How Banks Magically Create Money

Summary

TLDRThis video delves into the history and mechanics of money, tracing its evolution from ancient barter systems to today’s digital economy. It explains how money is created through loans and the intricate processes behind its circulation, including the roles of banks, goldsmiths, and the government. The video highlights the balance between productivity, inflation, and the creation of new money, revealing how debt drives the modern economic system. Through this journey, the video emphasizes the impact of these systems on individuals and the broader economy.

Takeaways

- 😀 Money production in the U.S. starts with government facilities turning paper into physical currency, but the majority of money exists digitally, increasing by billions daily.

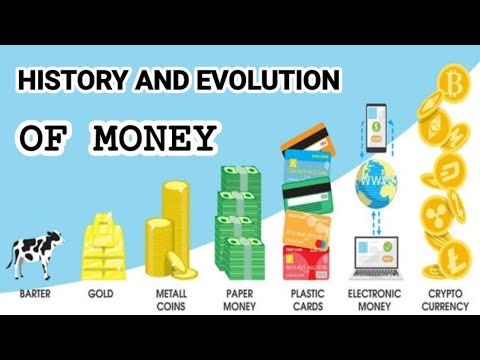

- 😀 Money didn't always exist; in ancient times, people used goods like cattle or grain to trade before settling on valuable metals like gold and silver for transactions.

- 😀 Goldsmiths in the 17th century began issuing paper notes for gold deposits, which led to the early form of banking and modern currency systems.

- 😀 Goldsmiths loaned out more money than they actually had, creating 'fake' promise notes that increased the money supply without corresponding real value.

- 😀 Banks today function similarly to 17th-century goldsmiths, creating new money by issuing loans that increase the total money supply in the economy.

- 😀 Money creation by banks doesn't require physical cash – loans are essentially new digital money typed into existence and can lead to economic growth when spent productively.

- 😀 New money entering the economy through loans is crucial for economic growth, fueling business expansion, productivity, and technological advances.

- 😀 Inflation occurs when more money is created than there are goods and services, causing prices to rise as there’s more competition for fewer products.

- 😀 Modern banks have the freedom to create nearly unlimited amounts of money, but they need to be cautious to prevent excessive inflation and instability.

- 😀 The U.S. government funds its deficit by issuing bonds, which are bought by banks, corporations, and foreign countries, leading to a cycle of increasing national debt.

- 😀 While the money system operates through debt creation, it could be more efficient if funds were directed into productive sectors like business, education, and infrastructure for better long-term returns.

Q & A

How much money does the U.S. government produce daily?

-The U.S. government facility in Washington D.C. prints over 500 million dollars daily to meet the demand for currency.

What is the majority of money in circulation today?

-Most of the money in circulation today exists digitally, with the amount increasing by over 4 billion dollars every day.

How did trade evolve before money existed?

-Before money, trade involved bartering, such as a farmer promising future payment for a tool or using items like cattle, grain, and salt as valuable trade goods.

What led to the use of metal coins in trade?

-As demand for trade grew, using bulky items like cattle or grain was impractical, so people turned to metal coins like gold and silver, which were small, valuable, and durable.

What was the role of goldsmiths in the 17th century regarding money?

-Goldsmiths began holding people's gold for safekeeping, issuing paper notes that allowed customers to retrieve their gold. Over time, they began lending out more notes than they had gold, creating fake money.

How did goldsmiths' practices evolve into modern banking?

-Goldsmiths' lending practices, where they issued more notes than they had gold, are akin to modern banking systems, where banks create new money through loans.

How do banks create money today?

-Banks create money by issuing loans. When a bank gives a loan, it doesn't reduce its reserves but simply adds new money into the borrower's account. This increases the money supply.

What role does debt play in the money system?

-Debt is central to the money system; both individuals and governments borrow money to inject new funds into the economy. For example, the U.S. government creates bonds to raise money, furthering national debt.

What is the impact of creating more money on inflation?

-Creating more money can lead to inflation if the supply of goods doesn't keep up with the increased money in circulation. This creates more competition for fewer goods, raising prices.

How does the government manage its debt?

-The U.S. government manages its debt by issuing bonds. These bonds are bought by banks, corporations, and foreign countries, generating income for the government to fund its spending, which often exceeds its revenue.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

5.0 / 5 (0 votes)