MA47 - Transfer Pricing - Explained

Summary

TLDRThis video explains the complex concept of transfer pricing using a real-world example from Kraft Heinz. It covers the dynamics between subsidiaries like Heinz Ketchup and Bagel Bites, examining different methods of setting transfer prices: market price, variable cost, full cost, and negotiated prices. The video delves into the advantages and disadvantages of each method, emphasizing the importance of opportunity cost and excess capacity. It concludes by offering guidance on which pricing methods work best under various conditions, aiming to simplify the intricate decision-making process in large companies.

Takeaways

- 😀 Transfer pricing refers to the pricing of goods and services sold between subsidiaries of the same parent company, and it can be complex to determine.

- 😀 A key concept in transfer pricing is that the company must decide how much one subsidiary should pay another for goods or services (e.g., how much Bagel Bites should pay Heinz for ketchup).

- 😀 Kraft Heinz owns several smaller companies like Lea & Perrins and Bagel Bites, and their transfer pricing decisions can affect profitability across these subsidiaries.

- 😀 One of the main considerations in transfer pricing is taxation—companies may set transfer prices to minimize their overall tax bill, which can sometimes involve manipulating prices across international borders.

- 😀 Transfer pricing can follow one of several methods: market price, variable cost, or full cost. Each method has its advantages and disadvantages depending on the situation.

- 😀 The market price method charges the internal subsidiary the same amount that external customers would pay, ensuring objectivity and fairness but potentially overlooking internal relationships.

- 😀 Variable cost pricing is the minimum price a company might charge, as it covers the cost of producing additional units, without accounting for fixed costs. This method is more suitable when there is excess capacity.

- 😀 Full cost pricing includes both variable and fixed costs, ensuring that all costs are covered, but it can reduce efficiency because there is no incentive to lower costs.

- 😀 Transfer pricing negotiations allow for flexibility in pricing, but they can lead to unequal outcomes if one party is a better negotiator, potentially harming one of the subsidiaries.

- 😀 A key rule of thumb in transfer pricing is that if the company has excess capacity, the variable cost method is most appropriate; if there is no excess capacity, market price should be used for optimal decision-making.

Q & A

What is transfer pricing and why is it important?

-Transfer pricing refers to the pricing of goods or services sold between divisions or subsidiaries of the same company. It is important because it impacts a company’s profitability, taxation, and internal operations, especially for multinational corporations with subsidiaries in different countries.

Why is the example of Kraft Heinz used to explain transfer pricing?

-The Kraft Heinz example is used because the company owns multiple subsidiaries, including Heinz Ketchup and Bagel Bites. This creates a real-world scenario where transfer pricing decisions need to be made between these divisions, making it easier to explain the concepts.

What are the three main transfer pricing options presented in the video?

-The three main transfer pricing options presented are market price, variable cost, and full cost. Each method has its advantages and disadvantages depending on the context of the divisions involved.

What is the advantage of using the market price for transfer pricing?

-The market price method is advantageous because it is objective, reflecting the price that the company would charge external customers. It also represents the opportunity cost, meaning it helps the company make decisions that maximize profits and avoid selling at a lower price than what is available in the market.

When is using the market price for transfer pricing not ideal?

-Using the market price may not be ideal when there is no clear external market for the product or when the relationship between the internal divisions is not fully captured by the market price, such as in the case of unique or customized internal products.

What are the main drawbacks of using variable cost for transfer pricing?

-The main drawbacks of using variable cost are that it doesn't cover the fixed costs of the selling division, and there is a risk of misclassifying costs. Additionally, the seller division has less incentive to be efficient since they are only covering the variable costs, not the full costs of production.

What is the difference between variable cost and full cost in transfer pricing?

-Variable cost refers to the cost incurred for producing an additional unit of a product, while full cost includes both variable costs and fixed costs (like overhead). Full cost pricing ensures that all production costs are covered but may reduce the incentive for the selling division to be efficient.

Why might a company choose to use the full cost method for transfer pricing?

-A company might choose to use the full cost method because it ensures that all costs, both variable and fixed, are covered. This method also avoids issues with misclassifying costs, as all production-related expenses are accounted for in the transfer price.

What is the primary disadvantage of the full cost transfer pricing method?

-The primary disadvantage of the full cost method is that it can reduce efficiency. The selling division has no incentive to cut costs, as they are guaranteed to recover all of their expenses through the transfer price.

How does negotiating a transfer price between divisions work, and what are its potential advantages and disadvantages?

