Trade with Institutional Tools: Part 1 ( In English)

Summary

TLDRThis video provides an in-depth guide on using advanced charting tools like the Footprint Chart and Imbalance Chart for order flow analysis. It explains how to customize tick size, volume formatting, and block size settings for optimal trade insights. The video also introduces essential features like the Delta profile, preset options, and the Power Trade Scanner for monitoring live market conditions. Key concepts such as market orders, limit orders, and volume thresholds are covered to enhance trading decision-making and technical analysis.

Takeaways

- 😀 Footprint charts display detailed market information, including buy/sell volume, delta, and price action for each candle.

- 😀 The **Delta** feature in the footprint chart helps visualize the net difference between buy and sell volume.

- 😀 Footprint charts allow you to toggle between displaying **volume profiles**, which show trading volume at specific price levels.

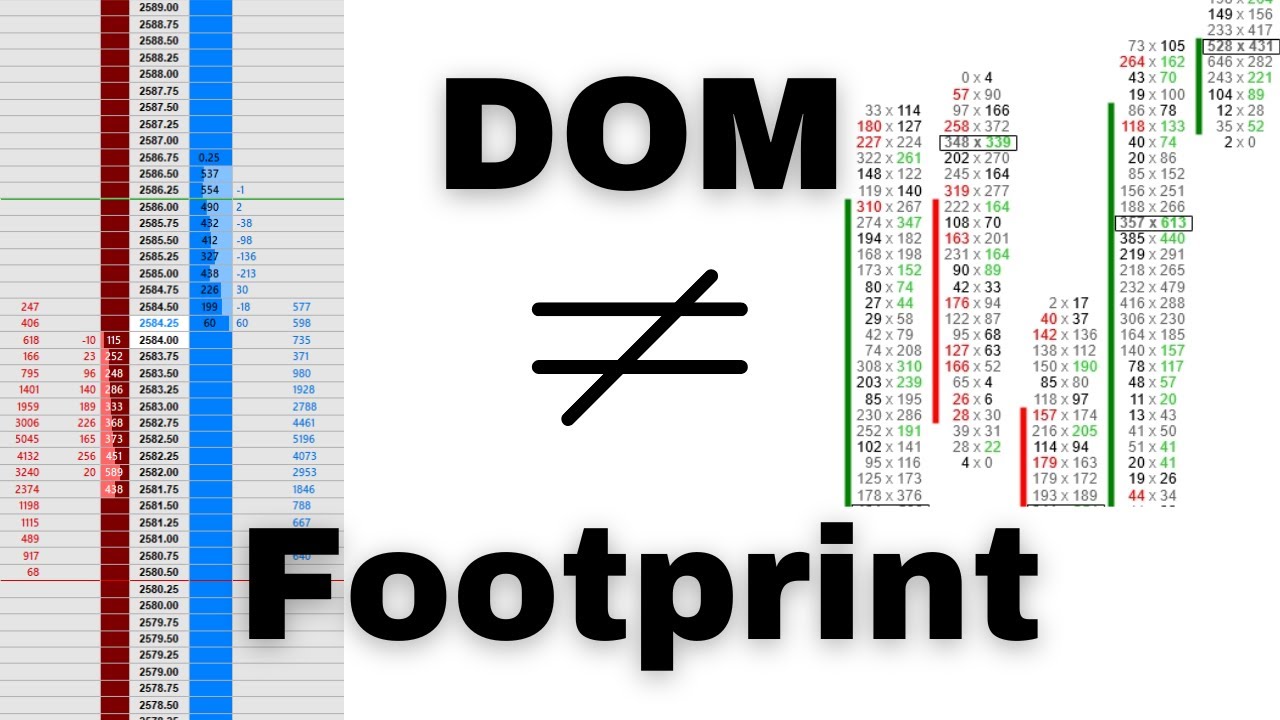

- 😀 It's important to differentiate between **footprint charts** and **imbalance charts** as they are used for different types of analysis.

- 😀 Preset options such as **Delta profile**, **bid profile**, and **volume profile** are available for easier data interpretation.

- 😀 **Tick Manager** adjusts the tick size for the chart, with **auto mode** being a useful starting point for optimizing tick size settings.

- 😀 The optimal **block size** for tick settings typically falls between 10 and 50, as excessively small or large sizes don’t provide meaningful data.

- 😀 Using **auto lot size** for volume calculations allows for more accurate representation based on the actual trading lot size of specific stocks like Reliance.

- 😀 The **Power Trade Scanner** generates real-time trading signals by comparing current volume with average volume over specific time intervals.

- 😀 The **order flow settings** section allows for customizations to track the number of orders, which can be adjusted based on manual or auto lot sizes for better volume analysis.

Q & A

What is the purpose of the footprint chart in market analysis?

-The footprint chart is used to display market data at a granular level, showing both the buy and sell volumes for each candle, which provides a detailed insight into market dynamics and helps in decision-making for traders.

How does the Delta feature in the footprint chart help traders?

-The Delta feature allows traders to visualize the difference between buying and selling pressure in the market. By examining this difference, traders can identify whether bulls or bears are dominating at a particular price level.

What is the role of the volume profile in the footprint chart?

-The volume profile in the footprint chart shows the volume traded at each price level for a particular time period. This helps traders understand price levels with high liquidity, which can indicate support or resistance zones.

What are the key differences between the footprint chart and the imbalance chart?

-The main difference is that the footprint chart includes both volume and Delta data for each candle, providing a more detailed picture of market activity, while the imbalance chart focuses primarily on the imbalance between buy and sell orders.

How should traders select the appropriate tick size in the order flow settings?

-Traders should avoid setting the tick size too low or too high. A very small tick size may lead to excessive noise, while a very large tick size may obscure meaningful data. Starting with the auto mode is recommended, and then adjusting based on personal observation and strategy.

What is the significance of block size in order flow analysis?

-Block size determines the range of price movements within which buy and sell orders are tracked. It helps traders understand large market orders and price action. Setting the block size too high or too low may lead to irrelevant data.

What does the 'Format Volume' feature do in the footprint chart?

-The 'Format Volume' feature allows traders to adjust how volume is displayed. Traders can choose between displaying the volume based on manual lot size or using an auto lot size, which adjusts according to the stock’s specifications.

What is the 'Auto Lot Size' option in volume formatting?

-The 'Auto Lot Size' option automatically adjusts the volume displayed based on the exact lot size for a particular stock (e.g., Reliance). This feature ensures accurate volume representation without needing manual adjustments.

How does the Power Trade Scanner work in the context of order flow analysis?

-The Power Trade Scanner tracks volume across time intervals (e.g., 5 minutes to 10 seconds) and generates signals when the volume surpasses a predetermined threshold, indicating potential market movements that may offer trading opportunities.

Why is it important to consider both market orders and limit orders in order flow analysis?

-Market orders and limit orders provide different types of information about market sentiment. Market orders reflect immediate buying or selling interest, while limit orders indicate where traders are willing to buy or sell at specific price levels. Together, they offer a more complete picture of market conditions.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Understanding The Differences Between a DOM and Footprint Chart

An explanation of equipment and tools used when updating an ADMIRALTY Standard Nautical Chart

ICT Mentorship 2023 - Deep Dive Into Institutional Order Flow

FULL Guide - Swing Trading Strategies for Beginners 2025

An Easy Guide On ICT Dealing Ranges

Market Profile: Course Introduction

5.0 / 5 (0 votes)