Mengukur dan Melaporkan Posisi Keuangan

Summary

TLDRIn this video, Maria Monika Karangkuti explains the fundamental concepts of balance sheets in accounting, focusing on the measurement and reporting of assets, liabilities, and equity. The video covers principles like historical cost, going concern, consistency, and prudence, emphasizing how balance sheets provide a snapshot of a company's financial position at a specific point in time. The tutorial also discusses asset valuation, including revaluation and depreciation, and how balance sheets reflect liquidity, solvency, and capital structure. Viewers are encouraged to explore key questions about asset valuation and its challenges, which will be discussed further in class.

Takeaways

- 😀 The video focuses on the measurement and reporting of the balance sheet (neraca) in accounting.

- 😀 Understanding the components of a balance sheet, such as assets, liabilities, and equity, is essential for preparing financial reports.

- 😀 A balance sheet is a snapshot of a company's financial position at a specific point in time, often at the end of an accounting period.

- 😀 There are two primary formats for presenting a balance sheet: vertical and horizontal. Vertical presentation lists assets and liabilities in a straight line, while horizontal has assets on the left and liabilities and equity on the right.

- 😀 The key accounting principles affecting balance sheet preparation include historical cost, going concern, consistency, and prudence.

- 😀 The historical cost principle involves recording assets based on their acquisition cost.

- 😀 The going concern principle assumes that the company will continue operating in the foreseeable future.

- 😀 The consistency principle requires that the same accounting methods be used consistently across periods.

- 😀 The prudence principle advises caution in not overstating assets or income.

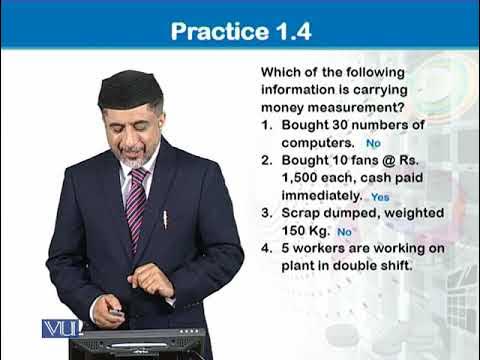

- 😀 Only financial information that can be measured in monetary terms is included in the balance sheet, excluding non-financial items such as customer loyalty.

- 😀 The interpretation of a balance sheet involves assessing liquidity (short-term ability to pay), solvency (long-term ability to pay), and capital structure (debt-to-equity ratio), which are crucial for decision-making by investors, creditors, and management.

Q & A

What is the main topic of the video?

-The main topic of the video is the measurement and reporting of the balance sheet in accounting.

What was the focus of the previous lesson before this video?

-The previous lesson focused on understanding the definition of a balance sheet, the information presented in it, and the components of the balance sheet.

What is necessary to prepare a balance sheet?

-To prepare a balance sheet, it is essential to measure each account, asset, liability, and equity before reporting them.

What is the purpose of the learning objectives mentioned in the video?

-The purpose is to help students understand the basic structure of the balance sheet, its reporting timeline, accounting conventions, measurement concepts, asset valuation methods, and how to interpret balance sheet information.

What is the difference between vertical and horizontal formats of the balance sheet?

-In the vertical format, assets, liabilities, and equity are aligned in a straight line, with totals shown below. In the horizontal format, assets are on the left side, while liabilities and equity are on the right side.

What distinguishes the balance sheet from the income statement?

-The balance sheet reflects the financial position of the company at a specific point in time, while the income statement covers a specific period of time.

What are the key accounting principles influencing balance sheet preparation?

-The key accounting principles include historical cost, going concern, consistency, and prudence.

Why is customer loyalty not recorded on the balance sheet?

-Customer loyalty is not recorded on the balance sheet because it cannot be measured in monetary terms, which is a requirement for inclusion in the financial statements.

How are assets typically valued on the balance sheet?

-Assets are usually valued based on their historical cost, but some assets may be revalued, such as property. Additionally, assets may undergo depreciation or impairment.

What does interpreting the balance sheet provide for stakeholders?

-Interpreting the balance sheet provides insights into a company's liquidity (short-term ability to pay), solvency (long-term ability to pay), and capital structure (the proportion of debt to equity). This information is crucial for investors, creditors, and management in decision-making.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآن5.0 / 5 (0 votes)