Wick Size Matters: The Key to Understanding Reversal and Expansion Candles

Summary

TLDRThis video dives into advanced trading strategies focusing on candle structures, wick formations, and the timing of entry points. It covers how to identify reversal and continuation signals, emphasizing the importance of waiting for the right candle closures and the fractal nature of price action across different timeframes. The speaker explains how to recognize consolidation phases, assess wick formations, and use higher timeframes as a filter for trade setups. With a focus on precision and patience, the video offers actionable insights for traders seeking to enhance their technical analysis skills.

Takeaways

- 😀 Patience is key in trading: Wait for candle closures and confirmation of price action before entering a trade.

- 😀 Small wicks early in a candle can indicate potential for price expansion, either up or down, depending on the market's state.

- 😀 Consolidation phases should be observed before making a trade decision, as the market could continue in its current range or break out.

- 😀 A 'change in state of delivery' is a critical factor in identifying price direction, helping traders time their entries more accurately.

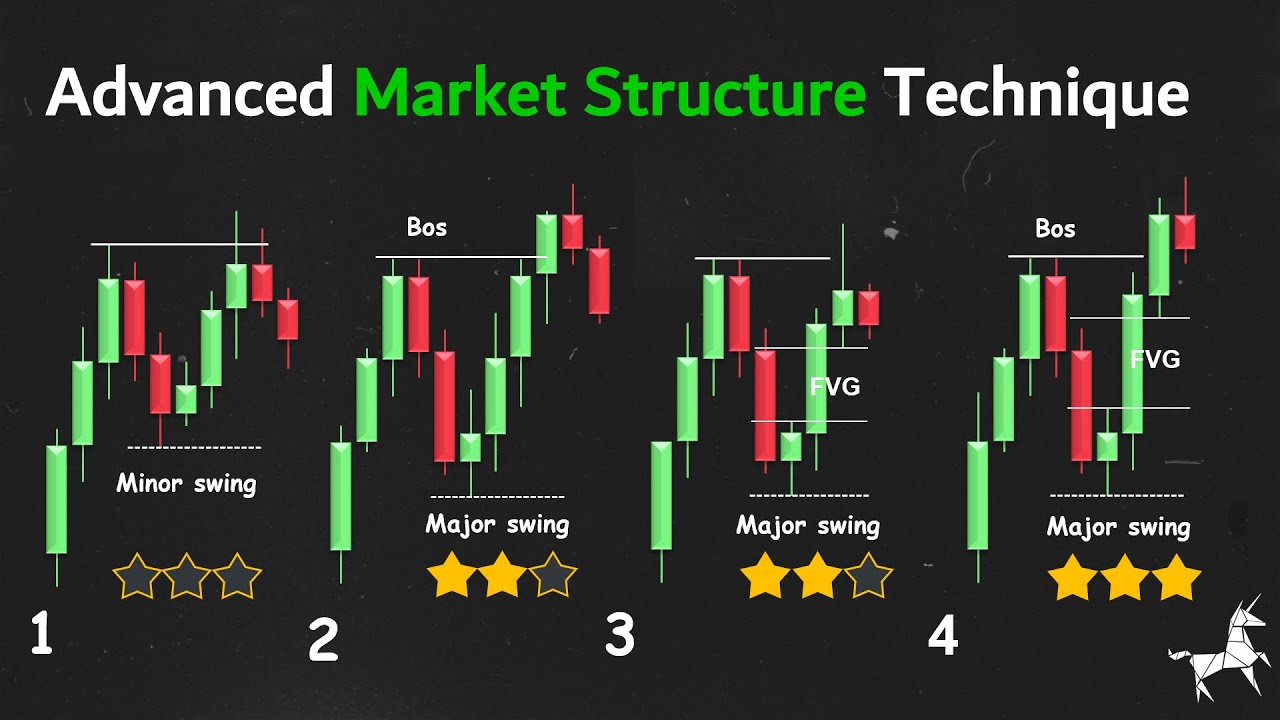

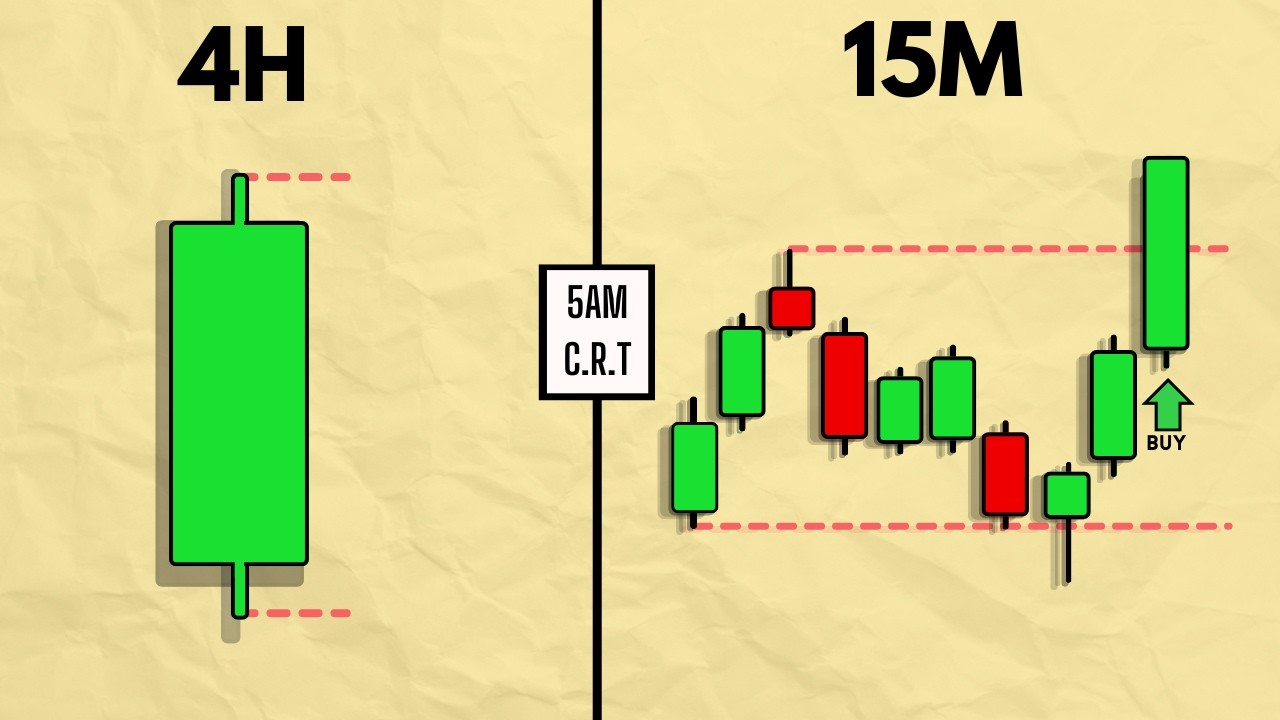

- 😀 Fractal market behavior means the same candle patterns and principles can be applied across different timeframes (e.g., 1-minute and 15-minute charts).

- 😀 Reversals and continuation trades should be based on clear price action signals, such as failure swings or a small opposing run.

- 😀 When seeking a reversal, wait for a small wick or confirmation of price action before entering a position to avoid premature trades.

- 😀 Avoid chasing trades; instead, let the price confirm the direction, particularly by observing price structure on higher timeframes.

- 😀 The strategy emphasizes not just the price action itself but how different timeframes work together to confirm trading decisions.

- 😀 Proper trade management involves understanding when a market phase has ended (e.g., after candle 3 and 4), and adjusting strategy accordingly.

Q & A

What is the significance of a small wick early in a candle during price action analysis?

-A small wick early in a candle indicates potential price expansion. This is important because it shows the market’s initial direction and may suggest a reversal or continuation, depending on the overall price structure and state of delivery.

How do consolidation candles help in determining the market's next move?

-Consolidation candles represent a range-bound market where price neither breaks the high nor low. They are used to identify a neutral phase in the market. Traders should wait for the next candle to see if price expands in one direction or forms a reversal.

What does the term 'state of delivery' refer to in this trading strategy?

