Journals | Odoo Accounting

Summary

TLDRThis video script offers an insightful guide to the concept of journals in accounting, emphasizing their role in categorizing transactions based on type. It explores five main journals: sales, purchases, bank and cash, and miscellaneous operations, all culminating in a general ledger. The script provides a step-by-step tutorial on configuring journals in an accounting application, highlighting the importance of setting up default accounts, sequences, and activation of the 'log posted entries with hash' feature for immutability. It also addresses the creation of custom journals, such as for salary entries, and discusses strategies for organizing and filtering invoices by region without overcomplicating the journal setup.

Takeaways

- 📚 Journals in accounting are used to categorize transactions based on their type, such as sales, purchases, bank and cash, and miscellaneous operations.

- 🔍 All journal entries eventually consolidate in the general ledger, providing a comprehensive view of all transactions.

- 🛠️ The accounting application may already have existing journals, but users can manually create additional ones as needed.

- 📝 Configuration of journals involves setting up default accounts, credit note sequences, and short codes for easy identification.

- 🔑 For purchase journals, it's important to set a default expense account and a short code to standardize entries.

- 🏦 Bank journals require additional configurations, including a default bank account, which will be covered in a dedicated video.

- 💼 The miscellaneous operations journal also has a dedicated short code for categorizing various types of transactions.

- 🔒 To prevent modification of posted entries, activate the 'log posted entries with hash' feature in the advanced settings.

- 💡 Creating a new journal, such as one for salary entries, involves selecting the appropriate type and assigning a short code for quick reference.

- ✋ The order of journals in the dashboard can be customized by simply dragging and dropping in the list view.

- 🌐 While it's possible to create multiple sales journals for different regions, it's recommended to keep it simple to avoid confusion in assigning the correct journal automatically.

Q & A

What are journals in the context of accounting?

-Journals in accounting are a method to organize and categorize transactions based on their type, such as sales, purchases, bank and cash, and miscellaneous operations.

How do journals help in sorting out transactions?

-Journals help by providing a specific place to record transactions of a similar nature, which simplifies the process of tracking and analyzing financial activities.

What is the purpose of a general ledger in accounting?

-The general ledger is a comprehensive record that compiles all journal entries from various journals, providing a single source to view all financial transactions.

How can I configure a journal in an accounting application?

-You can configure a journal by accessing the accounting dashboard, selecting the journal, and using the configuration options available, such as setting up a default account, sequence, and short code.

What is a purchase journal and what configurations does it require?

-A purchase journal records transactions related to vendor bills. It requires configurations such as a default expense account, credit note sequence, and a short code.

What is the significance of a short code in a journal?

-A short code in a journal provides a quick and easy way to identify and reference specific journal entries, streamlining the process of recording and reviewing transactions.

Why is it important to activate the 'log posted entries with hash' feature in the advanced settings of a journal?

-Activating this feature prevents users from modifying or resetting to draft any posted entries, ensuring the integrity and finality of the recorded transactions.

What is the role of a bank journal in accounting?

-A bank journal is used to record all transactions related to the company's bank accounts, including payments and receipts, and requires specific configurations such as a default bank account.

How can I create a new journal for specific types of transactions, like salary entries?

-You can create a new journal by specifying the type of transactions it will handle, such as 'salary entries', choosing the appropriate journal type like 'miscellaneous', and assigning a short code for easy reference.

Can I create different sales journals based on the region of the sales?

-While you can create multiple journals, it's not recommended for sales and purchase journals due to the automatic selection process in the application. Instead, using sales teams as a filter for regional sales can be a better solution.

How can I change the order of journals presented in the accounting dashboard?

-You can change the order by dragging and dropping the journals in the list view within the dashboard, allowing you to prioritize the journals as needed.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Akuntansi Dasar | Pengantar Akuntansi | Tutor Aja

