in the B2B payments sector.

Q & A

What are some of the challenges facing M&A deals according to the guest?

-The guest, Cameron Ansari, mentions that regulatory obstacles, lack of predictability, and the need to go through multiple regulatory bodies in different countries are the biggest challenges facing M&A deals currently.

How has the regulatory environment impacted the M&A landscape?

-The regulatory environment has become more complicated, with companies often needing to go through four to six regulatory bodies, including the DOJ, FTC, UK regulators, EU regulators, and regulators in other countries like China and Saudi Arabia, depending on their operations. This lack of predictability and numerous hurdles have made the M&A route less desirable for many companies.

Why might companies prefer private equity buyers over corporate M&A deals?

-Companies might prefer private equity buyers because corporate M&A deals can take a very long time (12-24 months), lack predictability, and face high risks of not closing. Private equity deals offer a similar return with far less risk in terms of closing.

How has the IPO market been faring, and what impact does this have on potential exits for large privately held companies?

-The IPO market hasn't been very open either, which means that large privately held companies looking for an exit may have to wait longer. However, the guest expects the IPO market to pick up, especially towards the end of the year or in 2025, allowing some of these companies to go public.

What has been the M&A activity among large tech companies like Google, Facebook, and Apple?

-The guest suggests that large tech companies like Google, Facebook, and Apple have been reticent to do deals due to antitrust risks. The only large tech company that has been active in M&A is Amazon, but they have been acquiring non-core assets like MGM Studios and Whole Foods, which are less likely to face antitrust issues.

What sector does the guest find particularly interesting for investment opportunities?

-The guest, as a venture investor, finds the B2B payments space in the fintech sector particularly interesting and underserved. He mentions that there is only one major B2B payments company (Bill.com) at scale, and he is actively looking for companies in this area.

How does the B2B payments market compare to consumer-focused fintech companies?

-The guest notes that while consumer-focused fintech companies like PayPal, Stripe, Square, and Venmo enable consumers to pay businesses or each other, the B2B payments market, which facilitates business-to-business payments, is a much bigger market than all of those consumer-focused companies combined.

What does the guest expect to happen with the IPO market this year?

-The guest expects the IPO market to pick back up, particularly towards the end of the year or in 2025, as the market has been doing better in recent months, inflation has been curbed, and the Federal Reserve is expected to pause or cut interest rates.

How has the M&A activity been in the tech sector compared to previous years?

-According to the guest, M&A activity in the tech sector in 2023 was down about 177% globally to $2.9 trillion from the previous year, 2022. He describes 2023 as a "tough year for M&A" and says that there were very few deals, particularly in the tech sector.

What factors contribute to the guest's optimism about deal-making activity picking up this year?

-The guest expresses optimism about deal-making activity picking up this year due to factors such as the market performing better in recent months, inflation being curbed, expectations of the Federal Reserve pausing or cutting interest rates, and an increase in venture funding and term sheets being offered to companies.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Why it feels like we're in a recession (when we're not) | About That

2024 YILI SON UCUZ OTOMOBİL FIRSATLARI | PAZAR SOHBETİ

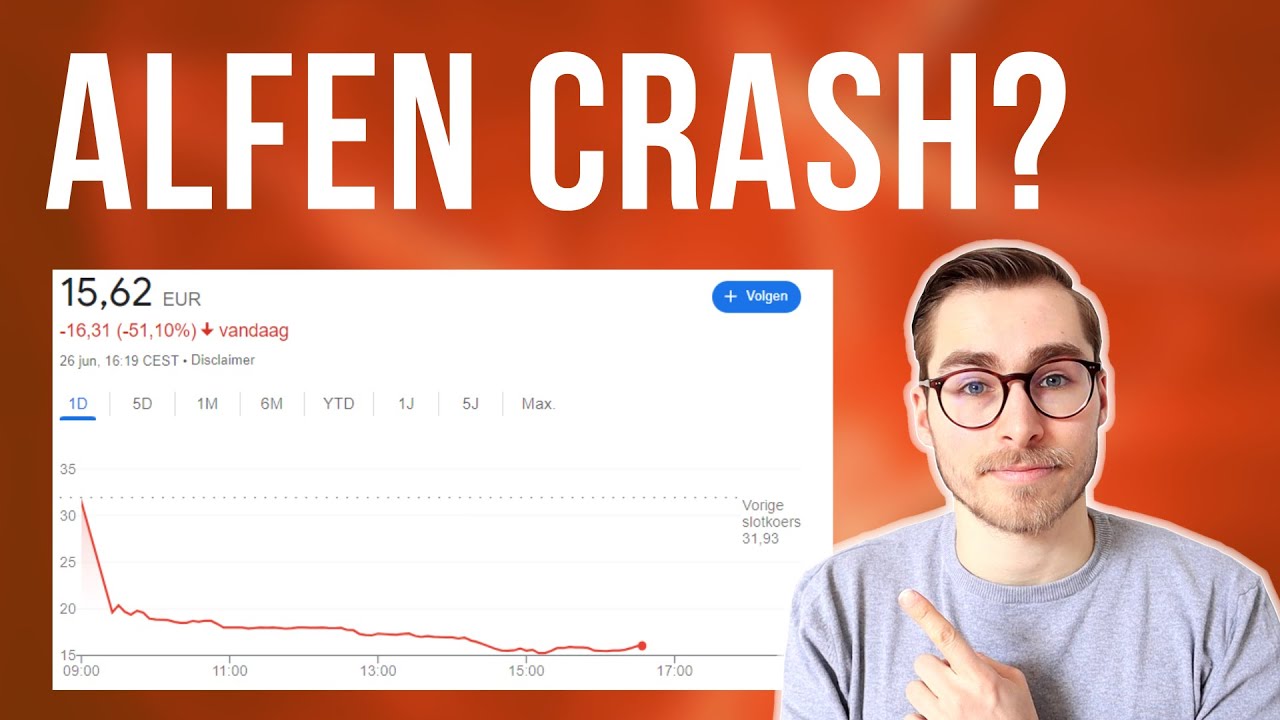

Wat is er aan de hand met ALFEN?

KFC mengalami Kerugian Besar Hingga Tutup Banyak Gerai | OneNews Update

Paslon Tunggal di 43 Daerah, Kemunduruan Demokrasi [Selamat Pagi Indonesia]

Mahindra, Tata, Toyota have Started a PRICE WAR as Buyers are Done Overpaying !!

5.0 / 5 (0 votes)