LAPORAN HARGA POKOK PRODUKSI

Summary

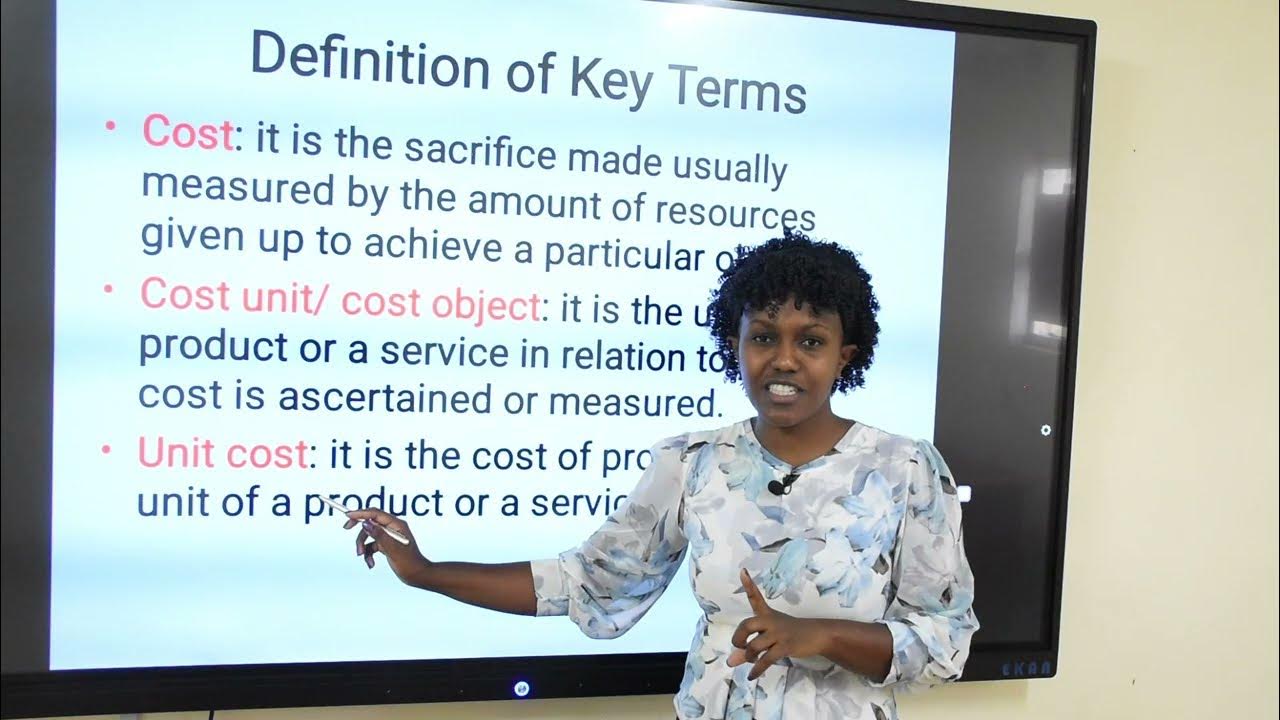

TLDRIn this educational video, Sumiati Hadi discusses financial accounting concepts, focusing on the production cost report (Laporan Harga Pokok Produksi). She explains its importance as a part of financial statements in manufacturing companies, alongside other reports like income statements and cash flow reports. The video covers the components of production costs, including raw materials, direct labor, and factory overheads. Sumiati also provides a detailed example using PT Revi, a company producing bags, to demonstrate how to calculate production costs and compile the production cost report.

Takeaways

- 😀 The production cost report is a key part of financial statements for manufacturing companies.

- 😀 Manufacturing companies have an additional report called the production cost report, aside from the usual five reports in service or trading companies.

- 😀 The production cost is the total cost incurred to produce goods or services, including raw materials, direct labor, and factory overhead.

- 😀 The production cost is calculated using the formula: Total production cost = Production costs + Beginning work-in-process inventory - Ending work-in-process inventory.

- 😀 Three main components make up the production costs: raw materials, direct labor, and factory overhead.

- 😀 Raw materials cost is calculated by adding the beginning inventory, raw material purchases, and transport costs, then subtracting the ending inventory.

- 😀 Direct labor costs refer to the wages of workers directly involved in manufacturing, like the ones making bread in a bakery.

- 😀 Factory overhead includes all other factory-related expenses, such as equipment maintenance, factory utilities, and indirect labor costs.

- 😀 To calculate the production cost, you must also factor in the beginning and ending inventory of work-in-process goods.

- 😀 A practical example involving PT Revi shows how to calculate the production cost for a company by adding raw material costs, direct labor, and factory overheads.

- 😀 The final production cost for PT Revi as of December 31, 2022, is IDR 1,713 million, based on the detailed calculations provided in the example.

Q & A

What is the purpose of the cost of production report in financial accounting?

-The cost of production report is a financial statement that provides detailed information on the costs incurred by a company to produce goods or services. It is part of the broader financial reports in manufacturing companies.

What are the five main financial reports in service or trading companies?

-In service or trading companies, the five main financial reports are the income statement, statement of changes in equity, balance sheet, cash flow statement, and notes to the financial statements.

How is the cost of production calculated?

-The cost of production is calculated by adding the production costs to the beginning work-in-process inventory and then subtracting the ending work-in-process inventory.

What are the components of production costs?

-The components of production costs are raw material costs, direct labor costs, and factory overhead costs.

What is raw material cost and how is it calculated?

-Raw material cost is the expense of materials directly used in the production process. It is calculated by adding the beginning inventory of raw materials to the net purchases of raw materials, including any shipping costs, and then subtracting the ending inventory of raw materials.

What does 'direct labor cost' refer to in production accounting?

-Direct labor cost refers to the wages of workers who directly contribute to the transformation of raw materials into finished products, such as factory workers involved in making products like bread or other goods.

What is included in factory overhead (BOP)?

-Factory overhead (BOP) includes all manufacturing costs that are not directly tied to raw materials or direct labor. Examples include factory utilities, machine maintenance, storage costs, indirect labor, and depreciation on factory buildings.

What does 'work-in-process inventory' mean?

-Work-in-process inventory refers to items that are in the production process but are not yet completed. These are partially finished goods awaiting further processing.

How is the cost of production report structured in a manufacturing company?

-The cost of production report in a manufacturing company includes the following components: raw material costs, direct labor costs, factory overhead, beginning work-in-process inventory, and ending work-in-process inventory.

What are the key components of the cost of production report for PT Revi, as mentioned in the example?

-The key components of the cost of production report for PT Revi include raw material costs (435 million), direct labor costs (700 million), factory overhead costs (513 million), beginning work-in-process inventory (150 million), and ending work-in-process inventory (85 million).

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

JURNAL PENYESUAIAN UD ABADI - PEMBAHASAN SOAL UKK AKUNTANSI PAKET 1 TAHUN 2024

Cara Mudah Hitung HPP Usaha Kecil (Harga Modal Berapa?)

Introduction to Cost and Management Accounting

#part1 Ch 17 Investment - Akuntansi Keuangan Menengah 2

Basic Accounting Equation

Accounting Principles | Class 11 | Accountancy | Chapter 3 | Part 2

5.0 / 5 (0 votes)