Truck Capacity Might Start Falling Off A Cliff in 2025

Summary

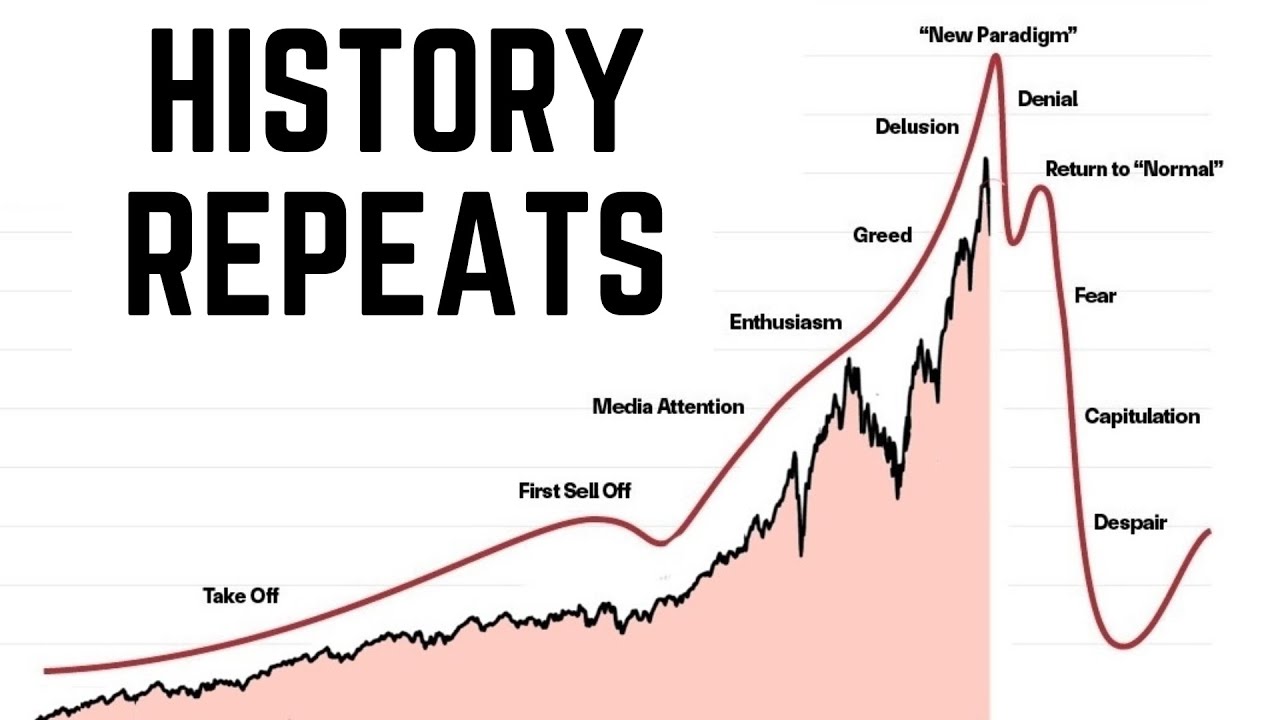

TLDRThis video explores the slow market recovery in the trucking industry, challenging the historical 12-month downturn cycle. The script delves into the unexpected persistence of truck capacity despite low rates, attributing it to the influx of SBA loans during the pandemic, which provided a financial buffer allowing carriers to stay afloat despite reduced income. The video also discusses the potential long-term impacts, including the looming repayment of these loans and the challenges of equipment depreciation, suggesting that the industry may face further difficulties as the need to replace aging trucks arises.

Takeaways

- 🛑 The market hasn't recovered as expected despite the typical 12-month downturn cycle.

- 🚛 There's an oversupply of trucks compared to available freight, keeping rates low.

- 💡 Many thought lower rates and higher operating costs would force small fleets out of the market.

- 📰 According to Freight Waves, rates bottomed in May 2023 at $1.49 per mile, rising slightly to $1.60 per mile a year later.

- 📉 Theories suggest carriers saved up during the COVID boom or brokers increased market share, but these don't fully explain the situation.

- 💵 The Small Business Administration (SBA) loans provided a significant financial cushion for many carriers.

- 📊 Over $37 billion was lent to the transportation and warehousing sector via SBA loans.

- 💸 The average loan was around $88,200, allowing carriers to survive longer despite low rates.

- 📅 The SBA COVID loan program ended in early 2022, but repayments are starting to become due.

- 🔧 Aging equipment and high maintenance costs pose a future challenge for carriers who relied on SBA loans.

Q & A

Why is the market recovering slower than expected after a downturn?

-The market is recovering slower due to an oversupply of trucks compared to the available freight, which has persisted longer than anticipated, keeping rates low.

What was the average rate per mile for trucking in May 2020 according to FreightWaves?

-The average rate per mile excluding fuel was $1.49 in May 2020.

What was the expectation for the trucking market after rates fell below carrier operating costs?

-The expectation was that small fleets and owner-operators would be forced out of the market, leading to a contraction in trucking capacity and a restoration of supply-demand balance, causing rates to rise.

Why did carriers continue to operate even after rates fell and operating costs increased?

-Carriers continued to operate longer than expected, possibly due to financial reserves from the COVID-19 boom or increased accessibility of freight through brokers.

What role did the Small Business Administration (SBA) play in supporting trucking companies during the pandemic?

-The SBA provided long-dated business loans at very low interest rates to alleviate economic injury to small businesses, including those in the transportation and warehousing sector.

How much money was injected into the economy by the SBA's pandemic relief program?

-Over $390 billion was injected into the economy through the SBA's program.

What was the average loan amount provided by the SBA to the transportation and warehousing sector?

-The average loan amount was $88,200.

How did the SBA loans impact the ability of trucking companies to survive despite low rates and increased costs?

-The loans provided financial support that allowed companies to continue operating even when their income was significantly reduced, effectively delaying the market contraction.

What is the estimated total cost of trucking in the United States annually?

-Trucking costs in the United States total about $800 billion annually.

What is the potential consequence for small fleets and owner-operators who relied on SBA loans to stay afloat?

-They may not be able to afford to replace their aging equipment as the depreciation horizon approaches, which could lead to further market challenges.

What policy proposal was considered by the Biden Administration regarding delinquent COVID loans, and what was the outcome?

-The Biden Administration considered a policy proposal to not pursue collection on delinquent COVID loans less than $100,000, but it was objected by the Inspector General of the Treasury Department, and in May 2024, the SBA decided to begin referring delinquent loans for collection.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

We are at the Precipice of a Major Turning Point for US Stocks…

What’s The Worst Case Scenario For Bitcoin Right Now?

The Accelerated Bitcoin Cycle - Everything You Need To Know

Predictions for the tech job market

BREAKING: Michael Saylor Predicts $13 Million Per Bitcoin

The Next 26 Days Will Make Millionaires in 2025 (Here's How)

5.0 / 5 (0 votes)