FLOWCHART SIKLUS PEMBELIAN|| SIA

Summary

TLDRThis presentation explains the purchasing cycle within an organization, detailing both cash and credit purchase processes. It describes how the warehouse identifies the need for goods, followed by document creation and approval flows involving the purchasing, finance, and warehouse departments. The process also covers interactions with suppliers, including order creation, delivery, and payment. Emphasis is placed on the importance of document tracking, approvals, and communication between departments to ensure smooth purchasing operations, whether for cash or credit purchases. The cycle concludes with final payments and record-keeping for proper management control.

Takeaways

- 😀 The presentation is about the purchasing cycle within a company, specifically focusing on cash and credit purchases.

- 😀 The purchasing cycle involves a series of transactions to acquire goods or services for the company, either through cash or credit, from suppliers.

- 😀 A purchasing system is defined as a combination of people, technology, media, procedures, and controls designed to ensure effective communication and decision-making within an organization.

- 😀 The purchasing cycle can be divided into four types: cash purchase based on supplier offers, cash purchase initiated by the company, credit purchase based on supplier offers, and credit purchase initiated by the company.

- 😀 The cash purchase flowchart starts with the warehouse requesting goods through an SPB (purchase request form), which is then processed by the purchasing department and sent to the supplier for approval and order creation.

- 😀 After receiving an order confirmation from the supplier, the purchasing department generates a purchase order (SOP) and sends it to the supplier, finance department, warehouse, and keeps a copy for records.

- 😀 The supplier then sends an invoice along with the ordered goods to the purchasing department, which sends the invoice and goods to the warehouse for receiving and inspection.

- 😀 The warehouse verifies the goods against the purchase order and generates an LPB (goods receipt report), which is sent to the purchasing and finance departments.

- 😀 The finance department processes the payment based on the invoice and goods receipt report and then generates a payment confirmation for the supplier.

- 😀 The credit purchase cycle follows a similar process but involves a credit report (LPK) to manage payments, which is approved by the company leadership before proceeding.

- 😀 The presentation concludes with a reminder that the flowcharts illustrate the steps of cash and credit purchases, helping organizations streamline their purchasing processes.

Q & A

What is the purchasing cycle?

-The purchasing cycle refers to a series of activities or transactions involved in acquiring goods, either through cash or credit, by an organization. It helps companies meet operational needs by purchasing goods from suppliers or selling them to customers.

What are the key components of an accounting information system for purchasing?

-The accounting information system for purchasing includes people, facilities, technology, media, procedures, and controls that work together to manage purchase transactions and ensure communication within the organization.

What are the four types of purchases in a company?

-The four types of purchases in a company are: 1) Cash purchases based on supplier offers, 2) Cash purchases initiated by the company, 3) Credit purchases based on supplier offers, and 4) Credit purchases initiated by the company.

What is the flow of a cash purchase in a company?

-In a cash purchase, the process begins with the warehouse requesting goods and issuing a Purchase Request (SPB). The purchasing department then creates a Purchase Order (SOP), which is sent to the supplier. The supplier delivers the goods and invoice, which are sent to the warehouse and finance department for payment processing. Once payment is made, the supplier issues a paid invoice.

