Liquidity Concepts Simplified | BASIC TO ADVANCE | 30 Years of ICT

Summary

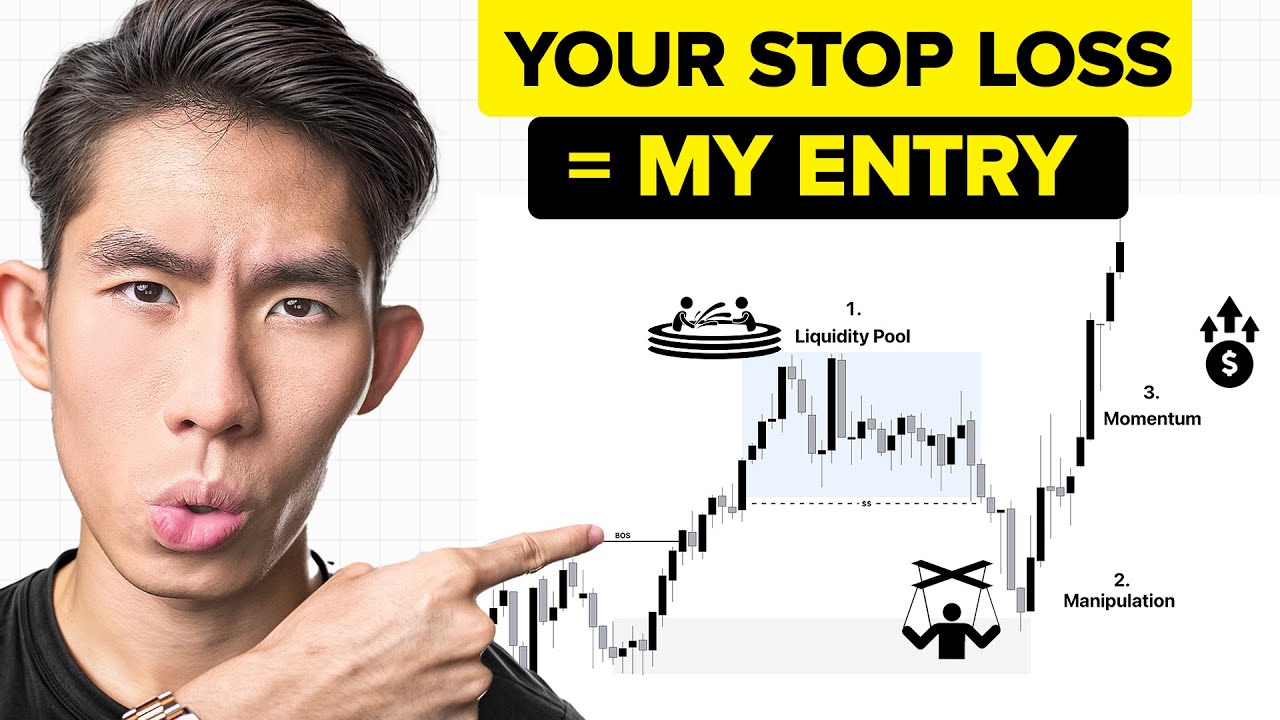

TLDRThis video script delves into the concept of liquidity in trading markets, essential for market operations. It explains how buy and sell orders are executed, the role of market makers, and the impact of liquidity on market movements. The script discusses various types of liquidity, including internal and external range liquidity, and how they influence market trends and volatility. It also covers the importance of recognizing liquidity traps and market manipulation to make informed trading decisions.

Takeaways

- 📈 The concept of 'Liquidity' is fundamental to market operations, as it is the basis upon which the market functions.

- 🔄 The necessity of a buyer and seller for every transaction is highlighted, emphasizing the importance of liquidity for executing orders.

- 🛑 The script discusses 'No Liquidity' errors, which occur when there are no sellers in the market to match a buyer's order, causing the order not to execute.

- 💡 Market manipulation is a strategy used when there is insufficient liquidity to execute trades, where traders can influence the market to create the necessary conditions for their orders to be executed.

- 📊 Retail traders are mentioned as they use trend lines to identify market patterns and potential entry and exit points for trades.

- 🚀 The idea of 'Stop Loss is also a Sell Order' is introduced, explaining that when a stop loss is triggered, it becomes a sell order contributing to market liquidity.

- 🔄 The market's movement from external to internal liquidity and vice versa is explained, showing how the market absorbs and releases liquidity at different price levels.

- 🌐 'Time-Based Liquidity' is discussed, focusing on how market liquidity can shift based on the trading sessions of different geographical markets.

- 📉 The concept of 'Fake Liquidity' is introduced, where the market structure shifts, leading to liquidity traps that can catch out traders.

- 📋 The script covers various types of liquidity, including structural, internal range, external range, equal highs, and lows, and trendline liquidity, providing a comprehensive overview of liquidity in trading.

Q & A

What is the main concept discussed in the video?

-The main concept discussed in the video is 'Liquidity', which is one of the most important concepts in the market.

Why is every buyer in the market in need of a seller and vice versa?

-In the market, every buyer needs a seller to execute their buy order, and every seller needs a buyer to execute their sell order to facilitate the trade.

What does the term 'Not in Liquidity to Execute Your Order' imply?

-This term implies that there are not enough sellers in the market to match the buy orders, or vice versa, which prevents the order from being executed.

What is meant by 'market manipulation' in the context of the video?

-In the context of the video, market manipulation refers to the act of artificially influencing the supply and demand for an asset in the market to create liquidity and execute trades that are otherwise not possible.

What is the significance of 'retailers' in the market as per the video?

-Retailers in the market are significant as they follow trends and set up their buy positions based on market movements, which can influence the market dynamics.

What is the role of 'stop loss' orders in the market according to the video?

-Stop loss orders play a crucial role in the market as they are used by traders to limit their potential losses by automatically selling when the market reaches a certain price.

What is the difference between 'Internal Range Liquidity' and 'External Range Liquidity' as discussed in the video?

-Internal Range Liquidity refers to the liquidity within the current trading range, while External Range Liquidity refers to the liquidity outside of the current trading range, such as at old highs and lows.

Why is 'Fair Value Gap' important in the context of liquidity?

-Fair Value Gap is important because it represents the difference between the current market price and the value at which the market is expected to trade, influencing the direction of the market movement.

What is the concept of 'Time Based Liquidity' mentioned in the video?

-Time Based Liquidity refers to the liquidity that is influenced by the time of day or specific trading sessions, which can affect market volatility and trading opportunities.

How does the video explain the impact of 'Breakout' on the market?

-The video explains that a breakout can significantly impact the market by causing a rapid movement in price as traders react to the market surpassing a key resistance or support level.

What is the significance of 'Volume' in determining the liquidity of a market?

-Volume is significant in determining the liquidity of a market because higher trading volume indicates more participants in the market, leading to greater liquidity and potential for price movement.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

How to KNOW where price will ALWAYS go - DOL simplified!

Boot Camp Day 10: Liquidity Pt. 2

I Decoded The Liquidity & Manipulation Algorithm In Day Trading

How Smart Money Manipulate YOUR Trades….(leaked video)

Understanding Market Makers || Optiver Realized Volatility Kaggle Challenge

1 Internal, External Range Liquidity & Catalysts for Pullback

5.0 / 5 (0 votes)