Cara Menyusun Jurnal Penyesuaian

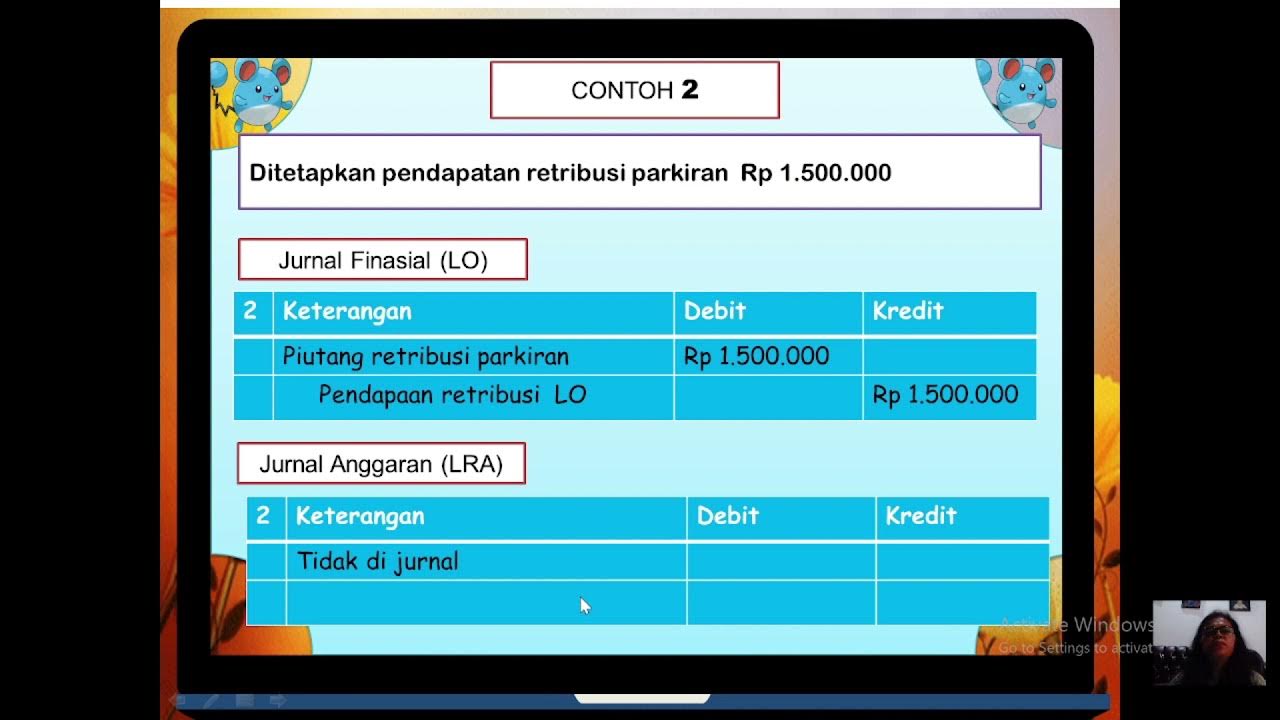

JURNAL SKPD AKUNTANSI PEMERINTAHAN

Bookkeeping Basics for Small Business Owners

Lesson 031 - Accounting for Merchandising Operations 5: Special Journals and Subsidiary Ledgers

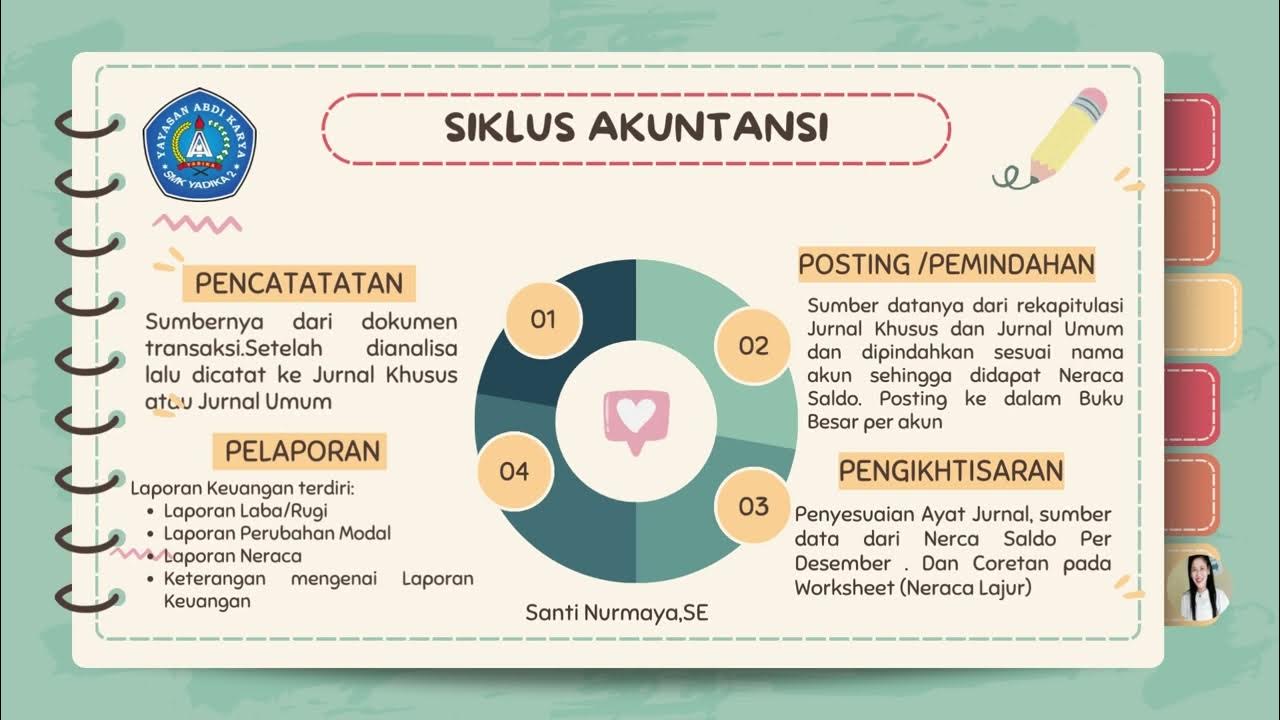

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

5.0 / 5 (0 votes)