P 6 7JN

Summary

TLDRThe video script discusses the importance of registering personal details such as contact numbers and email IDs for mutual fund investments. It emphasizes the high regulatory standards of the Securities and Exchange Board (SEBI) and the need for accurate investor information to ensure compliance. The script also highlights the practice of registering investor details for the past six years and the process of authenticating these details for investment transactions. It assures investors that they retain full control over their investments unless they request changes.

Takeaways

- 📌 Register your contact number and email ID with the General to keep all your ITR filings organized.

- 🔒 Investments in Mutual Funds are highly regulated by SEBI, requiring registered contact and email details for each investor.

- ❗ If a distributor's email ID or contact number is found registered in any investment, SEBI will automatically delete it from the portfolio.

- 🔄 For the past six years, it has been a practice that every investor's email ID and contact number must be registered with their investment.

- 📝 Before making any investment, details such as the investor's email ID, contact number, bank account for investment, and nomination details are authenticated.

- 👤 Post authentication, the default details of the investor will continue to be used for all their investments unless they recommend a change.

- 💼 SEBI guidelines ensure that investment details are strictly followed, maintaining the integrity of the investment process.

- 📧 The importance of having a registered email ID cannot be overstated, as it is crucial for communication and updates regarding investments.

- 📞 Similarly, a registered contact number is essential for reaching out to investors for any necessary communication or verification.

- 🗂️ The script emphasizes the need for accurate and up-to-date investor details to maintain proper records and compliance with regulatory bodies.

- 🛡️ SEBI's strict adherence to investor detail registration serves as a protective measure against fraudulent activities in the investment sector.

Q & A

What is the importance of registering a General's contact number and email ID in ITR filings?

-Registering a General's contact number and email ID in ITR filings is crucial for maintaining a clear line of communication and ensuring that any updates or inquiries regarding the investment can be addressed promptly and accurately.

Why can't we register our email ID and contact number in our investment even if we want to?

-Mutual fund investments are highly regulated by SEBI (Securities and Exchange Board of India) guidelines. Distributors cannot register any email ID or contact number in an investment without proper authorization to maintain regulatory compliance.

What happens if a distributor's email ID or contact number is found registered in an investment?

-If a distributor's email ID or contact number is found registered in an investment without proper authorization, SEBI guidelines mandate that it should be automatically deleted from the portfolio to ensure compliance.

What has been the practice for the last six years regarding investor's email ID and contact number registration?

-For the past six years, the practice has been to ensure that every investor's email ID and contact number are registered in their investment to maintain transparency and facilitate direct communication.

What details are authenticated from the investor during the registration process on the web portal?

-During the registration process, the investor's email ID, contact number, bank account details for investment, and nomination details are authenticated to ensure the accuracy of the investment records.

What control does the investor have over their investment details after registration?

-After registration, the investor has full control over their investment details. If they wish to make any changes, such as updating their contact information or nomination, they can do so through the web portal.

How does the default process work for investment details once an investor is registered?

-Once an investor is registered, the system defaults to using the registered email ID and contact number for all investment-related communications and updates unless the investor requests a change.

What is the role of SEBI guidelines in the registration and management of mutual fund investments?

-SEBI guidelines provide the regulatory framework that governs how mutual fund investments are registered and managed. They ensure that the process is transparent, secure, and in compliance with financial regulations.

What are the consequences of not following SEBI guidelines during the investment registration process?

-Not following SEBI guidelines can lead to penalties, legal actions, and the possible deletion of unauthorized registrations from the investment portfolio.

How can an investor ensure that their investment details are accurate and up-to-date?

-An investor can ensure their investment details are accurate and up-to-date by regularly checking and updating their information through the web portal, and by communicating any changes to the fund house.

What is the significance of nomination in the context of mutual fund investments?

-Nomination is significant in mutual fund investments as it designates a person to receive the investor's assets in the event of their death, ensuring a smooth transfer of assets and adherence to the investor's wishes.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Investment by money maths P 7 JN7

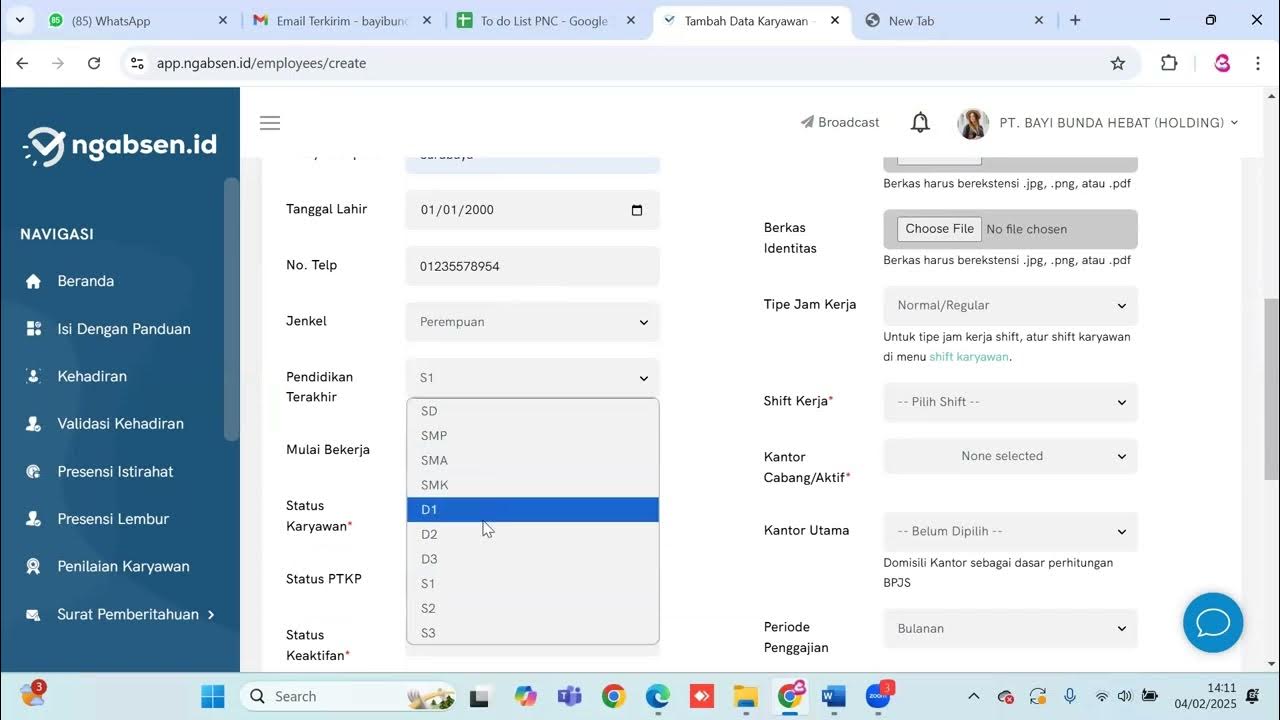

Tutorial Pengisian Data Bidan Baru (HT dan Hybrid) pada Ngabsen.id

Quant Mutual Fund Front Running Allegations: What should investors do?

How Should MF Investors Position For Next 5 Years?: Kalpen Parekh & Amit Kukreja Decode

What Are Mutual Funds? | Mutual Funds for Beginners | mutual funds A to Z guide

Top 3 UTI Mutual Fund 2024 | UTI Equity Fund | UTI Midcap Fund | UTI Nifty Index Fund

5.0 / 5 (0 votes)