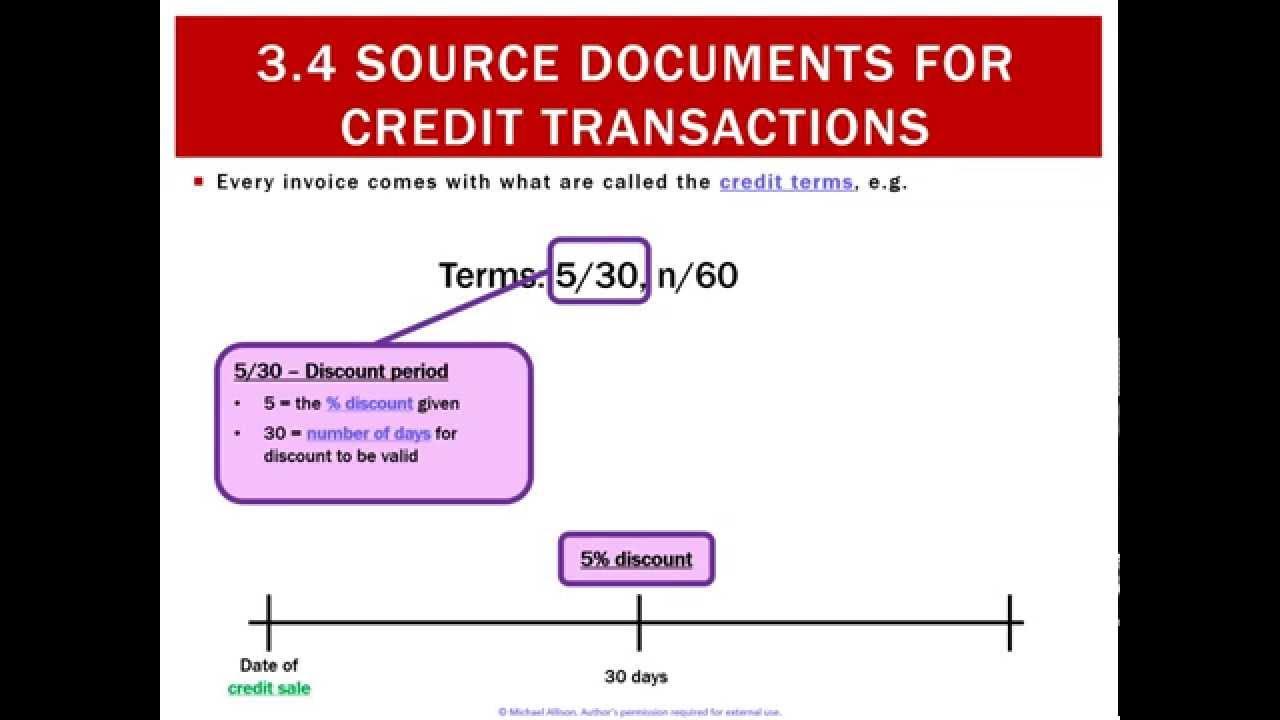

How does the credit purchase flow differ from the cash purchase flow?

-The credit purchase flow is similar to the cash purchase process, but with the key difference being that payment is made on credit rather than upfront. After receiving the goods and invoice, the finance department processes a Credit Purchase Report (LPK) and seeks approval from management before completing the payment.

What documents are involved in the cash purchase process?

-The documents involved in the cash purchase process include: 1) Purchase Request (SPB) from the warehouse, 2) Purchase Order (SOP) sent to the supplier, 3) Invoice from the supplier, 4) Goods Receipt Report (RPP) from the warehouse, and 5) Payment report generated by the finance department.

What happens after the warehouse receives goods in a cash purchase?

-Once the warehouse receives the goods, they issue a Goods Receipt Report (RPP) and send it to the purchasing and finance departments. The finance department uses this document along with the invoice to process the payment.

How does the purchasing department interact with suppliers during the credit purchase process?

-During a credit purchase, the purchasing department sends a Price Offer Request (SPPH) to suppliers, receives a Price Offer (SPH) in return, and then prepares a Purchase Order (SOP) which is sent to the supplier. The supplier then sends the invoice and goods to the purchasing department.

What is the role of the finance department in both cash and credit purchases?

-In both cash and credit purchases, the finance department is responsible for processing payments. For cash purchases, they pay the supplier upon receiving the goods and invoice. For credit purchases, they create a Credit Purchase Report (LPK), which is approved by management before payment is made.

Why is the Goods Receipt Report (RPP) important in the purchasing cycle?

-The Goods Receipt Report (RPP) is important because it confirms that the goods ordered have been received by the warehouse. It serves as a key document for both the purchasing and finance departments to ensure that payments are made for the correct items.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)