-'State of delivery' refers to the internal structure of a candle or the price action pattern forming during the candle's creation. A change in the state of delivery, such as a shift in momentum or price structure, signals a potential move in the market.

Why is it important to wait for the next candle to confirm a trade setup?

-Waiting for the next candle allows traders to confirm the direction and strength of the price move. By avoiding premature entries, traders can ensure they are trading with the market’s momentum rather than against it, increasing the likelihood of success.

How can a fractal approach be applied to candle patterns on different timeframes?

-A fractal approach means recognizing that price action patterns, such as reversals or expansions, repeat across different timeframes. By analyzing higher and lower timeframes, traders can identify opportunities that align with the same price behavior at various scales.

What role do failure swings play in confirming trade entries?

-Failure swings occur when price breaks a previous high or low but then reverses. This failure to sustain the breakout signals a potential reversal or continuation. Traders look for these failure swings to confirm entry points, especially when a reversal pattern forms at key levels.

What does a shallow opposing run indicate in price action trading?

-A shallow opposing run refers to a small price movement against the prevailing trend within a candle. It suggests the market is not overly strong in reversing and may be preparing to continue in the original direction. Traders use this as a confirmation for continuation trades.

How does the concept of a 'change in the state of delivery' relate to expansion or contraction in the market?

-A 'change in the state of delivery' occurs when price structure shifts, such as a change from consolidation to expansion. This indicates a change in market sentiment or direction, and traders use this shift to anticipate a move either higher or lower, depending on the context.

Why is the risk of entering late into a candle considered high in this strategy?

-Entering late into a candle means you might be trading after much of the price move has already occurred. This reduces the probability of success as the market may already be at an overextended point, and you might miss the ideal entry for a reversal or continuation.

What is the significance of using higher timeframe candles to filter entries?

-Higher timeframe candles act as a filter to help confirm the broader market direction and key support or resistance levels. By using them, traders can avoid being misled by noise in lower timeframes and ensure their trades align with the overall market trend.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Strategi Trading Forex dengan Akurasi Tinggi

1 Candle Tells You Everything

Best Bank Nifty Scalping Strategy || Golden 10% Q&A

ICT Concepts - Immediate Rebalance (Strongest Signature) 🤫

I Discovered Best Market Structure Analysis (Premium Video)

Trading one candle is easy, actually | Determine Market Direction and Daily bias

5.0 / 5 (0 votes)