Apa itu PBV? | Price to Book Value

Summary

TLDRThis script explores the concept of Price to Book Value (PBV) to determine if a stock is overvalued or undervalued. It explains how to calculate PBV using a company's equity and total shares, and compares PBV ratios across different companies and historical data to make informed investment decisions.

Takeaways

- 😀 The script discusses the concept of Price to Book Value (PBV) to determine if a stock is cheap or expensive.

- 📈 To calculate PBV, you need to know the market price of the stock and its book value, which is derived from the company's net equity divided by the total number of shares.

- 💼 The book value represents the intrinsic value or the net asset value per share of a company.

- 🏦 The script uses the example of a 'bakso' company (BASO) to illustrate how to calculate PBV and determine if the stock is overvalued or undervalued.

- 🔍 To assess a stock's value, you should compare its PBV with its historical PBV and with PBVs of similar companies in the same industry.

- 📊 A PBV greater than 1 indicates that the stock might be overvalued, while a PBV less than 1 suggests that it might be undervalued.

- 🏢 The script provides a detailed example of how to calculate PBV for Antam, a mining company, using its net equity and total outstanding shares.

- 📈 The script suggests that a high PBV compared to historical averages or industry averages can indicate that a stock is expensive.

- 🏦 The script also discusses the PBVs of major Indonesian banks, comparing them to illustrate which might be overvalued or undervalued.

- 🤔 The script emphasizes that while PBV is a useful ratio, it should be combined with other financial ratios and company fundamentals to make a comprehensive investment decision.

- 📚 The script encourages viewers to learn about stocks and financial ratios to make informed investment decisions, rather than relying solely on the advice of others.

Q & A

What is the significance of the stock price alone in determining whether a stock is cheap or expensive?

-The stock price alone is not sufficient to determine if a stock is cheap or expensive. It's necessary to also consider the intrinsic value of the stock, which is its book value or the value of the equity per share.

What is the intrinsic value of a stock in the context of the script?

-The intrinsic value of a stock, also known as the book value, is the actual value of the equity per share. It is calculated by dividing the total equity of the company by the total number of shares issued.

How is the Price to Book Value (PBV) ratio calculated?

-The PBV ratio is calculated by dividing the market price of a stock by its book value. It helps in determining if a stock is overvalued or undervalued.

What does a PBV ratio greater than 1 indicate about a stock?

-A PBV ratio greater than 1 indicates that the stock is overvalued, meaning the market price is higher than its intrinsic value.

What does a PBV ratio less than 1 indicate about a stock?

-A PBV ratio less than 1 indicates that the stock is undervalued, meaning the market price is lower than its intrinsic value, potentially making it a good investment.

How can you compare the PBV ratio of a company over time?

-You can compare the PBV ratio of a company over time by calculating its PBV for different years and observing the trend. This can help in understanding if the stock is currently overvalued or undervalued compared to its historical valuation.

How can you compare the PBV ratio of a company with its industry peers?

-You can compare the PBV ratio of a company with its industry peers by calculating the PBV of similar companies and finding the average. This helps in understanding if the company is overvalued or undervalued relative to its competitors.

What is the significance of comparing PBV ratios across different companies in the same industry?

-Comparing PBV ratios across different companies in the same industry can provide insights into which companies are overvalued or undervalued relative to their peers, which can be a useful tool for investment decisions.

Why is it important to consider other financial ratios besides PBV when evaluating a stock?

-While PBV is a useful metric, it's important to consider other financial ratios such as Return on Equity (ROE) to get a comprehensive understanding of a company's financial health and profitability. This helps in making a more informed investment decision.

How can a beginner in stock investing benefit from understanding the PBV ratio?

-A beginner in stock investing can benefit from understanding the PBV ratio as it provides a simple yet effective way to evaluate whether a stock is overvalued or undervalued. This can help in making more informed investment decisions and avoiding overpriced stocks.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Cara Mencari Saham Salah Harga seperti Lo Kheng Hong (PBV & PER)

Tips Menilai Harga Wajar Saham | feat. Rivan Kurniawan

PE Ratio Explained (With Examples)

CARA NGITUNG NILAI SAHAM | #GhibahinSaham eps 4

Stock Multiples: How to Tell When a Stock is Cheap/Expensive

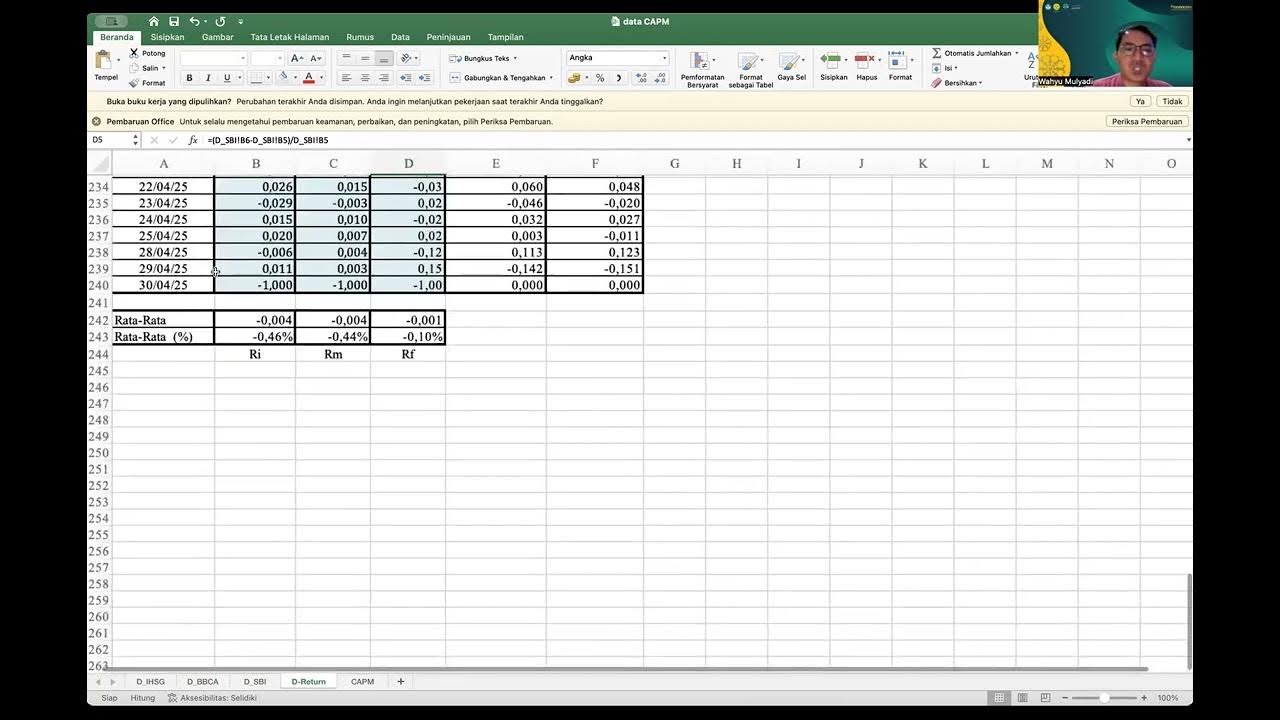

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

5.0 / 5 (0 votes)