-Negotiating a transfer price allows the divisions to reach a mutually beneficial price, often somewhere between market price and full cost. The advantages include ensuring both divisions act in their best interest, which can lead to optimized profits. The disadvantages include the risk of one division out-negotiating the other, leading to an unfair deal, and the time-consuming nature of the negotiation process.

What is the role of opportunity cost in transfer pricing, as explained in the video?

-Opportunity cost plays a crucial role in transfer pricing decisions, particularly when using the market price method. If a company has limited supply and external demand is high, the opportunity cost of selling internally at a lower price could be significant, as it would mean giving up potential profit from outside customers.

How does excess capacity impact the choice of transfer pricing method?

-Excess capacity impacts the transfer pricing method because when a company has unused capacity, it may be appropriate to charge based on variable costs rather than market prices or full costs. This is because the additional production doesn't require significant new investment, and the company can sell at a lower price while still covering the marginal cost of production.

Why is transfer pricing particularly complicated for multinational companies?

-Transfer pricing is complicated for multinational companies because they operate across different tax jurisdictions. These companies may structure their transfer pricing to minimize their global tax liabilities, which introduces complexity and potential legal and ethical concerns.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

What is Transfer Pricing | Transfer Pricing Methods | CMA | CIMA | CA | ACCA | Commerce Specialist |

How Hotels Price Rooms

Why Kraft Heinz Is Warren Buffett's Worst Bet

[MEET 10] AKUNTANSI MANAJEMEN - HARGA TRANSFER

Cara melakukan transaksi antar divisi dalam Akuntansi | Transfer Pricing | Akuntansi Manajemen

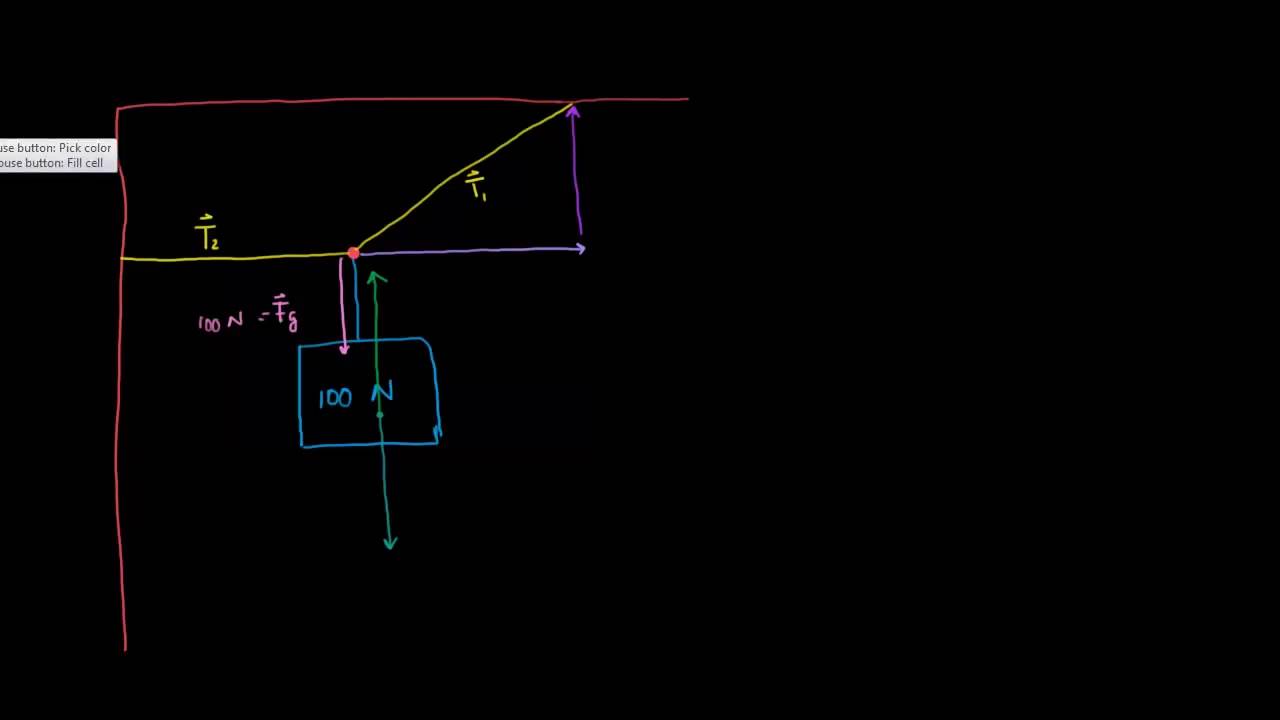

Introducción a la tensión

5.0 / 5 (0 votes)